In the ever-shifting waters of financial markets, where fortunes are made and lost in the blink of an eye, option trading stands as a beacon of both opportunity and risk. Among the myriad strategies employed by seasoned traders, the Iron Condor stands out for its unique ability to harness market neutrality and capture profits from sideways price movements. In this comprehensive guide, we’ll delve into the world of Iron Condors, exploring its intricacies, benefits, and potential drawbacks, empowering you with the knowledge and confidence to navigate the turbulent waters of option trading with greater skill.

Image: www.warriortrading.com

What is an Iron Condor?

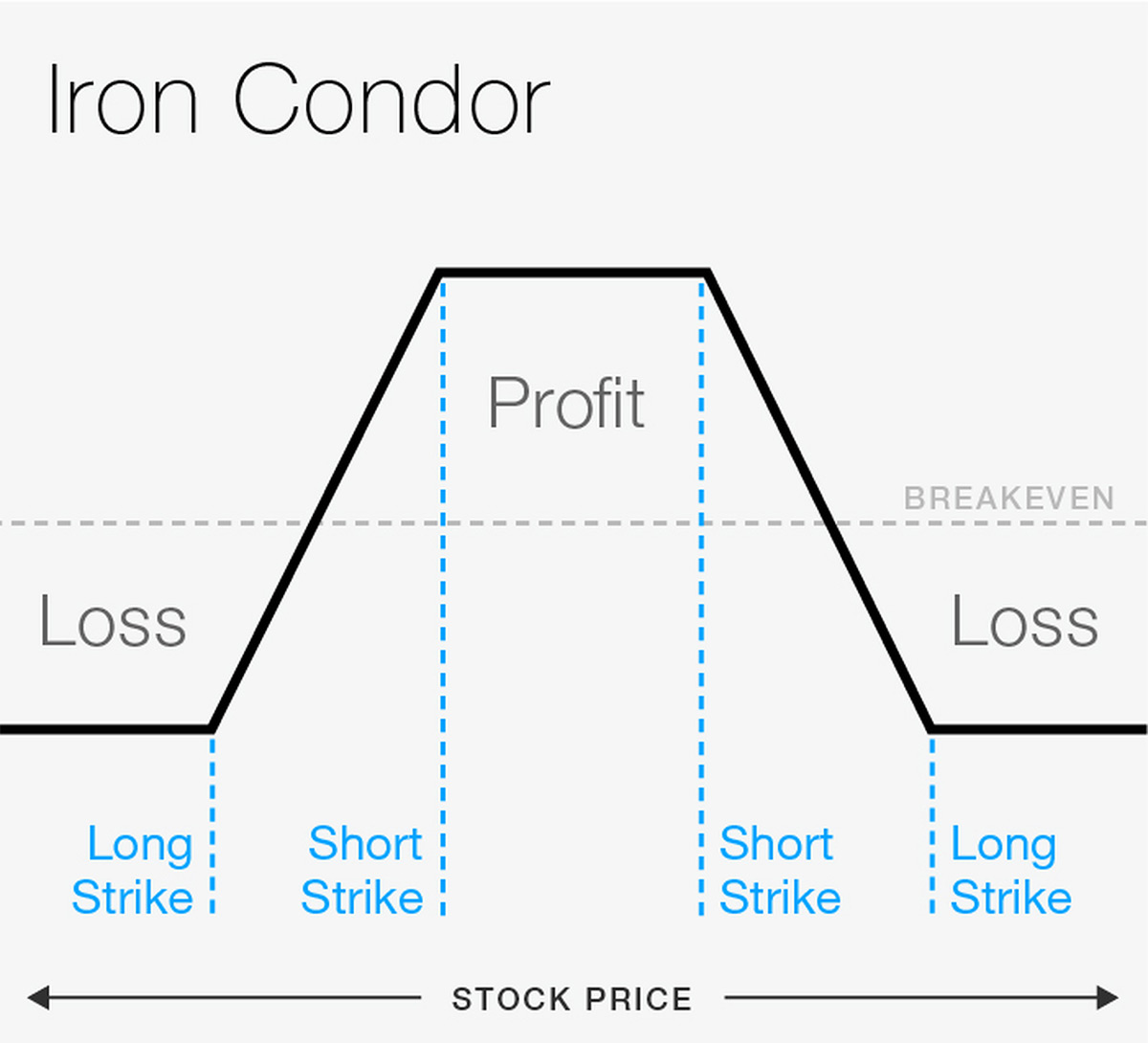

An Iron Condor is an advanced multi-leg option strategy that involves selling an out-of-the-money (OTM) call option, buying an OTM put option, selling an OTM put option, and buying an OTM call option. The strike prices of the sold and bought options are equidistant from the current stock price, creating a neutral position that profits from a limited range of price movements.

How it Works

Iron Condors capitalize on the concept of implied volatility, which measures the market’s expectation of future price fluctuations. By selling options with higher implied volatility (OTM options), the trader can collect a premium at the outset. The profit potential arises when the underlying stock price remains within the range defined by the strike prices of the sold options, effectively creating a “no-trade” zone. Should the stock price stray beyond these boundaries, the trader faces the risk of significant losses, highlighting the importance of careful analysis and risk management.

Benefits of Iron Condors

-

Profit from sideways Markets: Iron Condors thrive in periods of low volatility and limited price movements. This is because the strategy’s profit zone lies within a narrow range around the current stock price.

-

Reduced risk compared to naked Options: By employing both long and short options, Iron Condors mitigate the inherent risks associated with naked option selling.

Image: www.pinterest.com

Drawbacks of Iron Condors

-

Capped Profit Potential: Unlike some other option strategies, Iron Condors have a limited profit potential. This is because the strategy profits from a defined range, after which losses can escalate rapidly.

-

Complex Strategy: Iron Condors require a keen understanding of option pricing and market movements, making them less suited for novice traders.

Option Trading Iron Condor

Image: stock-investing-guide.com

Trading Iron Condors

-

Define your risk tolerance: Before embarking on Iron Condor trading, it’s crucial to determine your risk appetite and set clear trading parameters.

-

Select appropriate strike prices: The strike prices of the sold and bought options should be carefully selected to create a realistic profit zone while limiting potential losses.

-

Manage your position: Regular monitoring of your Iron Condor position is essential to adjust exits and manage risk.