Investing in the financial markets can be a daunting task, especially for beginners. Options trading can seem particularly complex, but mastering strategies like cash-covered puts can make it more approachable while generating potential returns. In this comprehensive guide, we will delve into the cash-covered put strategy, explaining how it works, its advantages and disadvantages, and how you can use it to enhance your investment portfolio.

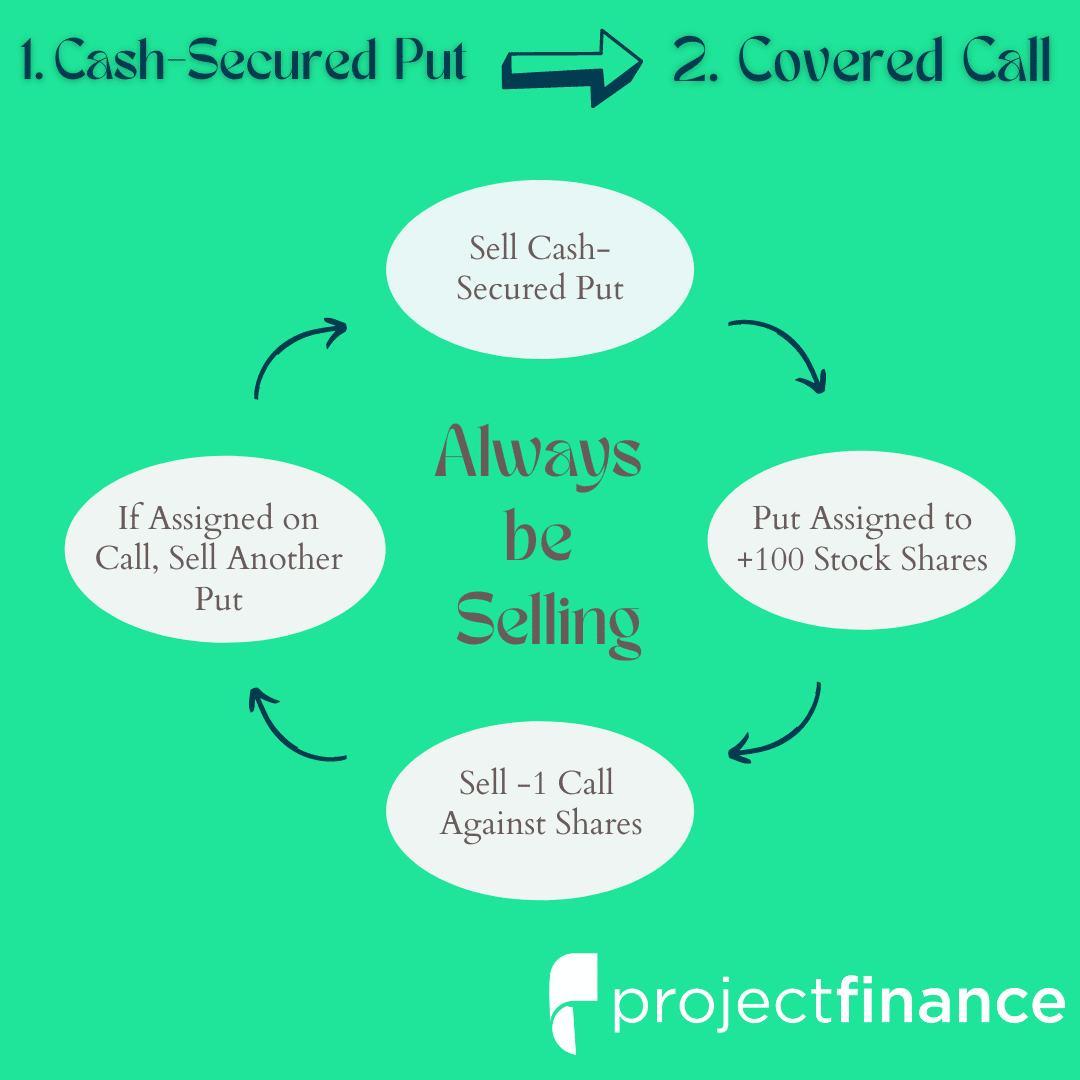

Image: www.projectfinance.com

Cash Covered Put: A Risk-Managed Options Strategy

A cash-covered put involves selling (or writing) a put option while holding an equivalent amount of the underlying asset (stock) in your account. By doing so, you create a scenario where you are obligated to sell the underlying stock at a predetermined price (strike price) if the option is exercised by the buyer. In return for assuming this obligation, you receive a premium payment from the party purchasing the option. This premium acts as a cushion, reducing the potential downside risk associated with the stock’s price movements.

Benefits and Drawbacks

The primary advantage of using a cash-covered put is its income-generating potential. The premium you receive from selling the option provides additional returns, especially if the stock price holds steady or increases. Additionally, this strategy can enhance your overall portfolio returns by lowering your cost basis on the underlying stock if it is eventually assigned (purchased) from you.

However, it’s essential to acknowledge potential drawbacks as well. If the stock price falls below the strike price, you are obligated to sell your shares at a loss. While the premium received can mitigate this loss to an extent, it may not fully compensate for significant stock price declines. Additionally, cash-covered puts can limit your potential upside if the stock price rises, as you are locked into selling the stock at the strike price.

How to Implement a Cash Covered Put

To implement a cash-covered put strategy, follow these steps:

- Own the underlying asset: First, you must have or purchase an equivalent number of shares of the underlying stock as the number of put options you intend to sell.

- Sell a put option: Sell a put option with a strike price that is lower than the current market price of the stock, typically just “out of the money”. The option expiration date should align with your goals and expectations for the stock’s price movements.

- Receive the premium: You will receive a payment from the buyer of the option in exchange for selling the put. This premium represents the cash component of the strategy.

Image: www.youtube.com

Tips and Expert Advice

Experienced traders and analysts offer valuable insights to enhance your cash-covered put strategy:

- Understand your risk tolerance: Before implementing this strategy, assess your risk tolerance and ensure that you are comfortable managing potential losses if the stock price falls below the strike price.

- Be selective with your stock choice: Choose stocks with strong fundamentals and long-term growth prospects. Avoid highly volatile stocks with unpredictable price movements.

- Set realistic strike prices: Determine strike prices that offer a balance between premium income and potential downside risk. Strike prices too close to the current market price increase the likelihood of assignment and potential losses.

Frequently Asked Questions (FAQs)

Q1: How long do I hold a cash-covered put position?

A: The expiration date of the put option determines the holding period. It can range from a few days to several months.

Q2: What happens if the option is assigned?

A: If the stock price falls below the strike price, you are obligated to sell your shares of the underlying stock to the option buyer at the agreed-upon strike price.

Q3: How much premium can I expect to receive?

A: The premium you receive will depend on factors such as the stock price, volatility, strike price, and time to expiration.

Options Trading Cash Covered Put

Image: savoteur.com

Conclusion

Cash-covered puts offer a viable investment strategy for generating income while reducing risk. Understanding the dynamics of this strategy and carefully selecting the underlying stock and strike price are crucial for success. By following the tips and advice presented in this guide, you can harness the potential of cash-covered puts within your investment portfolio. Whether you are a seasoned investor or just starting out, consider incorporating this strategy into your financial toolkit to enhance your returns.

Would you like to learn more about cash-covered puts or other options trading strategies?