A Rollercoaster Ride: My First Trade

It was a stormy Tuesday morning when I cautiously dipped my toes into the treacherous waters of SPX index options trading. With a mix of trepidation and anticipation, I placed my first order: a call option on the S&P 500 index. As the market opened, the roller coaster of emotions began.

Image: www.warriortrading.com

Within minutes, my heart skipped a beat as the market surged in my favor. The value of my option skyrocketed, sending shivers of excitement down my spine. But just as swiftly as the climb, the market reversed course, plummeting my option’s value to the depths of despair.

What is SPX Index Options Trading?

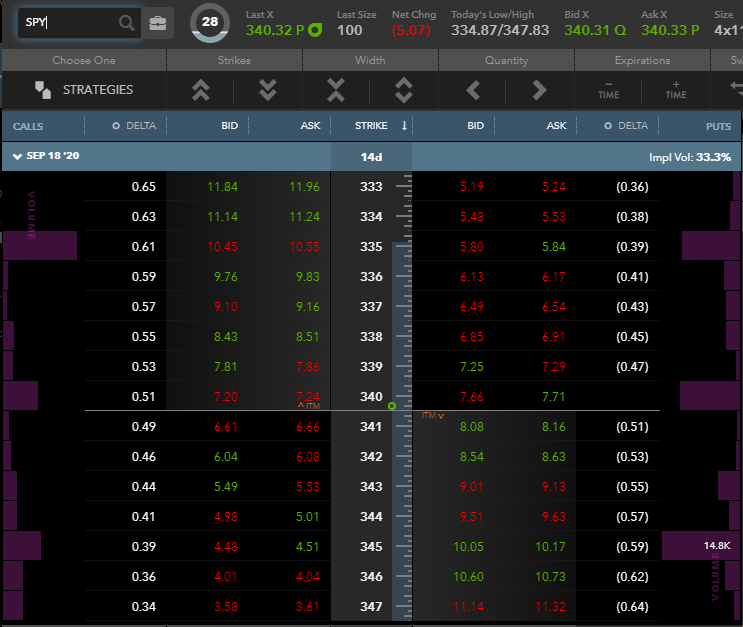

SPX index options trading involves speculating on the future value of the S&P 500 index, a broad measure of the US stock market. These contracts provide traders with the opportunity to bet on the direction of the market, either bullishly or bearishly.

Traders can buy or sell call options, which gives them the right to buy the S&P 500 index at a predetermined price (strike price) on or before a specific date (expiration date). Conversely, they can buy or sell put options, which gives them the right to sell the index at the strike price.

Mechanics of SPX Index Options Trading

SPX index options are standardized contracts traded on the Cboe Global Markets (Cboe). Each contract represents 100 shares of the S&P 500 index. Traders can choose from a variety of strike prices and expiration dates to suit their investment strategies.

When buying an option, the trader pays a premium to the seller. This premium reflects the market’s expectations of the index’s future movement. If the index moves in the direction predicted by the trader, the value of the option increases, potentially resulting in a profit. However, if the market moves against the trader’s prediction, the option loses value, potentially resulting in a loss.

Latest Trends and Developments

The SPX index options market is constantly evolving, with new strategies and products emerging regularly. Over-the-counter (OTC) options have gained popularity, offering traders more customization and flexibility.

Technology plays an increasingly vital role in options trading. Algorithmic trading and machine learning are transforming the way traders execute their strategies, enabling faster decision-making and risk management.

Image: www.tradingview.com

Expert Tips and Advice

Navigating the complex world of SPX index options trading requires a blend of knowledge, experience, and strategy. Seasoned traders recommend the following tips:

-

Research the Market: Stay informed about economic news and events that may influence the S&P 500 index, such as earnings reports, interest rate decisions, and global events.

-

Define Your Risk Appetite: Carefully assess your risk tolerance and match your trading strategies accordingly. Only trade with capital you can afford to lose.

Spx Index Options Trading

Image: www.environmentaltradingedge.com

FAQ

Q1: What is the difference between a call and put option?

A1: A call option gives the holder the right to buy the S&P 500 index, while a put option gives the holder the right to sell the index.

Q2: How long do SPX index options last?

A2: SPX index options have a variety of expiration dates, ranging from weekly to several months.

Q3: Can I lose more money than I invest in SPX index options trading?

A3: Yes, it is possible to lose more money than your initial investment if the market moves against your prediction.

Conclusion

SPX index options trading offers a powerful tool for sophisticated investors seeking to capitalize on the volatility of the stock market. By understanding the mechanics, following expert advice, and embracing the latest trends, traders can unlock the potential of this lucrative yet challenging market.

Are you ready to embark on your own SPX index options trading journey? Share your thoughts and experiences in the comments below.