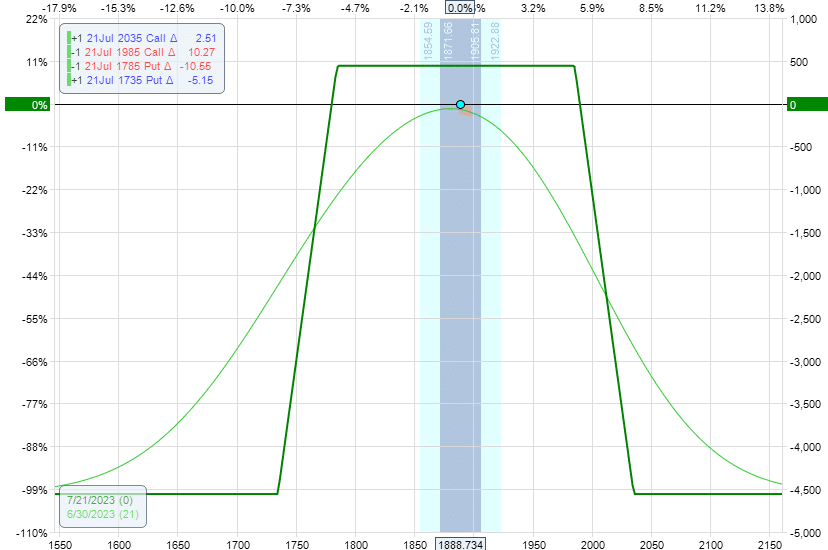

Iron condors are a neutral to slightly bullish or bearish option strategy that is designed to profit from a stock’s limited movement within a specific range. The strategy consists of selling an out-of-the-money call option, buying an out-of-the-money put option, selling an out-of-the-money put option, and buying an out-of-the-money call option. The stock price at the time of implementation should be between the strikes of the sold options.

Image: optionstradingiq.com

The maximum profit for an iron condor is limited to the net amount of the option premiums collected when the strategy is initiated, which is typically low. The maximum loss for an iron condor is limited to the difference between the strikes of the two sold options. Iron condors are considered a non-directional strategy because they can potentially profit from either a small increase or decrease in the underlying security’s price.

Anatomy of an Iron Condor

- Sell an out-of-the-money call option (higher strike price)

- Buy an out-of-the-money call option (lower strike price)

- Sell an out-of-the-money put option (lower strike price)

- Buy an out-of-the-money put option (higher strike price)

The distance between the strikes of the sold options determines the width of the range in which the strategy will profit. A wider range results in a higher probability of profit but also a lower maximum profit potential. A narrower range results in a lower probability of profit but a higher maximum profit potential.

Iron Condors in Practice

Imagine the stock XYZ is trading at $100. You believe that the stock price will remain within a range of $95 to $105 over the next few weeks. You could implement an iron condor strategy with the following strikes:

- Sell an out-of-the-money call option with a strike price of $105.

- Buy an out-of-the-money call option with a strike price of $100.

- Sell an out-of-the-money put option with a strike price of $95.

- Buy an out-of-the-money put option with a strike price of $100.

If the stock price remains between $95 and $105, all four options will expire worthless, and you will keep the net premium collected when you initiated the strategy. If the stock price moves outside of this range, one or more of the options will be exercised, resulting in a loss for you.

Why Are Iron Condors Typically Low?

Iron condors are typically low because the strategy is designed to profit from a stock’s limited movement within a specific range. If the stock price moves significantly in either direction, the strategy will likely lose money. As a result, iron condors are best suited for situations in which the trader believes that the stock price will remain relatively stable.

Image: www.pinterest.com

In Options Trading Iron Condors Why So Low

Image: dripivplus.com

Conclusion

Iron condors are a neutral to slightly bullish or bearish option strategy that can profit from a stock’s limited movement within a specific range. The strategy is relatively low-risk but also has limited profit potential. Iron condors are best suited for situations in which the trader believes that the stock price will remain relatively stable.