Navigating the Complexities of Options Trading

In the exhilarating world of options trading, one’s skill hinges on the mastery of order execution. A market order, often the weapon of choice for seasoned traders, encapsulates the essence of decisive action. By delving into the depths of market orders, their nuanced implications, and the strategies that govern their efficacy, we embark on a journey towards options trading proficiency.

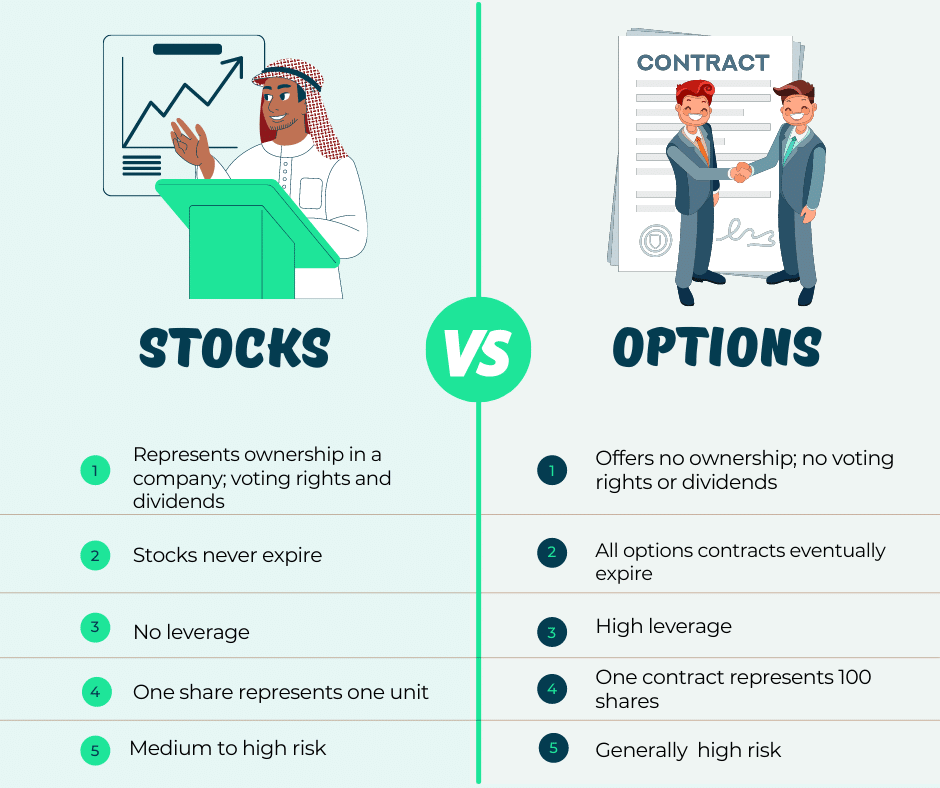

Image: www.projectfinance.com

The Anatomy of a Market Order

Unlike limit orders, market orders carry with them an air of immediacy. Upon the trader’s command, these orders cascade into the marketplace, seeking the most expedient execution possible. The essence of a market order lies in its unflinching pursuit of the prevailing market price, irrespective of any predetermined boundaries. This relentless drive ensures that the trader’s intention is fulfilled without delay.

Leveraging Market Orders for Strategic Advantage

Market orders emerge as a potent instrument in the arsenal of savvy options traders, offering an array of strategic benefits. For nimble traders seeking to capitalize on fleeting market opportunities, market orders serve as an invaluable tool. The ability to swiftly execute trades provides a significant edge in a market characterized by rapid price fluctuations and relentless volatility.

Additionally, market orders afford traders the advantage of anonymity, shielding their intentions from prying eyes. By concealing their hand, traders can navigate the market with greater discretion, potentially mitigating the impact of their actions on the wider market.

Risks to Consider When Employing Market Orders

As with any aspect of options trading, market orders are not exempt from inherent risks. The relentless pursuit of the market price may inadvertently lead to execution prices that deviate significantly from the trader’s expectations. This variability can prove perilous in rapidly moving markets.

Furthermore, market orders may exacerbate slippage, a phenomenon that arises when the executed price diverges from the desired price. This discrepancy can arise due to factors such as market volatility, order size, and liquidity constraints.

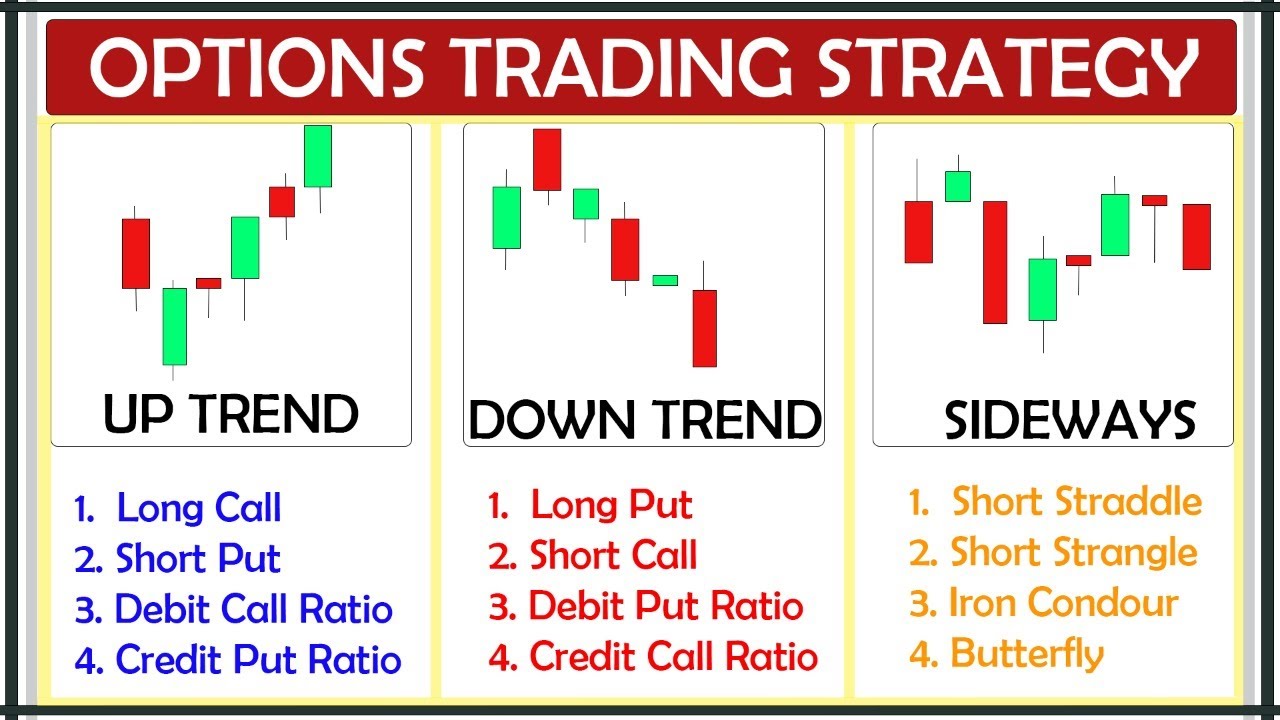

Image: www.youtube.com

Tips and Expert Advice for Market Order Mastery

To maximize the benefits while mitigating the risks associated with market orders, consider embracing the following tips and insights:

- Assess Market Conditions: Prior to executing a market order, meticulously evaluate prevailing market conditions. Determine whether the market is in flux or relatively stable. Market volatility can significantly impact the execution price.

- Gauge Your Appetite for Risk: Market orders are inherently riskier than limit orders, necessitating a clear understanding of your tolerance for potential losses. Prudent traders should consider their risk appetite before engaging with market orders.

FAQs on Market Orders

Q: What is the primary benefit of using a market order?

A: Market orders provide immediate order execution, ensuring that a trade is completed without delay.

Q: What is slippage, and how does it affect market orders?

A: Slippage refers to the difference between the desired execution price and the actual executed price. Market orders can exacerbate slippage, especially in volatile markets.

Q: How can I mitigate the risks associated with market orders?

A: To safeguard against potential losses, traders should carefully evaluate market conditions before executing market orders and ensure that they have a clear understanding of their risk appetite.

Options Trading Market Order

Image: www.pinterest.com

Conclusion

Options trading market orders represent a powerful tool in the arsenal of savvy options traders. Their ability to expedite trade execution and embrace anonymity provides a compelling advantage. However, it is imperative to approach market orders with a clear understanding of the associated risks, meticulously assessing market conditions, and exercising prudence in risk management.

Are you ready to delve into the world of options trading market orders? Embrace the knowledge and strategies presented herein, and unlock the potential to enhance your trading prowess.