As a seasoned investor, I’ve witnessed firsthand the transformative power of bloom trading options. Still, I remember the initial surge of curiosity that propelled me into this exciting realm. Bloom trading options have revolutionized the financial landscape, offering traders the potential for increased profitability and risk management. In this comprehensive guide, I’ll demystify the concept of bloom trading options, unravel its historical significance, and equip you with expert tips to maximize your trading success.

Image: www.investagrams.com

Unlocking the Potential of Bloom Trading

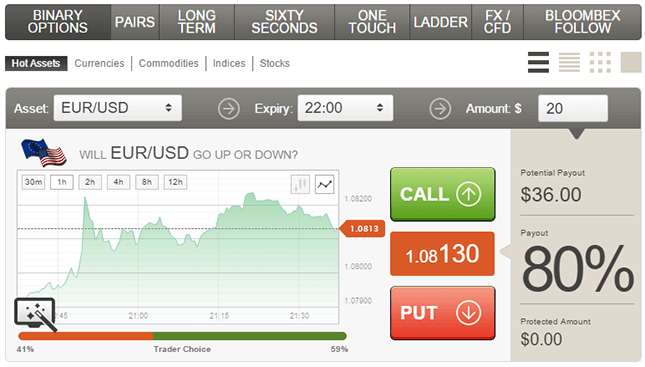

Bloom trading options is a sophisticated trading strategy that involves buying and selling options on underlying assets like stocks or indices. Options are financial contracts that give the buyer the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a predetermined price (strike price) on or before a set date (expiration date). By leveraging options, traders can potentially enhance their gains or mitigate losses under various market conditions.

The flexibility of bloom trading options allows traders to tailor their strategies to suit their risk appetite and profit objectives. Whether you’re seeking modest income generation or substantial capital gains, bloom trading options empowers you to pursue your financial goals.

Historical Evolution: A Trailblazing Technique

The origins of bloom trading options can be traced back to the early 20th century. In 1973, the Chicago Board Options Exchange (CBOE) introduced the first stock options market, paving the way for the widespread adoption of options trading. Over the years, the bloom trading options market has undergone significant advancements. The introduction of electronic trading platforms and the expansion of underlying assets have made options accessible to a broader pool of traders. Today, bloom trading options is a cornerstone of modern financial markets, empowering countless investors with versatile trading possibilities.

Moreover, the emergence of blockchain technology has introduced novel avenues for bloom trading options. Decentralized finance (DeFi) platforms provide alternative marketplaces for options trading, potentially offering greater transparency, security, and accessibility. The intersection of blockchain and bloom trading options is an evolving landscape, presenting both challenges and opportunities for traders.

Bloom Trading Options: A Step-by-Step Guide

Navigating the intricate web of bloom trading options requires a solid understanding of the process involved. Let’s embark on a step-by-step journey to unravel the mechanics of this exciting trading strategy.

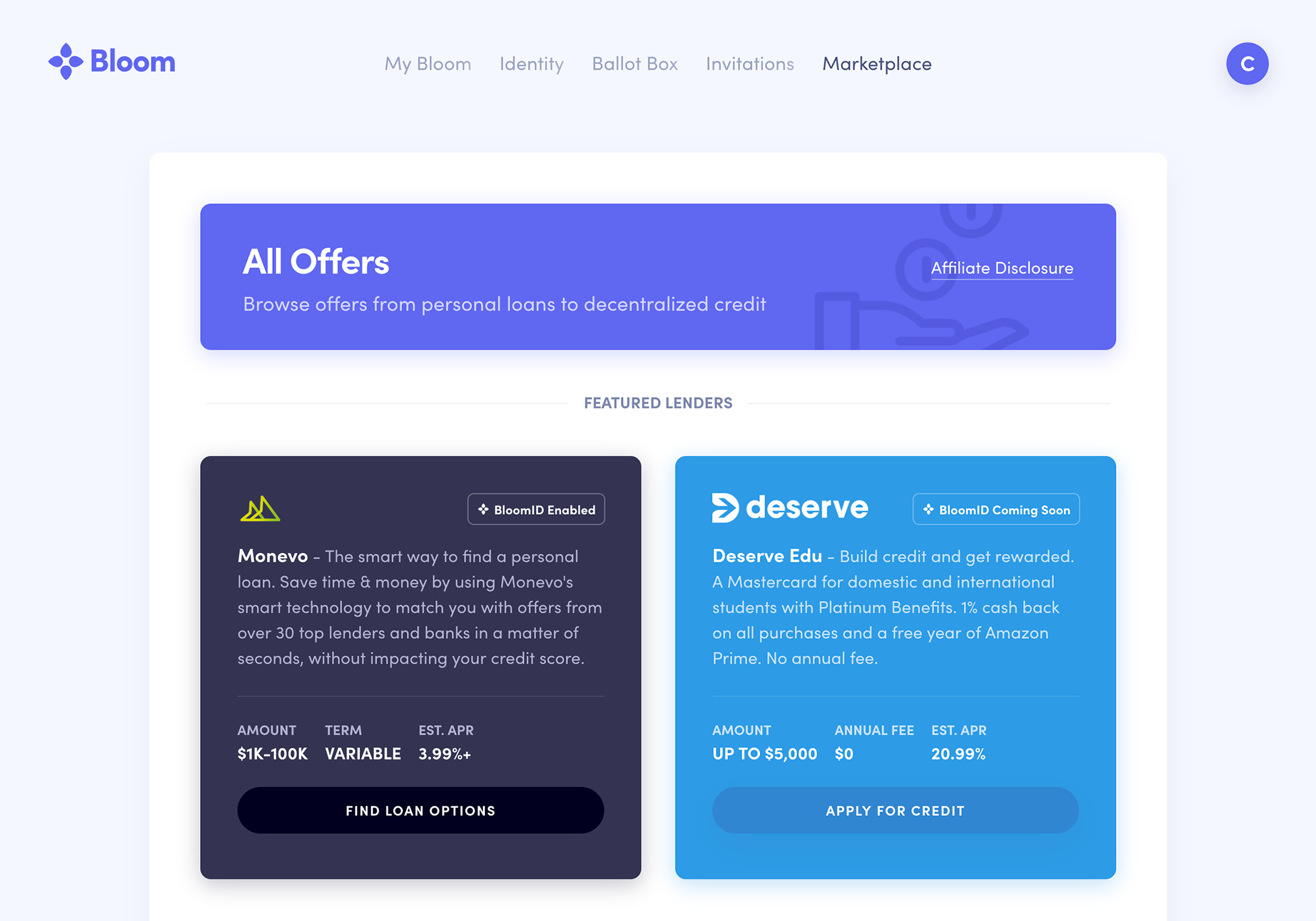

Image: bloom.co

1. Choosing the Underlying Asset

The first step in bloom trading options is selecting the underlying asset on which you wish to trade. This could be a stock, index, or currency. Your choice should align with your market outlook and risk tolerance.

2. Determining the Strike Price

Next, you need to determine the strike price of the option. The strike price represents the price at which you can exercise your right to buy (if it’s a call option) or sell (if it’s a put option) the underlying asset.

3. Choosing the Expiration Date

Options contracts have a predefined expiration date. This is the last date on which you can exercise your option rights. Bloom trading options expire either monthly or quarterly.

4. Deciding on the Option Type

There are two primary types of options: call options and put options. Call options give you the right to buy the underlying asset, while put options grant you the right to sell it.

5. Placing the Trade

Once you have determined all the parameters, you can place your bloom trading options trade through an online brokerage platform. Most platforms display real-time option prices, allowing you to make informed trading decisions.

Leveraging Bloom Trading Options: Maximizing Your Profits

Bloom trading options is a powerful tool, but it’s crucial to approach it strategically. Here are some expert tips to help you optimize your bloom trading experience:

1. Understand Risk Management

Bloom trading options involves inherent risk. It’s imperative to thoroughly understand the potential risks and implement risk management strategies to mitigate potential losses.

2. Set Realistic Expectations

Bloom trading options is not a get-rich-quick scheme. It’s a complex trading strategy that requires patience, skill, and a clear understanding of market dynamics.

3. Continuous Education

The bloom trading options landscape is constantly evolving. Continuous education and research are essential to stay abreast of the latest strategies, trends, and regulatory changes.

FAQs on Bloom Trading Options

Q: Can I make money with bloom trading options?

A: Yes, but it requires a combination of skill, knowledge, and risk management. Bloom trading options offer the potential for profit, but it’s crucial to approach it cautiously.

Q: How do I choose the right underlying asset for bloom trading options?

A: Consider your risk tolerance, market outlook, and trading objectives when selecting the underlying asset. Thoroughly research different assets before deciding.

Q: Is bloom trading options suitable for beginners?

A: Bloom trading options is a sophisticated trading strategy that requires a deep understanding of financial markets and options trading. It’s not recommended for beginners.

Bloom Trading Options

Image: worldforexonline.com

Conclusion

Bloom trading options is a versatile and potentially lucrative trading strategy that has transformed the financial realm. By grasping the nuances of bloom trading options, you can unlock the door to enhanced profitability, risk management, and tailored financial planning. Remember, the pursuit of knowledge and prudent risk management are the keys to unlocking the full potential of this dynamic trading technique.

Are you intrigued by the world of bloom trading options? Leave a comment below to join the conversation and connect with fellow traders exploring this exciting financial frontier.