In the world of financial markets, traders encounter a variety of market conditions, each posing its own unique challenges and opportunities. Among these conditions, sideways markets stand out as a period of prolonged consolidation characterized by a lack of clear directional bias. For options traders, navigating these markets requires a nuanced approach and an understanding of the nuances that set sideways markets apart. This comprehensive guide will delve into the intricacies of options trading in a sideways market, empowering traders with the knowledge and tactics to conquer this often-elusive terrain.

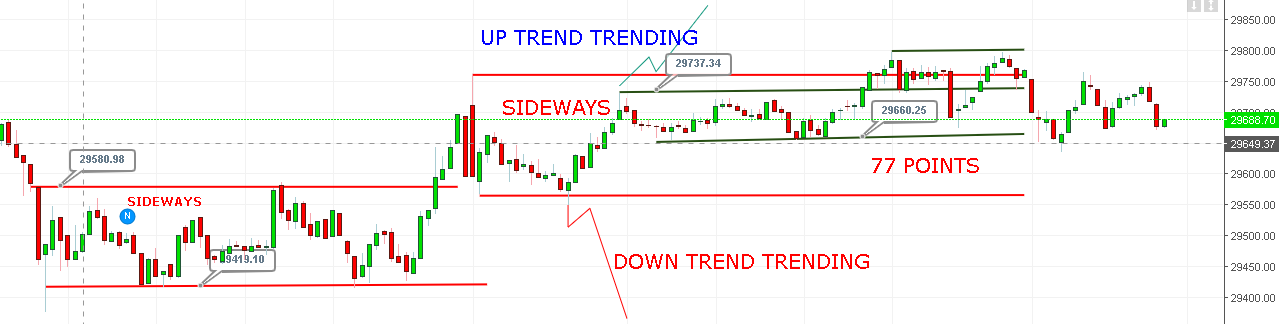

Image: ritapandit25.in

Understanding Sideways Markets: The Essence of Neutrality

Sideways markets emerge when a market’s price action fluctuates within a defined range, devoid of any discernible upward or downward momentum. This state of equilibrium results from an indecisive balance between buyers and sellers, each side cautiously awaiting a break in either direction. As such, sideways markets are often associated with periods of low volatility and limited price swings.

For options traders, this lack of pronounced trend translates into reduced profit potential from directional strategies like buying calls or puts. Instead, options strategies that capture fluctuations within a range, such as bull or bear spreads, become more suitable for capitalizing on the sideways market’s inherent characteristics.

Unveiling the Strategic Arsenal for Sideways Markets

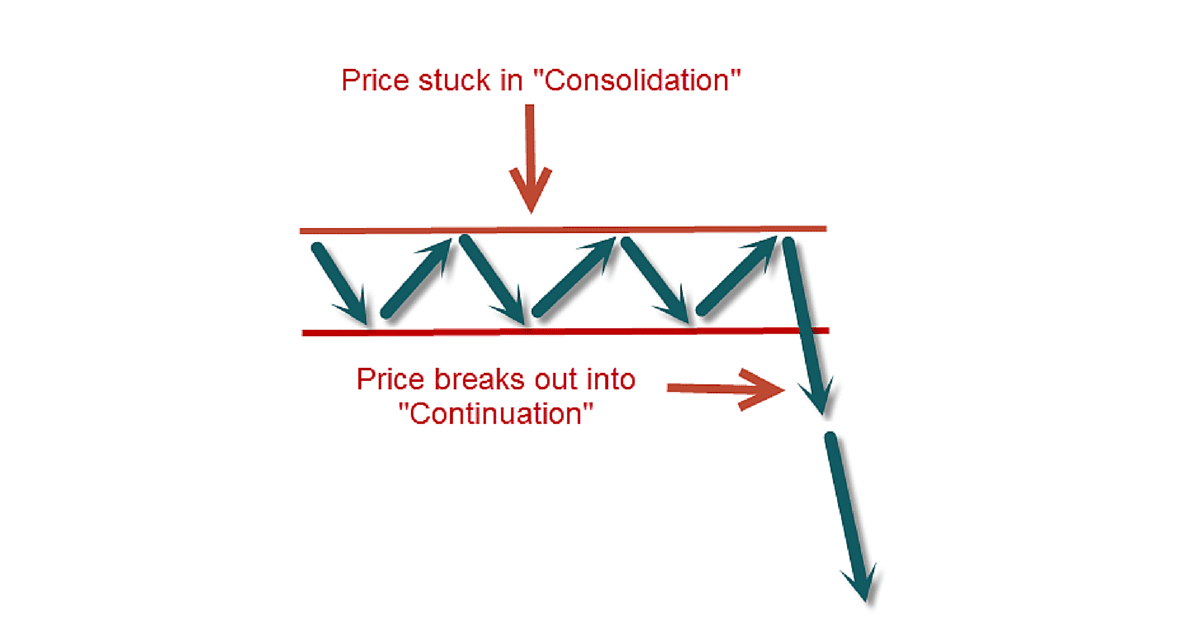

To achieve success in sideways markets, options traders must adapt their strategies to the unique market dynamics. Here lies the essence of options trading in such markets: recognizing that directionality is not the primary source of profit, but rather focusing on capturing price movements within the defined range.

1. Bull and Bear Spreads: Harnessing Range-Bound Opportunities

Bull and bear spreads involve the simultaneous purchase and sale of options with different strike prices within the same expiration cycle. Bull spreads are designed to profit from upward movement within a range, while bear spreads capitalize on downward movements. By relying on range-bound price action, these spreads offer a higher probability of profit compared to directional strategies in sideways markets.

Image: www.forexschoolonline.com

2. Calendar Spreads: Exploiting Time Decay in Sideways Markets

Calendar spreads involve purchasing an option with a shorter expiration date and selling one with a longer expiration date, both at the same strike price. In sideways markets where volatility is typically lower, the value of the shorter-dated option decays faster due to the passage of time. This creates an opportunity to profit from the difference in time decay between the two options.

3. Iron Condors: Crafting Neutral Stances

Iron condors are a neutral strategy that involves simultaneously selling a call spread and a put spread, both with different strike prices. The construction of this strategy creates a profit zone within a predefined range, allowing traders to capitalize on fluctuations within that range without having to predict the direction of the market.

Options Trading In A Sideways Market

Image: www.youtube.com

Conclusion: Embracing the Nuances of Sideways Options Trading

Options trading in a sideways market presents a unique set of challenges and opportunities for traders. By understanding the dynamics of sideways markets and employing strategies tailored to this neutral landscape, traders can harness the potential of options trading even in the absence of pronounced directional trends.

Remember, successful trading in sideways markets requires patience, discipline, and a refined understanding of option strategies. By embracing these principles, traders can navigate the complexities of this market condition and emerge victorious.