Trading options have gained immense popularity among investors seeking to enhance their returns and gain an edge in the volatile financial markets. An option is a financial instrument that grants the holder a right, but not an obligation, to buy or sell an underlying asset at a predetermined price within a specified period. This flexibility provides investors with unique opportunities to capitalize on market movements and hedge against downside risks.

Image: www.newtraderu.com

Understanding the Basics of Options Trading

An option contract comprises four essential elements: the underlying asset, the strike price, the expiry date, and the premium. The underlying asset can be stocks, commodities, indices, currencies, or any other financial instrument. The strike price is the price at which the holder can exercise the option to buy or sell the underlying asset. The expiry date specifies the day when the option contract expires and becomes void. Finally, the premium is the price paid for purchasing the option contract.

Types of Options

There are two main types of options: call options and put options. A call option grants the holder the right to buy the underlying asset at the strike price on or before the expiry date. A put option, conversely, grants the right to sell the underlying asset at the strike price. The decision of whether to buy a call or a put option depends on the trader’s expectations of the future price movement of the underlying asset.

Strategies for Success in Options Trading

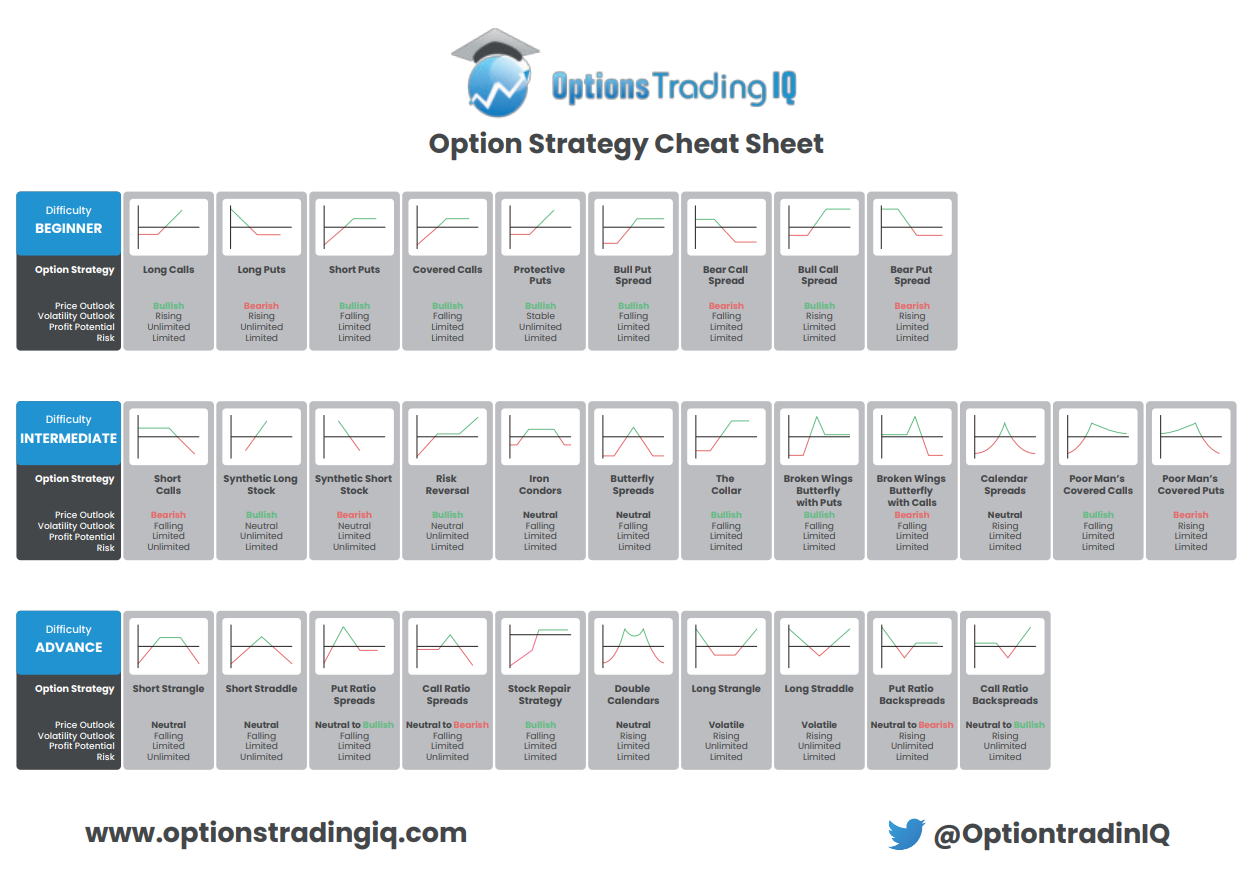

Options trading offers a wide range of strategies tailored to different risk appetites and investment goals. Some of the most common strategies include:

- Bull Call Spread: This strategy involves buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price. It benefits from a moderate increase in the underlying asset’s price while limiting the potential loss.

- Bear Put Spread: This strategy involves selling a put option at a higher strike price and simultaneously buying a put option at a lower strike price. It profits from a moderate decline in the underlying asset’s price while having limited potential gains.

- Iron Condor: This strategy combines a bull call spread and a bear put spread. It involves selling an out-of-the-money call option, buying an out-of-the-money call option at a higher strike price, selling an out-of-the-money put option at a lower strike price, and buying an out-of-the-money put option at an even lower strike price. This strategy benefits from a relatively small and stable range-bound movement in the underlying asset’s price.

Image: www.youtube.com

Trading Options For Edge

Conclusion

Trading options provides investors with a powerful tool to enhance their investment returns and mitigate risks. By understanding the basics of options, mastering different strategies, and diligently managing risks, traders can gain an edge in the financial markets and unlock new profit-making opportunities.