Introduction: Unveiling the World of Option Trading

In the realm of financial markets, options trading stands as a powerful tool for investors seeking to hedge risk or amplify potential returns. Options are derivative contracts that grant the holder the option to buy or sell an underlying asset, such as stocks or bonds, at a specified price on or before a predetermined date. To facilitate seamless execution of these transactions, investors rely on brokerage firms that act as intermediaries between them and the markets. ICICIDirect, a leading player in the Indian financial sector, offers a comprehensive platform for option trading. Yet, navigating the world of brokerage charges can be a daunting task for aspiring traders. This article aims to demystify the intricacies of option trading brokerage charges at ICICIDirect, empowering traders with the knowledge to make informed decisions.

Image: www.youtube.com

Understanding Brokerage Charges: Unlocking the Framework

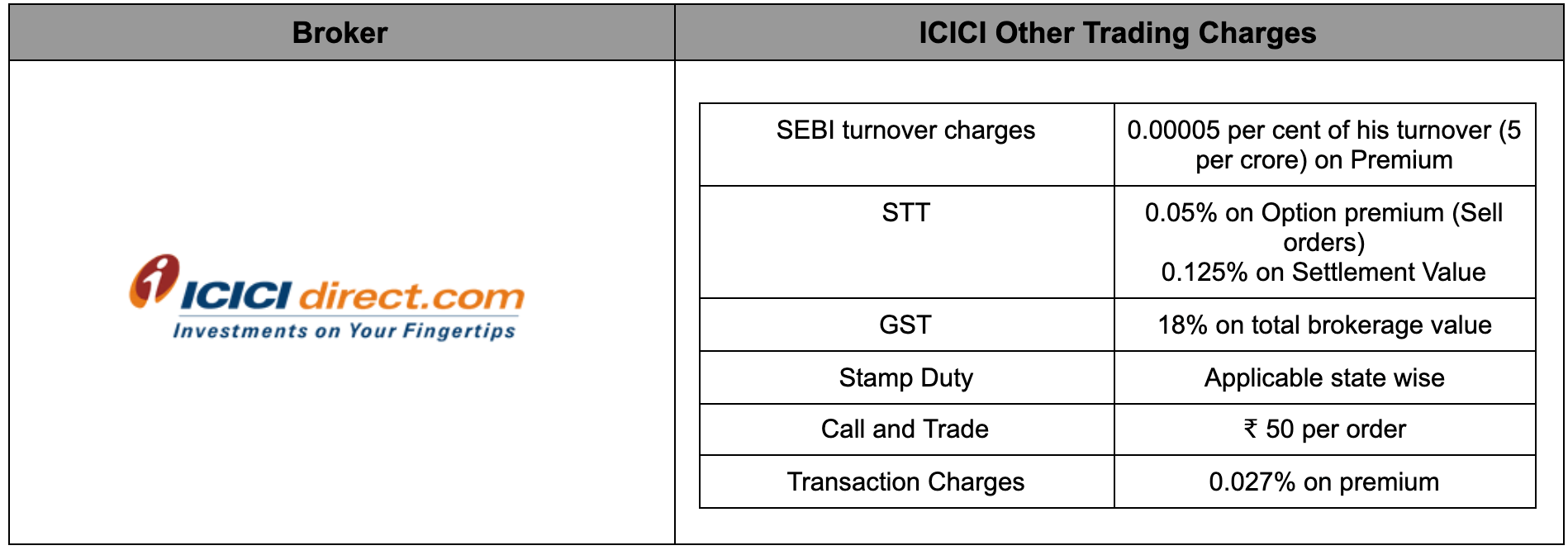

Brokerage charges represent the fees levied by ICICIDirect for its services in executing option trades. These charges typically encompass a transaction fee, a clearing fee, and a regulatory fee. The transaction fee, also known as brokerage, is a fixed amount levied per executed trade. The clearing fee, on the other hand, is a fixed charge pertaining to the settlement of trades through clearing corporations. Additionally, a regulatory fee may be applicable as per regulations stipulated by the Securities and Exchange Board of India (SEBI). It’s crucial for traders to factor these charges into their trading strategies to ensure profitability.

Calculating Brokerage Charges: A Transparent Approach

To determine the exact brokerage charges incurred for an option trade at ICICIDirect, traders can leverage a straightforward formula. The formula involves multiplying the transaction fee by the trade value and then adding both the clearing fee and regulatory fee to the product. The resulting figure represents the total brokerage charges applicable for the trade. By employing this formula, traders can anticipate their expenses and make informed decisions regarding trade execution.

Leveraging Brokerage Plans: Exploring Cost-Effective Options

ICICIDirect recognizes the significance of catering to traders’ unique requirements and preferences by offering a range of brokerage plans. These plans, tailored to different trading styles and volumes, provide a flexible framework for traders to optimize their costs. The plans, such as the Prime plan and the Value plan, feature varying transaction fee structures, allowing traders to select the plan that best aligns with their trading strategies and risk appetite.

Image: fundsmagazine.optionfinance.fr

Expert Assistance: Enhancing Trading Strategies

ICICIDirect is committed to empowering traders with the necessary knowledge and support to navigate the intricacies of option trading. Their dedicated team of experts offers personalized guidance, assisting traders in developing robust strategies, mastering risk management techniques, and identifying potential trading opportunities. By leveraging the expertise of these professionals, traders can refine their approaches and maximize their potential for success in the dynamic world of option trading.

Option Trading Brokerage Charges Icicidirect

Image: www.adigitalblogger.com

Conclusion: Embracing Informed Option Trading

In the arena of option trading, brokerage charges represent a crucial aspect that can significantly impact profitability. Understanding the structure and calculation of these charges empowers traders to make informed decisions regarding trade execution. ICICIDirect’s comprehensive platform, coupled with a range of brokerage plans and expert assistance, equips traders with the tools and knowledge to navigate the option trading landscape effectively. By embracing this understanding, traders can unlock the potential of option trading, hedging risks, amplifying returns, and maximizing their financial success.