Introduction

In the ever-evolving realm of financial markets, Netflix has emerged as a formidable force, captivating the attention of investors and traders alike. Its massive subscriber base and dominant position in the streaming industry make it an ideal candidate for option trading, providing ample opportunities for potential profit and portfolio diversification. This comprehensive guide will delve into the intricacies of Netflix option trading, empowering you with the knowledge and strategies to navigate this dynamic market.

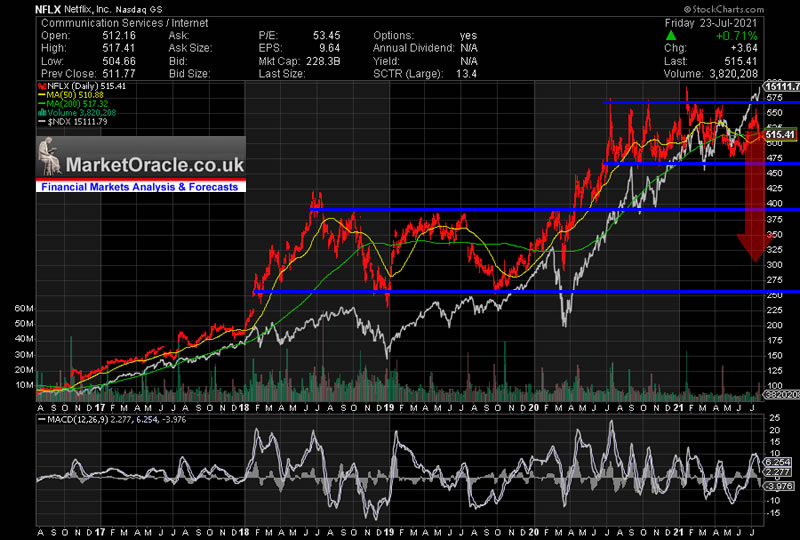

Image: www.marketoracle.co.uk

Understanding Netflix Option Trading

Option trading involves the buying and selling of options contracts, which are standardized financial instruments that grant the buyer the right, but not the obligation, to buy or sell an underlying asset (in this case, Netflix stock) at a predetermined price on or before a specific date. Netflix option trading allows investors to speculate on the future direction of Netflix’s stock price without the need to own the underlying shares.

Types of Netflix Options

There are two main types of Netflix options: calls and puts.

- Calls: Grant the buyer the right to buy Netflix shares at a predetermined price, known as the strike price.

- Puts: Grant the buyer the right to sell Netflix shares at a predetermined price.

Option Trading Strategies

There are various option trading strategies that can be employed to exploit the volatility of Netflix’s stock price. Here are some popular strategies:

- Covered Call: A strategy in which the investor sells covered calls against shares of Netflix stock they own. The seller receives a premium from the buyer in exchange for the option to buy the shares at the strike price. This strategy generates income and reduces the potential for losses if Netflix’s stock price falls.

- Cash-Covered Put: A strategy in which the investor sells cash-covered puts with the intent to purchase Netflix shares at the strike price if the option is exercised. The seller receives a premium from the buyer in exchange for the obligation to buy the shares if the strike price is reached. This strategy is similar to buying Netflix shares at a discount.

- Iron Condor: A more complex strategy that involves selling options at two different strike prices on both the call and put sides. The goal of an iron condor is to profit from a relatively small movement in Netflix’s stock price.

- Straddle: A strategy in which the investor buys both a call and a put option with the same strike price and expiration date. The goal of a straddle is to profit from a significant movement in Netflix’s stock price, regardless of its direction.

Image: www.skillfinlearning.com

Netflix Option Trading

Market Analysis for Netflix Option Trading

Before engaging in Netflix option trading, it is crucial to conduct thorough market analysis. Consider the following factors:

- Technical Analysis: Technical analysis involves the study of price patterns and indicators to identify potential trading opportunities. Common technical analysis tools include moving averages, candlesticks, and trendlines.

- Fundamental Analysis: Fundamental analysis examines Netflix’s financial performance, management, competitive landscape, and macroeconomic factors to gauge the intrinsic value of its stock.

- Social Sentiment Analysis: Analyzing sentiment expressed on social media, news, and