Step into the World of Options Trading

The realm of options trading holds endless possibilities for astute investors seeking to leverage market trends. Whether you’re a seasoned trader or just starting your journey into the world of options, understanding the fundamental strategies is crucial for success. This comprehensive guide will empower you with the knowledge and tools you need to navigate the exciting world of options and make informed trading decisions.

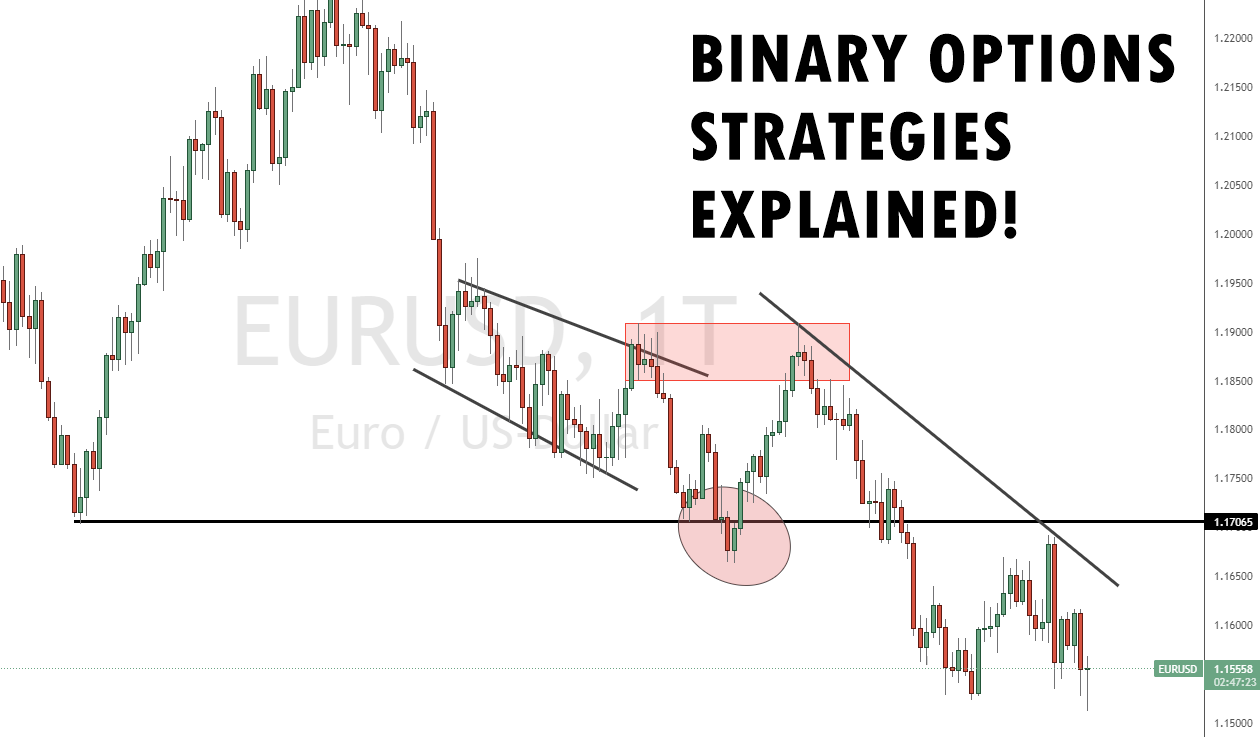

Image: investgrail.com

Demystifying Options Trading: A Comprehensive Definition

Options represent financial contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset, such as stocks, bonds, or commodities, at a predetermined price on a specific date. These contracts offer a unique way to capitalize on market movements, manage financial risk, and generate income through premiums.

Crafting a Basic Option Trading Strategy

There are numerous option trading strategies, each designed to meet specific investment goals and risk appetites. For beginners, understanding three foundational strategies is essential:

1. Buying Calls: Buying calls gives you the right to purchase an underlying asset at a specific price. This strategy is suitable for bullish investors who anticipate a price increase.

2. Selling Calls: Selling calls involves selling your right to someone else. This strategy is ideal when you own the underlying asset and believe its price will either decline or remain steady.

3. Buying Puts: Buying puts grants you the right to sell an underlying asset at a specific price. This strategy appeals to bearish investors who foresee a price decline.

Mastering the Art of Option Trading

While options trading can be lucrative, it’s essential to proceed with caution and develop a disciplined approach. Here are some tips and expert advice to help you navigate the complexities:

• Comprehend the underlying asset’s behavior and price history thoroughly.

• Determine your investment goals, risk tolerance, and time horizon.

• Choose an appropriate strategy that aligns with your objectives.

• Understand the option’s premium, expiration date, and strike price.

• Utilize market analysis tools to gauge market trends and potential opportunities.

Image: fabalabse.com

Exploring the Latest Trends and Developments

The world of options trading is constantly evolving, presenting both opportunities and challenges for investors. Stay abreast of the latest trends and developments by actively following financial news, industry updates, and social media discussions. This knowledge can provide invaluable insights into market sentiment and guide your trading decisions.

Frequently Asked Questions (FAQ)

Q: What is the difference between a call and a put option?

A: Call options give you the right to buy, while put options grant you the right to sell the underlying asset.

Q: How do I choose an expiration date for my options?

A: Consider your investment timeframe and the underlying asset’s expected volatility when selecting an expiration date.

Q: What is the strike price of an option?

A: The strike price represents the price at which you have the right to buy or sell the underlying asset.

Basic Option Trading Strategy

Conclusion

The world of options trading offers immense potential for investors seeking alternative investment strategies. By mastering fundamental strategies, staying updated on trends, and employing risk management techniques, you can harness the power of options to enhance your financial portfolio.

Are you ready to delve into the exciting realm of options trading? Arm yourself with knowledge, embrace prudent risk-taking, and make informed decisions to unlock the rewards this dynamic market has to offer.