Options trading, a complex yet lucrative arena, presents traders with the opportunity to execute sophisticated strategies to maximize returns and mitigate risk. By understanding the intricate dynamics of options contracts, traders can fine-tune their trading approaches and achieve a competitive edge in the financial markets.

Image: www.projectfinance.com

Decoding Options: A Bridge Between Stock and Risk Management

An option contract represents a derivative security that grants the holder the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a stipulated price (strike price) on or before a specified date (expiration date). This flexibility empowers traders to navigate market fluctuations and craft tailored strategies that align with their risk appetite and investment goals.

Striking a Balance: Intrinsic Value and Time Value

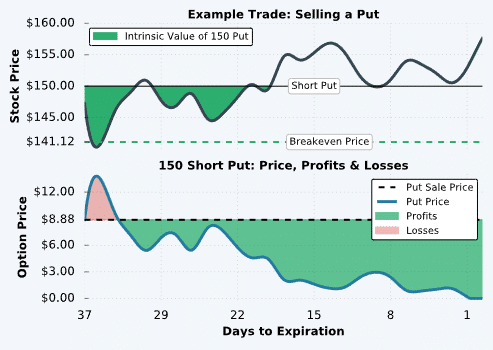

The value of an option contract comprises two fundamental components: intrinsic value and time value. Intrinsic value, the difference between the strike price and the current market price of the underlying asset, reflects the option’s immediate worth. Time value, on the other hand, represents the premium paid for the option’s optionality, namely its potential to provide a profit if the underlying asset’s price moves in a favorable direction before expiration.

Commanding Strategies: An Arsenal of Options Trading Approaches

Proficient options traders wield a broad spectrum of strategies to capitalize on market opportunities and minimize risk exposure.

- Covered Call: Selling a call option against an equivalent position in the underlying stock, generating income from the option premium while retaining the potential for stock appreciation.

- Cash-Secured Put: Selling a put option while holding sufficient cash to purchase the underlying asset at the strike price if exercised, capturing the option premium and potentially acquiring the asset at a discount.

- Bull Put Spread: Buying a call option at a higher strike price and selling a call option at a lower strike price, profiting if the underlying asset’s price rises above the lower strike price but below the higher strike price.

- Bear Put Spread: Selling a put option at a higher strike price and buying a put option at a lower strike price, generating income if the underlying asset’s price falls below the lower strike price but above the higher strike price.

Image: margintradeab.blogspot.com

Options in Action: Realizing the Potential

Options trading offers practical applications in various financial scenarios. Here’s how traders leverage options strategies:

- Hedging: Shielding portfolios from market downturns by purchasing protective put options or selling call options on the underlying assets.

- Income Generation: Selling options with low intrinsic value, collecting premiums over time while benefiting from potential capital appreciation in the underlying asset.

- Directional Trading: Expressing bullish or bearish market views by buying call or put options outright, aiming to profit from anticipated price movements.

Navigating the Options Landscape: Tips for Calculated Success

Venturing into options trading demands a deep understanding of the subject matter and meticulous adherence to risk management principles:

- Research and Education: Explore educational resources, study trading strategies, and consult with experienced brokers to equip yourself with a solid foundation.

- Risk Management: Determine your risk tolerance, implement appropriate stop-loss orders, and diversify your options portfolio to mitigate potential losses.

- Patience and Discipline: Options trading tests traders’ patience and discipline. Exercise caution, make informed decisions, and avoid emotional trading behaviors.

Embracing these principles empowers traders to navigate the options trading landscape with greater confidence and the potential for substantial returns.

Strategy In Options Trading

Image: www.youtube.com

Conclusion: Unveiling the Path to Strategic Returns

Strategy in options trading empowers traders with a versatile toolkit to harness market opportunities and manage risk. By understanding the fundamentals of options contracts, employing proven trading strategies, and adhering to sound risk management practices, traders can unlock the potential of this dynamic financial arena. As with any investment endeavor, thorough preparation and a calculated approach are paramount for successful outcomes.

Embrace the challenge of options trading, and embark on a journey toward calculated returns and market mastery.