The financial markets are brimming with diverse investment avenues that cater to varying risk appetites and return expectations. Among these options, options trading stands out as a sophisticated yet potentially lucrative strategy that has gained immense popularity in recent times. In the Indian context, ICICIDirect, a subsidiary of ICICI Bank, commands a prominent position as a trusted facilitator of option trading services. This definitive guide delves into the realm of ICICIDirect option trading, exploring its intricacies and empowering traders with the knowledge to make informed decisions.

Image: learn.quicko.com

Understanding the Fundamentals of Option Trading with ICICIDirect

Options contracts are financial instruments that grant buyers the right, not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. They provide a flexible approach to managing risk and creating potential profit opportunities in diverse market conditions. ICICIDirect acts as an intermediary between traders and exchanges, enabling them to execute option transactions seamlessly. The platform offers a comprehensive suite of options products, including equity options, index options, and currency options, catering to the diverse needs of traders.

Navigating the Market: Types of Options and Strategies

The options market encompasses a vast array of contracts, each with unique characteristics and potential applications. Call options confer the right to buy an underlying asset, while put options convey the right to sell. ICICIDirect provides access to both call and put options across a wide range of underlying assets, allowing traders to tailor their strategies to specific market scenarios.

Furthermore, the platform empowers traders with a vast repertoire of option strategies. Covered calls involve selling call options against existing holdings of an underlying asset, aiming to generate income while limiting potential losses. Protective puts, on the other hand, entail buying put options to hedge against potential declines in the underlying asset’s value. ICICIDirect offers comprehensive guidance and support, guiding traders in selecting the most appropriate options strategies for their risk tolerance and investment objectives.

ICICIDirect’s Trading Platform: A Gateway to Market Opportunities

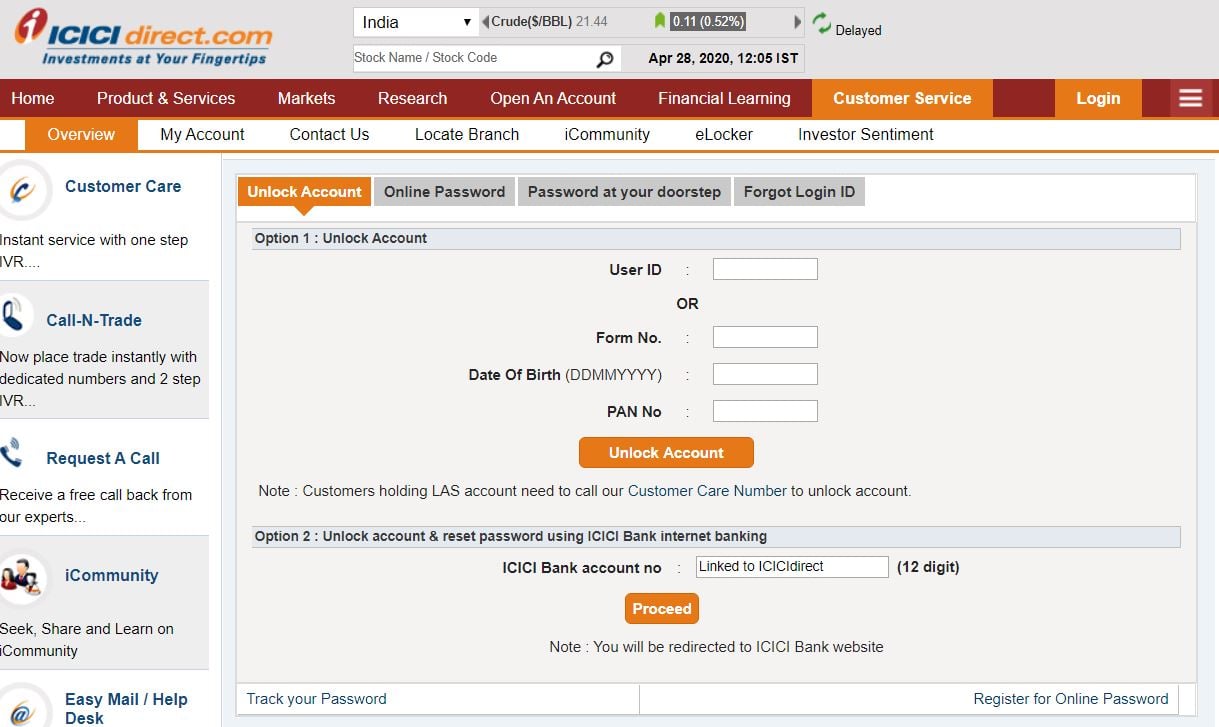

ICICIDirect’s state-of-the-art trading platform is designed to provide traders with an intuitive and user-friendly experience. The platform offers real-time market data, advanced charting tools, and customizable watchlists, empowering traders with the necessary insights to make informed decisions. Additionally, the robust risk management capabilities ensure that traders can manage their exposure and minimize losses effectively.

Image: www.youtube.com

Icicidirect Option Trading

Image: www.chittorgarh.com

Conclusion: Unlocking the Potential of ICICIDirect Option Trading

Navigating the complex world of option trading requires a comprehensive understanding of its concepts, strategies, and market dynamics. By leveraging ICICIDirect’s comprehensive offerings, traders can gain access to a world of possibilities, empowering them to create tailored investment strategies and harness the potential for profitable returns. Embark on the journey of option trading with ICICIDirect and unlock a universe of financial opportunities.