Introduction

In the realm of financial markets, the art of trading options on platforms like IG has emerged as a compelling strategy for investors seeking to enhance their portfolio returns. While options offer immense potential for profit, they also carry inherent risks that must be thoroughly understood. This comprehensive guide delves into the intricate world of options trading on IG, empowering traders of all skill levels to navigate this dynamic market with confidence and finesse.

Image: tradingplatforms.com

Options contracts, in essence, confer the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) a specific underlying asset at a predetermined price (known as the strike price) on or before a specified date (the expiration date). Trading options on IG provides investors with an unparalleled opportunity to tailor their exposure to risk and reward, unlocking a vast array of trading strategies.

Types of Options on IG

IG offers a diverse range of options contracts, each catering to distinct trading objectives and risk profiles. Here’s a brief overview of the primary types of options available on the platform:

- Call Options: These options grant the holder the right to purchase the underlying asset at the strike price. They are typically employed when traders anticipate a price increase in the underlying asset.

- Put Options: Put options provide the holder with the right to sell the underlying asset at the strike price. They are commonly used when traders anticipate a price decline in the underlying asset.

- Vanilla Options: Vanilla options represent the most basic type of options contracts, offering a simple premium structure and a straightforward payoff profile.

- Exotic Options: Exotic options, as the name suggests, offer more complex structures and payoff profiles compared to vanilla options. They cater to sophisticated traders seeking advanced trading strategies.

Understanding Options Premiums

When trading options on IG, it is crucial to grasp the concept of options premiums. An options premium refers to the price paid by the buyer of an options contract to the seller. This premium comprises two primary components:

- Intrinsic Value: Intrinsic value represents the difference between the current market price of the underlying asset and the strike price. For example, if a stock is trading at $50 and the call option has a strike price of $45, the intrinsic value of the option is $5.

- Time Value: Time value represents the value of the option’s remaining time until expiration. The longer the time to expiration, the higher the time value. This is because the option has a greater chance of becoming profitable as the price of the underlying asset fluctuates.

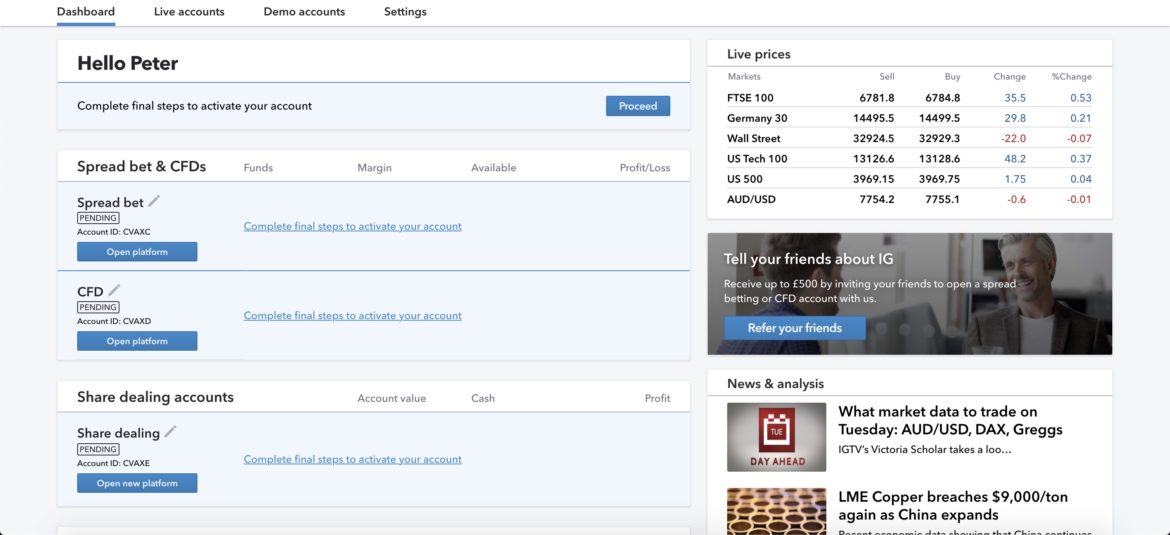

Leveraging IG’s Trading Platform

IG’s advanced trading platform offers a seamless user experience for options traders. Its intuitive interface provides real-time market data, in-depth charting tools, and advanced order types, empowering traders to make informed decisions and execute trades with precision.

IG’s risk management features, such as stop-loss orders and position limits, enable traders to effectively manage their risk exposure while maximizing potential returns. The platform also offers educational resources and dedicated support to assist traders in their journey.

Image: brokerchooser.com

Strategies for Trading Options on IG

The world of options trading on IG presents a multitude of strategies, each designed to address specific market conditions and trading objectives. Here are a few popular strategies to consider:

- Covered Calls: This strategy involves selling (or “writing”) a call option against an underlying asset that the trader already owns. The premium received from selling the call option provides additional income, while the trader retains the potential for unlimited profit from the underlying asset’s appreciation.

- Naked Calls: Naked calls involve selling a call option without owning the underlying asset. This strategy offers the potential for higher returns but also carries a higher risk of loss, as the trader is obligated to deliver the underlying asset if the option is exercised.

- Iron Condors: Iron condors involve selling both a call and a put option at different strike prices above and below the current market price of the underlying asset. This strategy generates income from the premium received but limits the trader’s profit potential while providing protection against significant market movements in either direction.

Trading Options On Ig

Risk Management in Options Trading

Risk management lies at the heart of successful options trading. Here are key principles to consider:

Understand Your Risk Tolerance: Before venturing into options trading, it is paramount to assess your risk appetite and determine the level of potential losses you are comfortable with. This will help you make informed decisions about the size and type of trades you enter.

Set Stop-Loss Orders: Stop-loss orders are essential risk management tools that automatically exit trades when the market price reaches a predetermined level. This helps limit potential losses and prevents emotions from clouding judgment during market volatility.

Diversify Your Portfolio: Diversification is a fundamental risk management technique that involves spreading your trades