Introduction

When I first delved into the world of options trading, the concept of the Iron Condor strategy seemed like an arcane mystery. However, as I immersed myself in the intricate mechanics, I discovered its potential as a robust tool for income generation and risk management.

:max_bytes(150000):strip_icc()/OptionsTradingWithTheIronCondor-b4d19d75069b4dbe9b5b97d87124c7dc.png)

Image: www.investopedia.com

Iron Condors are complex multi-leg option strategies that combine buying and selling options at different strike prices. Navigating the nuances of this strategy requires a comprehensive understanding of its components, risk-reward profile, and market dynamics.

Understanding the Iron Condor Strategy

Definition

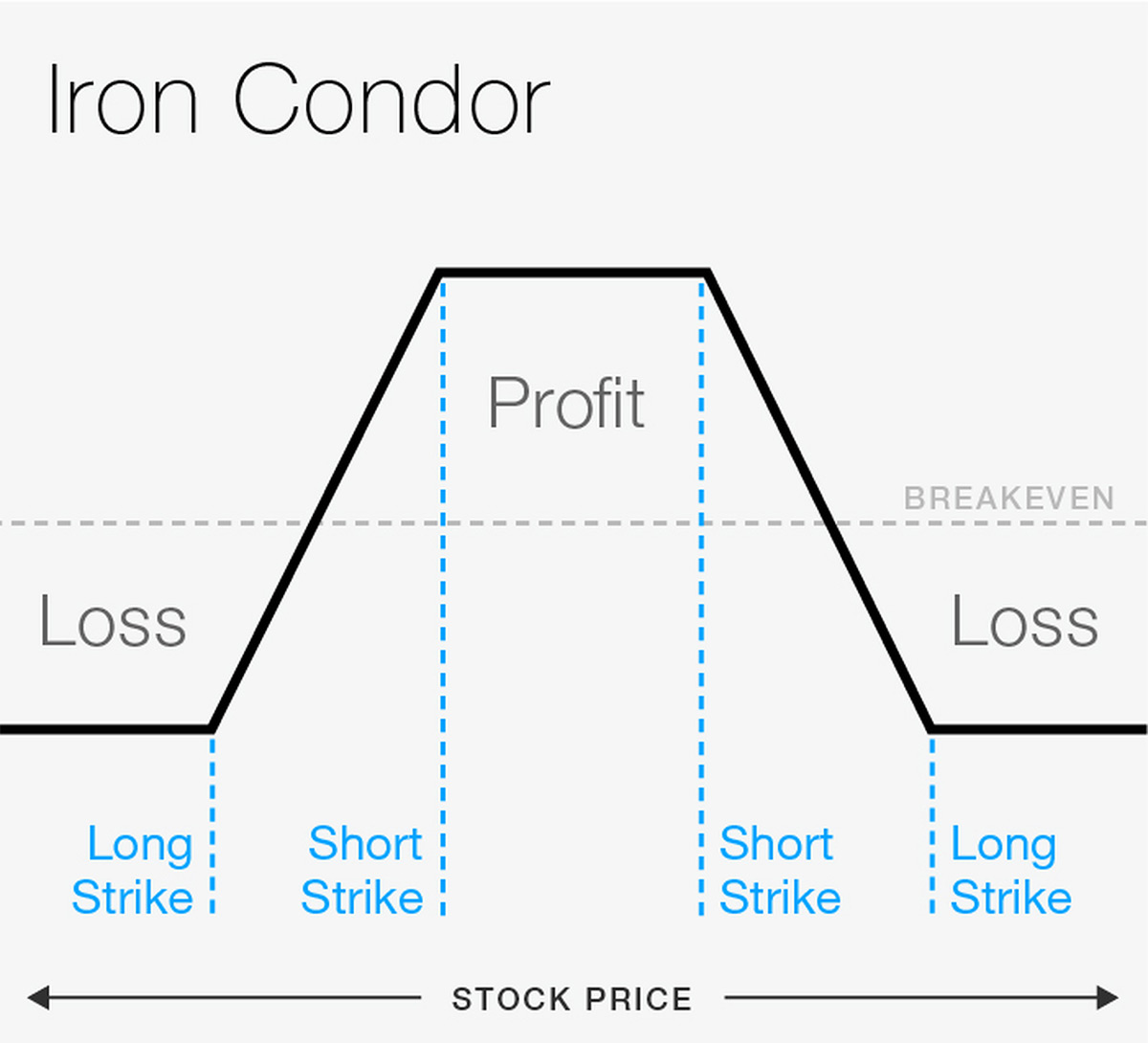

An Iron Condor strategy involves selling one Out-of-the-Money (OTM) call option and one OTM put option at a lower strike price, while simultaneously buying one OTM call option and one OTM put option at a higher strike price. This effectively creates a neutral position where the trader profits from the decay of time premium and fluctuations within a specific price range.

History and Significance

The Iron Condor strategy emerged as a popular risk-neutral option strategy in the late 1990s. As the popularity of options trading surged, traders sought innovative strategies to generate consistent returns while limiting potential losses. The Iron Condor, with its balanced risk-reward profile, quickly gained traction as a viable option.

![Iron Condor Options Strategy [Download Your Free Guide]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/5fea2e3cad7693ffbb5bc0cc_Iron Condor Payoff Diagram.jpg)

Image: optionalpha.com

Components and Mechanics

- Short OTM Call Option: Sell an OTM call option at a strike price above the current market price.

- Long OTM Call Option: Buy an OTM call option at a higher strike price than the short call.

- Short OTM Put Option: Sell an OTM put option at a strike price below the current market price.

- Long OTM Put Option: Buy an OTM put option at a lower strike price than the short put.

These options are structured in such a way that the maximum profit potential occurs when the underlying security’s price remains within the range defined by the strike prices of the short call and put options. If the price breaches either of these strike prices, the trader will incur losses.

Risk and Reward Profile

The Iron Condor strategy carries both potential rewards and risks:

Profit Potential

The primary goal of the Iron Condor strategy is to profit from the decay of time premium while the underlying security’s price remains within a certain range. Time decay erodes the value of the short call and put options, generating profits for the trader.

Risk Parameters

The risks associated with the Iron Condor strategy are limited, but not eliminated. If the underlying security’s price moves outside the defined range, the trader may incur significant losses. The amount of loss is capped by the net difference between the strike prices of the short and long options.

Latest Trends and Developments

The Iron Condor strategy has evolved over time, with traders refining their approach based on insights gained from market dynamics. Some notable trends include:

Volatility Targeting

Traders are zunehmend customizing Iron Condor strategies to target specific volatility levels. By using volatility indicators to identify market conditions, traders can adjust their strike prices and option premiums to maximize profit potential.

Dynamic Adjustments

Advanced traders employ dynamic adjustment techniques to manage risk and enhance returns. By monitoring market movements and adjusting the strike prices or options expiration dates, traders can adapt their strategies in response to changing conditions.

Tips and Expert Advice

- Define Clear Parameters: Establish a well-defined trading plan that outlines your target range, risk tolerance, and exit strategy.

- Understand Implied Volatility: Implied volatility is a crucial factor in determining the premium pricing of options. Study the historical and expected volatility of the underlying security to make informed decisions.

- Choose Liquid Options: Ensure that the options contracts you trade have sufficient liquidity to avoid execution delays or unfavorable pricing.

By adhering to these tips and seeking mentorship from seasoned traders, you can increase your proficiency in implementing the Iron Condor strategy.

FAQs

- Q: What is the ideal market condition for an Iron Condor strategy?

A: Low or moderate volatility, with the underlying security expected to trade within a defined range.

- Q: How do I determine the strike prices and expiration dates for an Iron Condor?

A: Consider the current market price, historical volatility, and your target profit range.

- Q: Can the Iron Condor strategy be used in volatile markets?

A: Yes, but it requires careful adjustment and close monitoring to manage risk.

Option Trading Iron Condor Strategy

Image: stock-investing-guide.com

Conclusion

The Iron Condor strategy is a powerful option trading strategy that offers the potential for income generation and risk management. By understanding its components, risk-reward profile, and nuances, traders can leverage this strategy to enhance their trading success. Remember, while the Iron Condor provides a balanced approach, it is not without risks. Thorough research, prudent execution, and ongoing market monitoring are essential for maximizing its effectiveness.

Are you interested in delving deeper into the world of option trading strategies? Stay tuned for upcoming articles and expert insights.