Introduction

Ever wanted to trade options but didn’t know where to start? Look no further than Zerodha, India’s leading online stockbroker. Zerodha offers a comprehensive option trading platform with an intuitive user interface, advanced charting tools, and a dedicated demo account.

Image: forexeageneratormt5.blogspot.com

In this comprehensive guide, we’ll take you through the basics of Zerodha Nifty option trading, from understanding the concepts to executing your first trade using the demo account. Whether you’re a complete novice or looking to refine your skills, this guide will empower you with the knowledge you need to navigate the world of options trading confidently.

Understanding Nifty Options

What are Nifty Options?

Nifty options are contracts that give you the right, but not the obligation, to buy or sell Nifty 50 index at a predetermined price on a specific date. These contracts are traded on the National Stock Exchange of India (NSE), the largest stock exchange in India.

Types of Nifty Options

There are two main types of Nifty options: call options and put options.

- Call options give you the right to buy Nifty at a specified price on or before a certain date.

- Put options give you the right to sell Nifty at a specified price on or before a certain date.

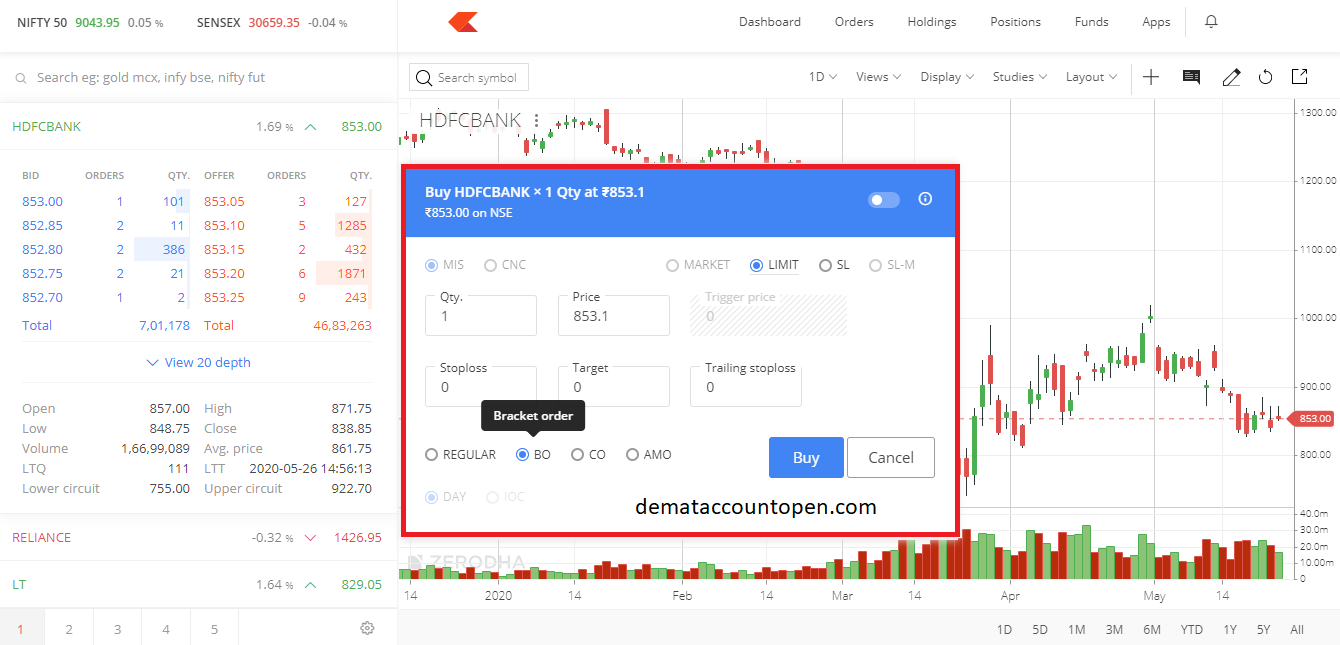

Image: demataccountopen.com

Trading Nifty Options on Zerodha

Step 1: Create a Zerodha Account

To start trading Nifty options on Zerodha, you’ll need to create an account. The process is simple and straightforward, and you can do it online in a few minutes.

Step 2: Open a Demo Account

Once you have a Zerodha account, you can open a demo account. A demo account allows you to trade Nifty options with virtual money, so you can practice without risking any capital.

Step 3: Place Your First Trade

With your demo account set up, you’re ready to place your first trade. Select the Nifty option you want to trade, enter the quantity, and specify the price and expiry date. Once you’re satisfied with your order, click “Buy” or “Sell” to execute the trade.

Tips and Expert Advice

Start Small

When you first start trading options, it’s important to start small. Don’t risk more money than you can afford to lose. As you gain experience, you can gradually increase the size of your trades.

Understand the Risks

Options trading carries significant risk. Before you start trading, make sure you understand the risks involved. Read books, articles, and consult with experienced traders to educate yourself about options trading.

FAQ

Q: What is the difference between a call option and a put option?

A: A call option gives you the right to buy Nifty at a specified price, while a put option gives you the right to sell Nifty at a specified price on or before a specific date.

Q: How do I choose the right strike price and expiry date for my option trade?

A: The strike price and expiry date of your option trade will depend on your investment strategy and market conditions. Consider factors such as the current price of Nifty, your profit target, and the market volatility when selecting your strike price and expiry date.

Zerodha Nifty Option Trading Demo

Image: www.moneycontain.com

Conclusion

Trading Nifty options on Zerodha is an excellent way to diversify your portfolio, hedge against risk, or speculate on the movement of Nifty 50 index. By opening a demo account, you can practice trading options without risking any capital, allowing you to build confidence and learn the intricacies of the market. Remember to start small, understand the risks involved, and seek expert advice to enhance your trading success.

Are you ready to embark on the exciting world of Zerodha Nifty option trading? With a demo account and the knowledge gained from this guide, you’re well-equipped to navigate the market and make informed trading decisions.