Introduction

In the realm of investing, navigating the labyrinthine world of financial instruments can be a daunting task. Amidst a plethora of choices, two distinct paths emerge: options trading and binary options. While both options offer investors the potential for profit, they diverge sharply in terms of risk, reward, and regulatory oversight. Understanding these fundamental differences is crucial for informed decision-making and reaping financial success.

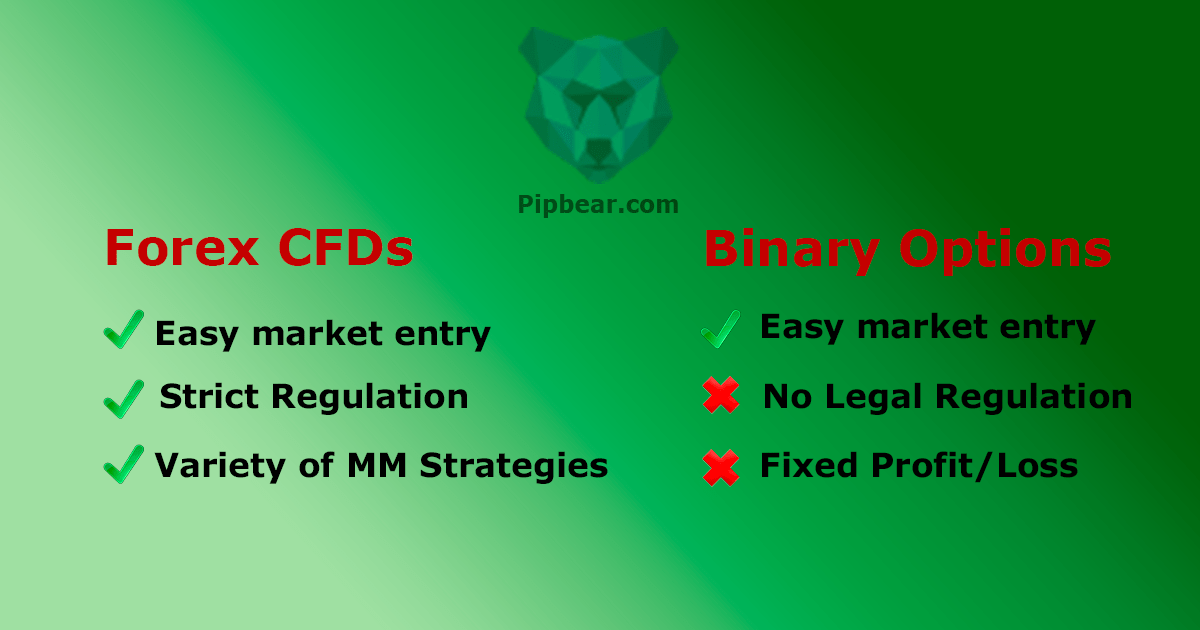

Image: pipbear.com

Unveiling the Dynamics of Options Trading

Options trading involves the purchase or sale of contracts that confer the right, but not the obligation, to buy or sell an underlying asset, such as a stock or bond, at a predetermined price on a specified date. Unlike binary options, options contracts offer investors a greater degree of flexibility and control over their investments. This flexibility stems from the ability to choose between call options (the right to buy an asset) and put options (the right to sell an asset), as well as the ability to specify the expiration date and strike price (the price at which the asset can be bought or sold).

The potential rewards of options trading can be significant, as profits are uncapped and directly linked to the performance of the underlying asset. However, this increased reward potential comes with a corresponding elevation of risk, since options contracts can expire worthless if the underlying asset does not move favorably.

Decoding the Binary Options Enigma

Binary options, in contrast to traditional options, present investors with a simplified and potentially lucrative proposition. These contracts offer a fixed payout, typically 80-95% of the investment, if the underlying asset closes above (in the case of a call option) or below (in the case of a put option) a predetermined strike price at a specified expiration time. The allure of binary options lies in their simplicity and seemingly high potential returns, which can be realized even with small price movements in the underlying asset.

However, this ease of use comes at a steep price. Binary options are essentially bets on the direction of an asset’s price movement, offering a fixed reward with no possibility of unlimited profit. Moreover, the risk in binary options is inherently binary: either the investor receives the predetermined payout or loses the entire investment. This risk-reward structure is inherently skewed towards the broker, as the odds of winning a binary options trade are often stacked against the investor.

监管的聚光灯:照亮options trading与二元期权的差异

监管框架在塑造投资领域方面发挥着至关重要的作用,options trading和binary options也不例外。Options trading受到严格监管,旨在保护投资者并确保市场的公平性和透明度。在美国,期货交易委员会(CFTC)负责监管所有期权合约的交易,包括在芝加哥期权交易所(CBOE)和纳斯达克期权市场(Nasdaq OMX PHLX)等交易所上市的期权合约。

与期权交易相比,二元期权的监管较为宽松,这为欺诈行为和滥用行为留下了空间。在美国,二元期权不被视为期货期权合约,因此不受CFTC监管。相反,它们由商品期货交易委员会(CFTC)监管。全国期货协会(NFA)作为自我监管组织。由于监管较少,二元期权市场充斥着不法经纪人和不可靠的平台,这使得投资者面临更高的风险。

Image: myfinanceresources.com

权衡选择:为您的投资目标量身定制

在期权交易和二元期权之间进行选择时,仔细权衡个人投资目标至关重要。对于寻求更多控制、灵活性和无限获利潜力的高风险承受能力投资者来说,期权交易可能是一个不错的选择。另一方面,追求简单、高回报且对风险承受能力有限的投资者可能会觉得二元期权更具吸引力。

值得注意的是,期权交易比二元期权需要更高级别的知识和技能。期权合约的复杂性可能使新手投资者难以理解,从而增加做出不明智决定和遭受损失的风险。

Options Trading Vs Binary Options

Image: forex-station.com

结论

期权交易和二元期权代表了投资领域内的两个独特选择,每个选择都带有自己的风险、回报和监管考虑因素。通过透彻了解这些金融工具之间的差异,投资者可以做出明智的决定,优化其投资组合并实现其财务目标。在进行任何投资之前,进行全面的研究并寻求合格金融专业人士的建议至关重要,以确保所选择的投资与个人风险承受能力和财务目标相一致。