Are you intrigued by the potential of options trading but unsure where to start? Look no further than option spread strategies—a powerful suite of techniques designed to reduce risk while enhancing profitability. In this comprehensive guide, we’ll delve into the world of proven option spread strategies, guiding you through their concepts, benefits, and expert insights.

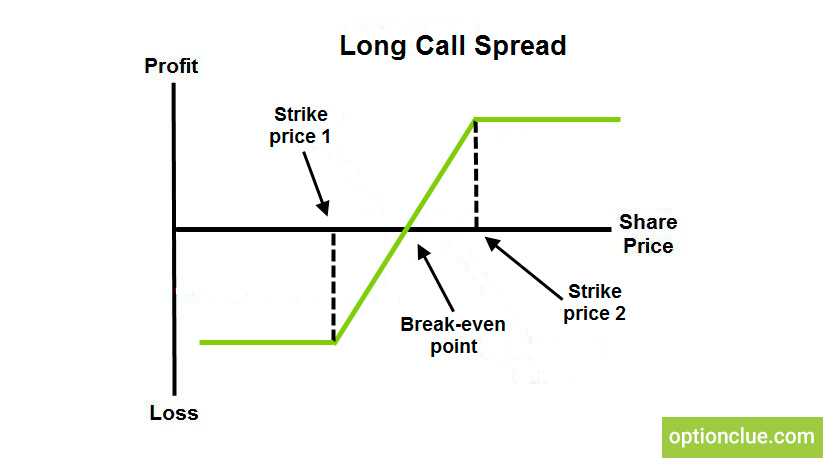

Image: optionclue.com

Understanding Option Spread Strategies

Option spreads involve simultaneously buying and selling options with different strike prices and expiration dates, creating a customized position that balances risk and reward. By combining multiple options, traders can potentially mitigate potential losses and fine-tune their exposure to market volatility.

Types of Option Spread Strategies

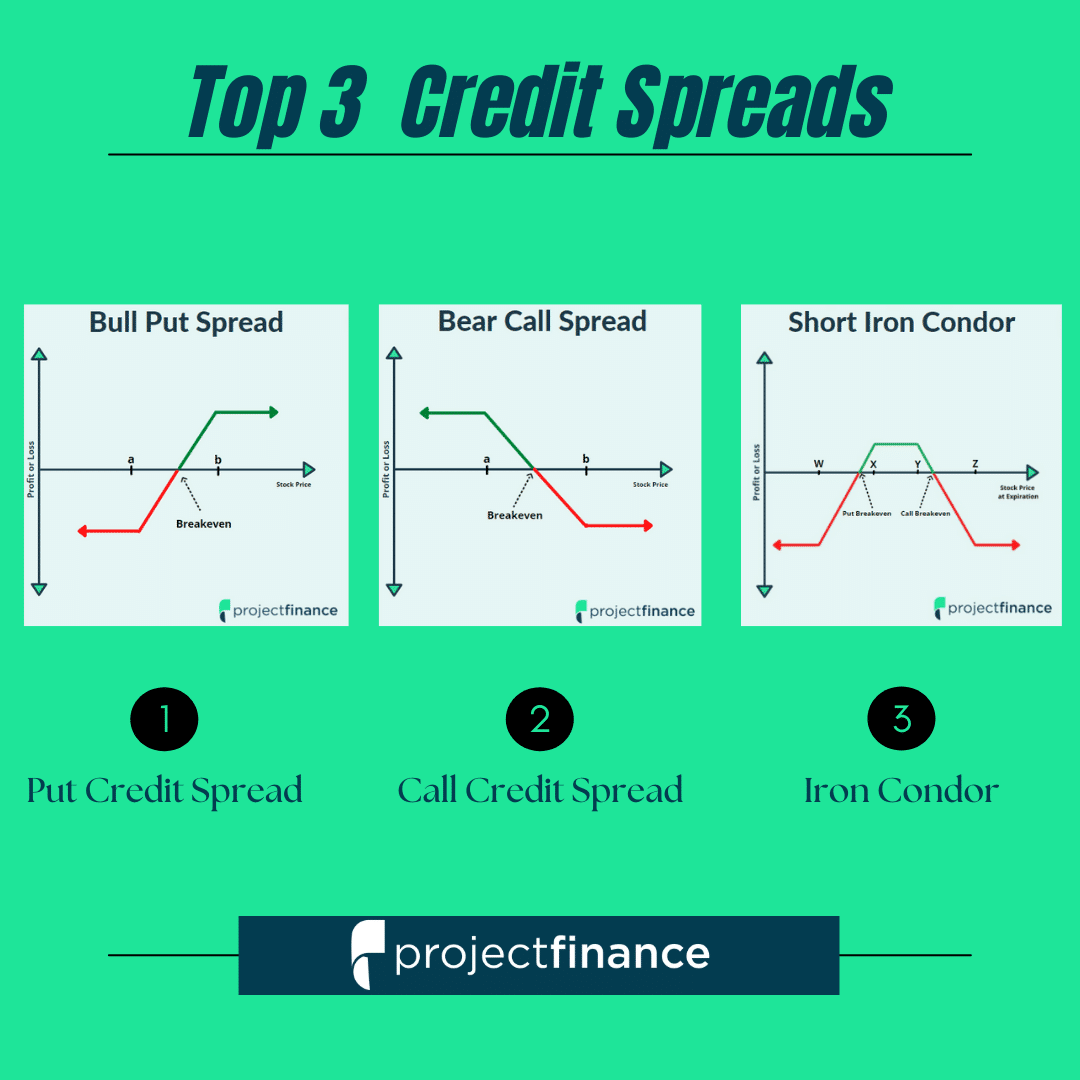

Bull Call Spreads: A bullish strategy designed to benefit from an underlying asset’s expected price increase. By buying a lower-strike call option and selling a higher-strike call option, traders create a profit potential within a specific price range.

Bear Put Spreads: A bearish strategy that seeks to profit from an underlying asset’s expected price decline. Traders sell a lower-strike put option and buy a higher-strike put option, hoping that the asset’s price will fall below a specified threshold.

Iron Condor Spreads: A neutral strategy that targets limited price movement or volatility. Traders simultaneously sell at-the-money put and call options while simultaneously buying out-of-the-money put and call options. The profit potential is capped in this strategy, but the risk of loss is also limited.

Butterfly Spreads: A combination of three options with different strike prices to create a profit potential within a narrow price range. These strategies are often employed when traders expect minimal price movement or high volatility.

Condor Spreads: Similar to butterfly spreads, condor spreads involve four options with different strike prices to create a profit potential within a defined price range. They are typically used when traders anticipate a sideways market or moderate volatility.

Expert Insights on Option Spread Trading

-

“Option spread strategies offer an effective way to manage risk while still capturing potential gains,” says Mark Fisher, a seasoned options trader. “The key is to select the right strategy for your market outlook and risk tolerance.”

-

“Research and due diligence are essential in option spread trading,” emphasizes Susannah Jones, a former Wall Street analyst. “Understand market trends, implied volatility, and the underlying asset’s fundamentals before executing any trade.”

-

“Risk management is paramount in option spread trading,” warns Michael Bloom, a financial advisor. “Always trade with stop-loss orders and size your positions appropriately based on your financial situation.”

Practical Tips for Successful Option Spread Trading

-

Start with a solid understanding of options and their risk-reward profile.

-

Identify a clear market outlook and choose an option spread strategy that aligns with your predictions.

-

Manage your risk by diversifying your portfolio, using stop-loss orders, and choosing strategies with limited loss potential.

-

Monitor your positions regularly and adjust or exit them as needed.

-

Continuously educate yourself and stay informed about market trends and trading best practices.

Image: purrgramming.life

Proven Option Spread Trading Strategies

Conclusion

Option spread trading strategies offer a versatile toolset for investors seeking to enhance their returns while managing risk. By understanding the different types of strategies, incorporating expert insights, and employing practical tips, you can harness the power of options to unlock new trading opportunities. Remember, the key to successful option spread trading lies in thorough preparation, risk management, and continuous learning.