Navigating the Lateral Landscape

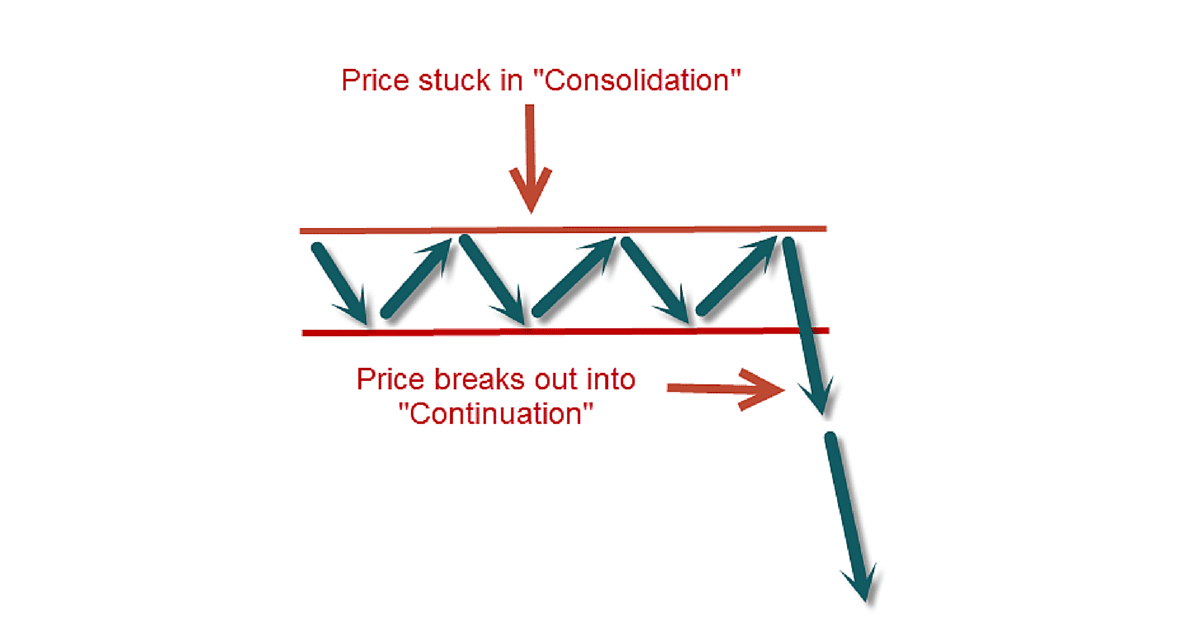

In the realm of options trading, sideways markets present a unique set of challenges and opportunities that require a tailored approach. Unlike trending markets with clearly defined uptrends or downtrends, sideways markets exhibit a lateral movement, with the price oscillating within a relatively tight range for an extended period. This can be a frustrating time for traders, but with the right strategies, it’s possible to generate profits in these choppy waters.

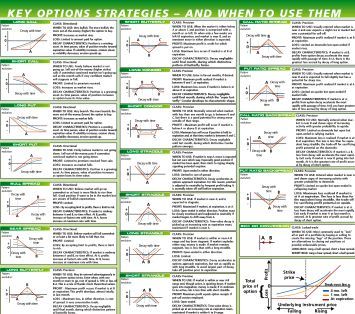

Image: www.warriortrading.com

Iron Condor

The iron condor is a neutral strategy that capitalizes on the low volatility and limited price movement characteristic of sideways markets. It involves selling a near-the-money call spread and buying a far-the-money call spread, along with selling a near-the-money put spread and buying a far-the-money put spread. The profit potential lies in the decay of options’ time value as the underlying asset remains within the defined range without making significant moves.

Short Straddle

Another option trading strategy for sideways markets is the short straddle. Similar to the iron condor, it consists of selling both a call spread and a put spread at the same strike price. However, unlike the iron condor, both spreads are sold at-the-money. This strategy benefits from the decay of options’ time value if the stock stays within a narrow range throughout the option’s duration.

Butterfly Spread

The butterfly spread is a bullish option trading strategy that seeks to profit from the belief that the underlying asset will remain within a specified range during the life of the options. It comprises selling an at-the-money call option, buying two at-the-money puts, and selling an out-of-the-money put. This strategy is suitable for markets where volatility is expected to be low and the investor expects the stock to move within a specific range.

Image: kumeyuroj.web.fc2.com

Collar

A collar is a type of options trading strategy that aims to limit both the potential gains and losses on an underlying asset. It consists of buying a protective put option below the current price of the underlying asset and selling a call option at a higher strike price. The potential profit is limited to the difference between the strike prices, minus the premium paid on the positions. The collar strategy is primarily intended for portfolio protection or to reduce risk on a long position.

Straddle Vs. Strangle

Straddles and strangles are two popular options trading strategies often used in sideways markets. Both strategies seek to take advantage of limited price movement and potential volatility. Straddles involve buying or selling call and put options at the same strike price, while strangles involve buying or selling options at different strike prices. Strangles typically offer a higher profit potential but also come with increased risk.

Options Trading Strategies Sideways

Image: www.forexschoolonline.com

Conclusion

Mastering options trading strategies for sideways markets requires a deep understanding of options pricing dynamics and an acute ability to analyze market conditions. By employing appropriate strategies, traders can navigate the lateral landscape and potentially generate profits in both trending and range-bound markets. Remember to approach trading with caution, manage your risk effectively, and always do your research before entering into any trades.