Introduction: Delve into the World of Options Trading Risk Management

In the fast-paced and dynamic financial markets, risks are an inherent part of trading. Effective risk management strategies are crucial for the success and profitability of both individual and institutional traders. Acquiring a specialized certification in financial trading risk management with vanilla options empowers traders with the knowledge and skills to navigate the complexities of options trading confidently and efficiently. Vanilla options, the most commonly traded option types, offer a versatile tool for managing exposure and optimizing returns. This comprehensive beginner’s guide will explore the intricacies of financial trading risk management with vanilla options, unveiling the components of a risk management framework, the types of risks involved, and the strategies employed to mitigate them effectively.

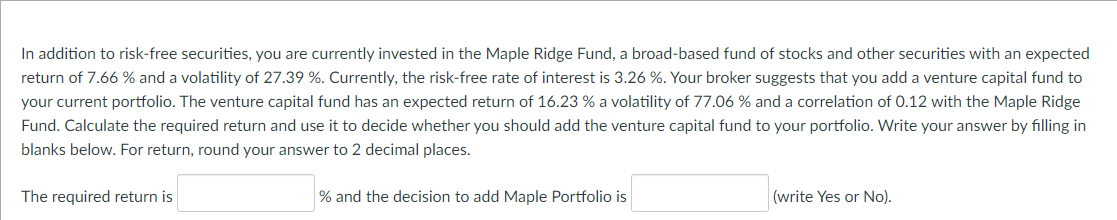

Image: www.chegg.com

Understanding Vanilla Options and Their Role in Risk Management

Vanilla options are standardized financial contracts that provide the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. These contracts are extensively utilized to hedge against price fluctuations, speculate on future market movements, and generate income through option premiums. Grasping the fundamentals of vanilla options is essential for comprehending their role in managing financial trading risks.

Types of Financial Trading Risks Associated with Vanilla Options

Trading vanilla options carries inherent risks, emphasizing the need for a robust risk management framework. These risks can be classified into various categories:

-

Market Risk: Arising from price fluctuations of the underlying asset, market risk is a substantial concern in options trading.

-

Option Risk: This risk stems directly from the nature of the option contract itself and includes time decay, volatility risk, and liquidity risk.

-

Counterparty Risk: Involves the potential default or non-fulfillment of obligations by the other party involved in the options transaction.

-

Operational Risk: Encompasses errors, breakdowns, or system failures that could lead to financial losses.

Mitigating Risks through Comprehensive Strategies

A comprehensive risk management framework encompasses an array of strategies designed to minimize potential losses and enhance the safety of financial trading operations. Some of the most effective risk management strategies include:

-

Position Sizing: Determining an appropriate position size based on risk tolerance and account capital is crucial.

-

Stop-Loss Orders: These orders are pre-set instructions to automatically exit a position if it reaches a predefined loss threshold.

-

Hedging Strategies: Involving the simultaneous purchase and sale of offsetting options positions to reduce exposure to directional market movements.

-

Volatility Management: Employing hedging techniques or adjusting option strategies to mitigate the impact of volatility fluctuations.

-

Stress Testing: Evaluating the resilience of risk management strategies under extreme market conditions through scenario analysis.

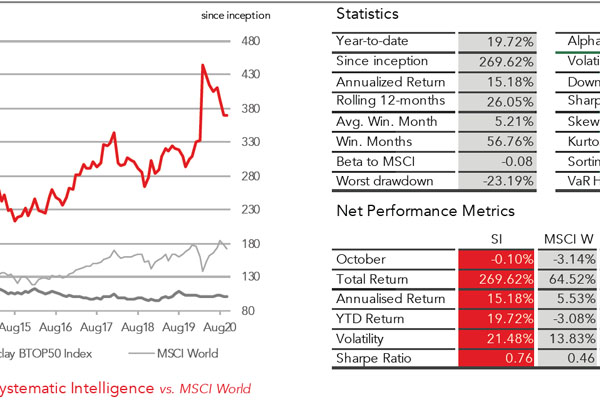

Image: github.com

Benefits of Acquiring a Certificate in Financial Trading Risk Management

Obtaining a certificate in financial trading risk management with vanilla options offers numerous advantages, empowering traders to:

-

Enhanced Risk Management Skills: Develop a deep understanding of financial trading risks and the strategies to manage them effectively.

-

Improved Trading Performance: Apply proven risk management principles to enhance trading performance and minimize losses.

-

Career Advancement: Showcase expertise in risk management, opening doors to senior positions in financial institutions.

-

Professional Credibility: Build credibility and recognition as a knowledgeable and certified risk management professional.

Certificate In Financial Trading Risk Management With Vanilla Options

Image: kaigai-tsumitate.com

Conclusion: Embarking on the Path to Risk Management Proficiency

In the ever-evolving financial markets, effective risk management is not just a necessity; it’s a competitive advantage. A certificate in financial trading risk management with vanilla options provides a comprehensive foundation for navigating the complexities of options trading. By leveraging this knowledge, traders can develop a robust risk management framework, empowering them to make informed decisions, mitigate losses, and optimize returns. Embark on this transformative journey today and unlock the potential for success in the dynamic world of financial trading.