Introduction

In the fast-paced world of financial markets, understanding trading hours is crucial for making informed decisions. Options, a versatile investment instrument, are subject to specific trading schedules. One of the most fundamental questions for options traders is: “What time do index options stop trading?” This article aims to provide a comprehensive understanding of index option trading hours, empowering you to optimize your trading strategy and minimize potential risks.

Image: millionairemindset.life

Defining Index Options

Index options are contracts that give the holder the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) the underlying index at a predetermined price on or before a specific date. Index options are based on a broad market index, such as the S&P 500 or Nasdaq 100, and are traded on an options exchange.

Trading Hours for Index Options

Index option trading hours typically follow the underlying index’s trading hours. This varies depending on the exchange and index in question. In the United States, the most common index options trading hours are:

| Underlying Index | Trading Hours |

|---|---|

| S&P 500 Index | 9:30 AM – 4:00 PM EST |

| Nasdaq 100 Index | 9:30 AM – 4:00 PM EST |

| Russell 2000 Index | 9:30 AM – 4:00 PM EST |

| Dow Jones Industrial Average | 9:30 AM – 4:00 PM EST |

It’s important to note that these are standard trading hours and may be subject to adjustments or closures on certain days. Always consult the relevant exchange for the most up-to-date trading schedule.

Trading After Hours

While most index option trading activity occurs during regular trading hours, some exchanges offer after-hours trading. This extended period typically runs from around 4:15 PM EST to 7:00 PM EST and allows traders to execute trades after the market has closed. However, it’s crucial to remember that after-hours trading may have reduced liquidity and wider spreads.

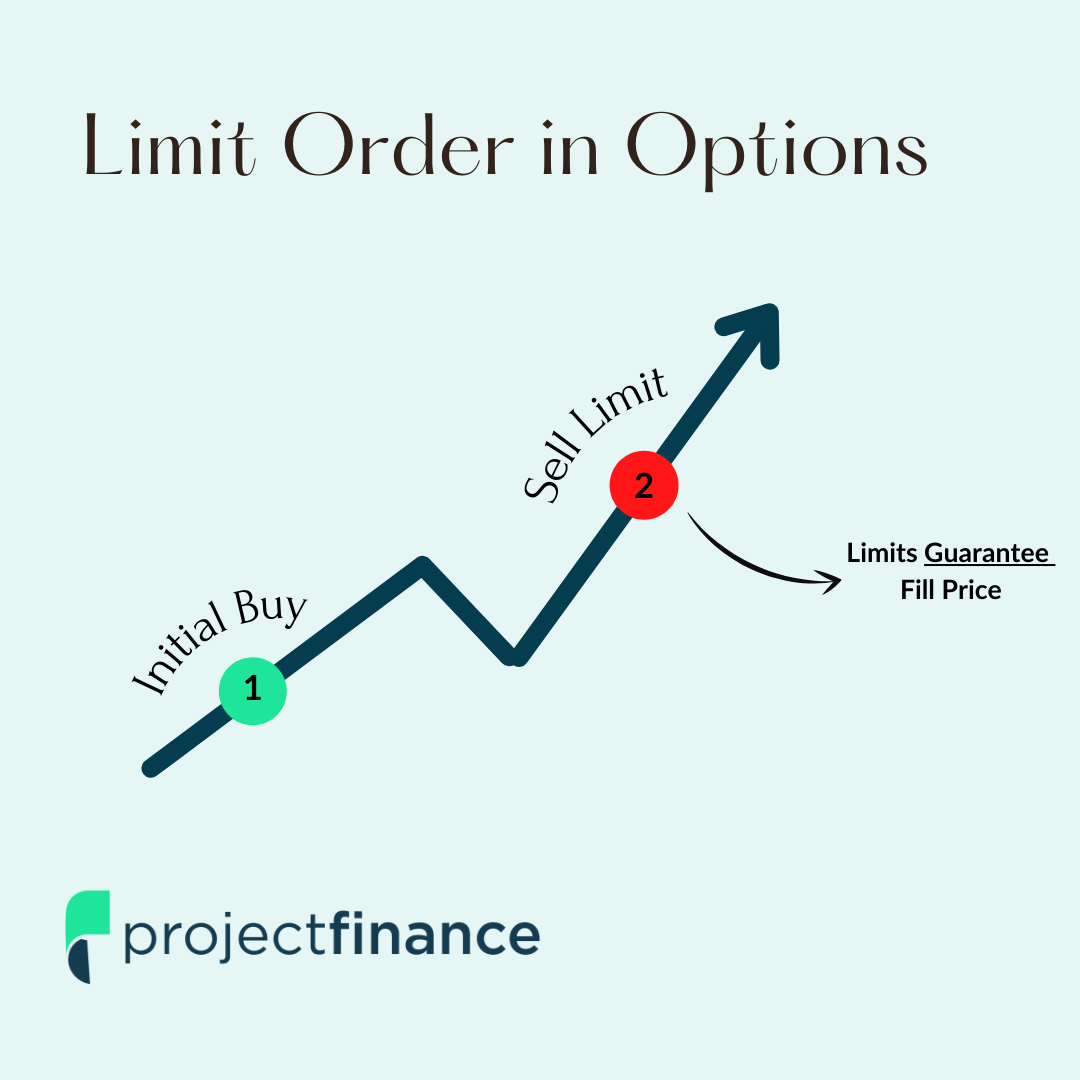

Image: www.projectfinance.com

Impact of Time Decay

Options have a limited lifespan, expiring on a specific date. As the expiration date approaches, the time value of the option decays, which means the option’s value decreases. The rate of decay accelerates during the final days and hours of trading. Therefore, traders need to be mindful of the time remaining before expiration when making trading decisions.

Implications for Trading Strategy

Understanding index option trading hours is essential for developing a successful trading strategy. By planning your trades within the given time frame, you can:

- Optimize entry and exit points to maximize profitability

- Minimize exposure to time decay and reduce potential losses

- Avoid missing out on opportunities due to market closures

- Manage risk effectively by not holding open positions overnight

What Time Do Index Options Stop Trading

Image: tradebrains.in

Conclusion

Index option trading hours are a crucial aspect of maximizing trading success. By understanding when index options stop trading, traders can plan their strategies accordingly, minimize risks, and optimize their position management. Stay informed about trading schedules, consider extended trading hours, and remember the impact of time decay. Remember, the key to unlocking the power of index options lies in mastering the temporal dimensions of the market.