In today’s dynamic financial markets, seasoned investors are actively seeking innovative strategies to enhance their returns. Call option trading in ICICIdirect has emerged as a popular choice, offering traders a compelling blend of risk and reward. This comprehensive guide delves into the intricacies of call option trading, empowering readers with the knowledge and expertise to navigate this exciting financial landscape.

Image: www.youtube.com

What is Call Option Trading?

A call option grants the holder the right, but not the obligation, to purchase a specific underlying asset (e.g., a stock, index, or commodity) at a predetermined “strike price” on or before a specified expiration date. Call option trading enables traders to speculate on potential price increases in the underlying asset, offering the potential for significant profits if the market moves in their favor.

Benefits of Call Option Trading in ICICIdirect

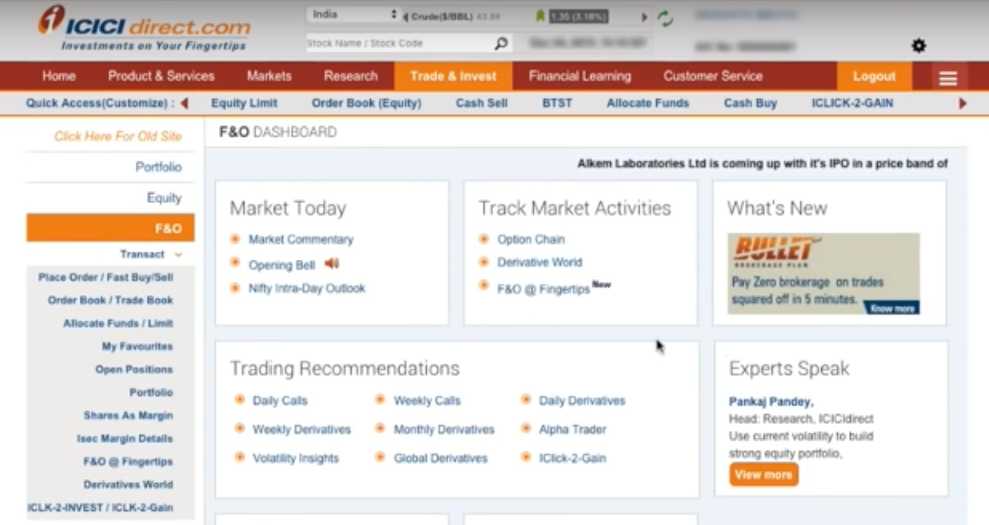

ICICIdirect, a leading financial services provider in India, provides a seamless and robust platform for call option trading. Traders leveraging ICICIdirect’s platform can enjoy several advantages, including:

- Access to real-time market data and analytical tools.

- Low brokerage rates and competitive transaction costs.

- Dedicated customer support and expertise.

- Educational resources and trading tutorials for beginners and experienced traders alike.

Understanding Call Option Trading Basics

To engage in call option trading effectively, grasping fundamental concepts is essential. Key terms include:

- Underlying Asset: The asset (e.g., stock, index, or commodity) whose price movements impact the option’s value.

- Strike Price: The predefined price at which the trader can purchase the underlying asset if they exercise the option.

- Expiration Date: The date on which the option ceases to exist and its rights expire.

- Premium: The price paid by the trader to acquire the option, which represents the potential profit or loss.

Image: www.chittorgarh.com

Types of Call Option Strategies

Traders can employ various call option strategies to align with their risk appetite and market outlook. Common strategies include:

- Covered Call: Selling a call option against an underlying asset that the trader already owns.

- Naked Call: Selling a call option without owning the underlying asset, exposing the trader to unlimited downside risk.

- Bull Call Spread: Simultaneously buying a call option with a lower strike price and selling a call option with a higher strike price.

- Collar: Combining a long call option with a short put option to create a defined range of potential profit and loss.

Example of Call Option Trading in ICICIdirect

To illustrate the practical application of call option trading in ICICIdirect, let’s consider the following example. Suppose a trader believes that the Nifty index will rise in the coming weeks. They could purchase a Nifty call option with a strike price of 18,300 and an expiration date of 30 days for a premium of 100 points.

If the Nifty index indeed rises above 18,400 before the expiration date, the trader could exercise their call option and buy the index at the strike price of 18,300. They could then immediately sell the purchased index in the market at the prevailing higher price, profiting from the difference minus the premium paid for the call option.

Call Option Trading In Icici Direct

Image: www.adigitalblogger.com

Conclusion

Call option trading in ICICIdirect offers a versatile and potentially lucrative investment avenue for discerning traders. By leveraging ICICIdirect’s robust platform and embracing a comprehensive understanding of the involved concepts, traders can harness this strategy to capitalize on market opportunities and enhance their financial objectives. Remember, as with any trading strategy, thorough research and a prudent approach are paramount to maximizing success and mitigating risks.