Introduction

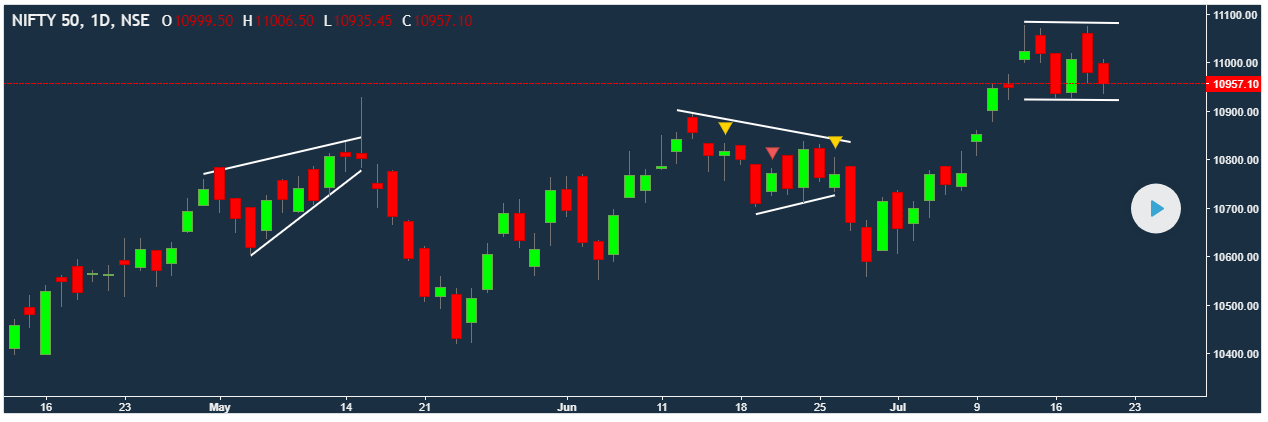

Image: zerodha.com

In the dynamic world of financial markets, where opportunities abound and risks lurk, derivative instruments have emerged as powerful tools to enhance returns and manage portfolio volatility. Among these derivatives, options trading on Nifty ETFs has gained immense popularity among both seasoned traders and aspiring investors. In this detailed guide, we will delve into the intricacies of Nifty ETF options trading, exploring its history, fundamental concepts, practical applications, and much more.

Nifty ETFs, or Exchange-Traded Funds, are passive investment vehicles that track the performance of the Nifty 50 index, a benchmark of the Indian equity market. By investing in Nifty ETFs, investors can gain broad exposure to the Indian stock market without the need for individual stock selection. Options contracts, on the other hand, grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price, known as the strike price, on or before a specific date, known as the expiry date.

Understanding Nifty ETF Options Trading

Options trading involves two primary players: the buyer, who acquires the right but not the obligation to trade the underlying asset, and the seller, who grants that right to the buyer and is obligated to fulfill the contract if exercised. Nifty ETF options are traded on the National Stock Exchange of India (NSE) and are characterized by standardized contracts with predefined terms.

When trading Nifty ETF options, investors have the flexibility to speculate on market movements and adjust their portfolios accordingly. Options contracts provide a range of strategies, including hedging against market volatility, generating income through premiums, and enhancing the potential returns of investments.

Key Concepts in Nifty ETF Options Trading

- Call Option: Gives the buyer the right to purchase a specified number of Nifty ETF units at the strike price on or before the expiry date.

- Put Option: Grants the buyer the right to sell a specified number of Nifty ETF units at the strike price on or before the expiry date.

- Strike Price: The price at which the buyer can exercise the option to buy or sell the underlying asset.

- Expiry Date: The date on which the option contract expires and ceases to have value.

- Option Premium: The price paid by the buyer to the seller for the right to trade the underlying asset.

- Time Value: The portion of the option premium attributed to the remaining time until expiry.

- Intrinsic Value: The difference between the strike price and the current market price of the underlying asset.

Strategies in Nifty ETF Options Trading

1. Bullish Strategies

- Buying Call Option: Betting on a rise in the Nifty ETF market price, giving the buyer the potential to profit from upward price movements.

- Selling Put Option: Banking on a limited downside risk while still collecting an option premium.

2. Bearish Strategies

- Buying Put Option: Anticipating a decline in the Nifty ETF market price, giving the buyer the potential to profit from downward price movements.

- Selling Call Option: Betting on a capped upside potential while earning an option premium.

3. Neutral Strategies

- Covered Call: Selling call options against an existing holding of Nifty ETF units to generate additional income while limiting upside potential.

- Protective Put: Buying put options as a hedge against a potential decline in the Nifty ETF market price, offering downside protection at a cost.

4. Income-Generating Strategies

- Selling Option Premium: Collecting option premiums by selling call or put options, benefiting from time decay if the underlying asset price remains stable or moves in the desired direction.

Conclusion

Nifty ETF options trading offers a diverse set of tools and strategies for investors of varying risk appetites and investment objectives. Understanding the fundamental concepts, market dynamics, and available strategies is crucial for navigating this market effectively. By conducting due diligence, managing risk, and continuously adapting to market conditions, investors can harness the potential of Nifty ETF options trading to enhance their portfolios and achieve their financial goals.

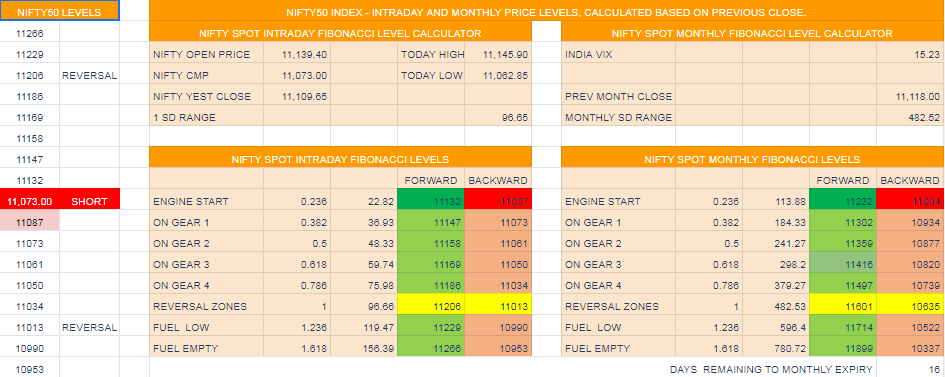

Image: unofficed.com

Nifty Etf Options Trading

Image: stocksonfire.in