Options trading schedules can sometimes be difficult to grasp. But, it’s an important element of understanding how options trading works. In this article, I’ll lay out what you need to know about option trading schedules, including some expert tips on how to trade options effectively using the schedule that suits your needs.

Understanding the time-sensitive factors that dictate when you can and cannot trade options can help increase your ability to fulfill your trading goals.

Image: uexo.com

Types of Trading Schedules

There are two main types of trading schedules in the options market:

- Regular trading hours: These are the hours during which the majority of option trading takes place. On NASDAQ and the NYSE the regular trading hours are 9:30 a.m. to 4:00 p.m. Eastern Time.

- Extended-hours trading: This is the period of time before and after regular trading hours when some options can be traded. Extended-hours trading hours vary depending on the exchange and the option.

Regular Trading Hours

Regular trading hours are the times when you can trade options on most exchanges. They encompass the period during which an option has liquidity, which ensures that there are buyers and sellers available to execute your order.

Extended-Hours Trading

Extended-hours trading is available on some exchanges for certain options. It provides the fleixbility to continue trading before and after regular trading hours, though this convenience comes with reduced liquidity.

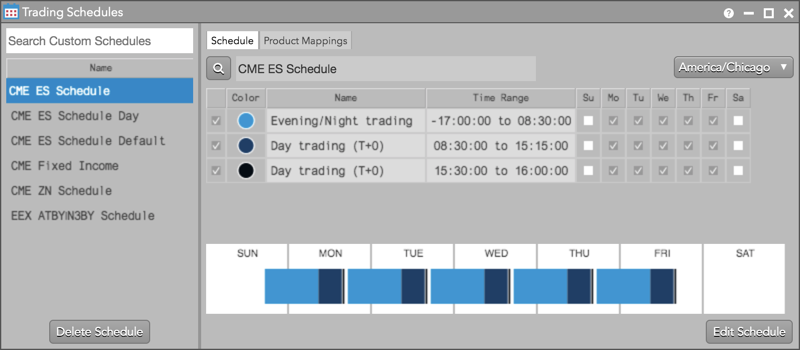

Image: library.tradingtechnologies.com

Why It’s Crucial To Understand Trading Schedules

Ultimately, understanding the schedule for trading options can help you to plan your trading strategy and maximize your trading success. Here’s how:

- Timely Execution of Trades: Staying within the designated trading schedule increases your chances of getting your orders executed swiftly, as this is when the highest liquidity exists within the market.

- Informed Decision-Making: Being aware of the accessible trading hours allows you to make informed trading decisions, understanding when to enter or exit a particular trade.

- Risk Management: Knowing when the market is open and closed for trading can aid in managing your risk exposure more effectively.

Tips for Trading with the Right Schedule

Here are some tips to help you as you trade options using the market schedule:

- Plan Your Trades in Advance: Familiarize yourself with the trading hours of the options you’re interested in. This way, you can plan your entry and exit points accordingly.

- Morning vs. Afternoon Trading: Study the historical price movements of the underlying security during various parts of the trading day. This can give you valuable insights into the best time to trade based on your objectives.

- Consider Volatility: Volatility can affect the liquidity of options. Stay informed about events that can impact volatility, such as earnings reports or economic data releases.

- Utilize Trading Platforms: Many trading platforms offer tools to monitor option prices and place orders outside of regular trading hours. Explore these features to stay ahead of the curve.

Frequently Asked Questions about Option Trading Schedules

Q: What are the regular trading hours for options on the NASDAQ and NYSE?

A: 9:30 a.m. to 4:00 p.m. Eastern Time.

Q: Where can I find information about extended-hours trading hours for options?

A: You can find this information on the website of the exchange where you plan to trade.

Q: Can I trade options 24 hours a day?

A: No, options trading is only available during the designated trading hours set by the exchanges.

Q: What happens if I try to trade an option outside of regular trading hours?

A: Your order will not be executed until the market opens.

Q: Is it better to trade options during regular trading hours or extended-hours trading?

A: It depends on your individual trading style and risk tolerance. Regular trading hours offer greater liquidity, while extended-hours trading provides more flexibility.

Option Trading Schedule

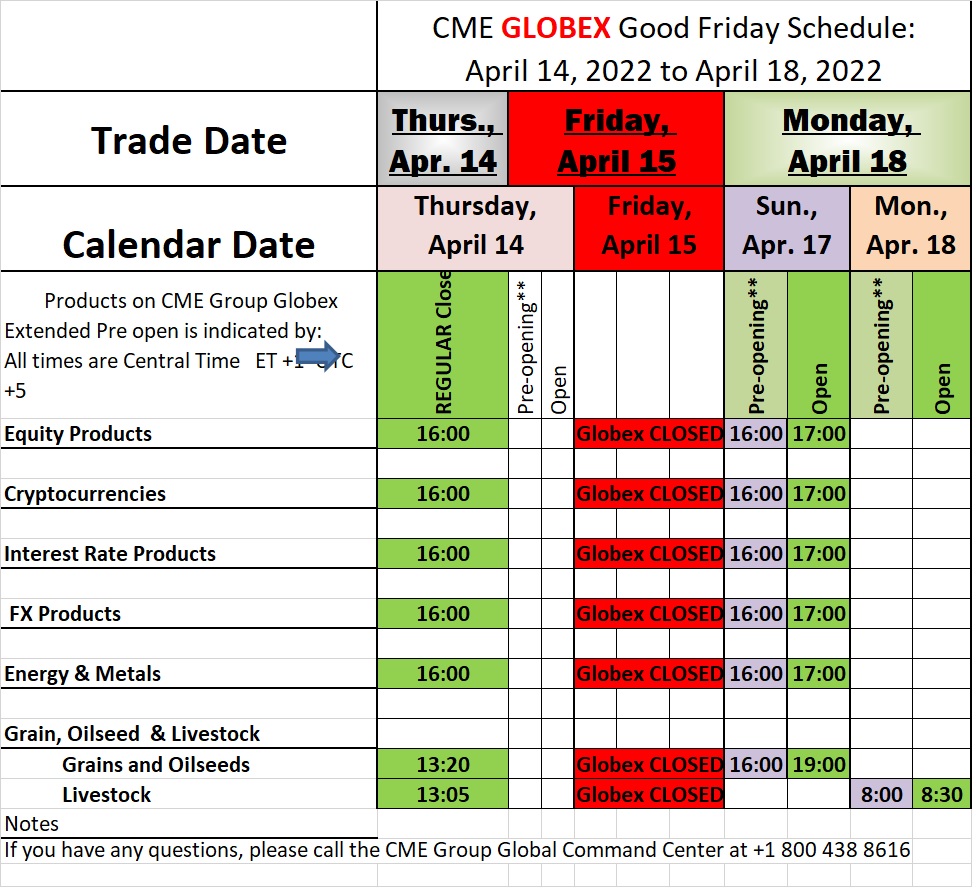

Image: www.cannontrading.com

Conclusion

Understanding the intricacies of the option trading schedule can greatly contribute to your trading success. By adhering to the trading hours and comprehending the dynamics of each trading session, you can enhance your decision-making, risk management, and ultimately your overall trading performance. Whether you are just starting out or have been trading options for years, it is always beneficial to have a clear grasp of your trading environment.

Is there anything else you’d like to know about option trading schedules? Drop your queries in the comments section below!