Introduction

In the fast-paced world of day trading, where emotions run high and profits can vanish as quickly as they appear, finding the optimal strategy is paramount. This comprehensive guide delves into the intricacies of day trading, empowering you with the knowledge and insights to craft a robust strategy that aligns with your goals and risk tolerance.

Image: tradeproacademy.com

The Fundamentals of Day Trading

Day trading is a specialized form of trading where positions are opened and closed within the same trading day. Unlike traditional investing, which focuses on long-term growth, day traders seek to capitalize on short-term price fluctuations by executing multiple trades throughout the day. This approach demands a deep understanding of technical analysis, market dynamics, and risk management techniques.

Crafting Your Day Trading Strategy

Developing a sound day trading strategy is an iterative process that involves research, experimentation, and constant refinement. Begin by identifying your trading objectives, whether it’s generating consistent profits, managing risk, or a combination of both.

Next, establish your trading style. Are you a scalper, profiting from tiny price movements, or a trend trader, riding the larger market waves? This choice will influence your entry and exit strategies.

The Power of Technical Analysis

Technical analysis is the cornerstone of day trading success. By studying price charts and identifying patterns, traders can make informed decisions about potential market movements. Common indicators include moving averages, support and resistance levels, and candlestick formations.

While technical analysis alone cannot guarantee profitability, it provides valuable insights into market sentiment and potential trading opportunities.

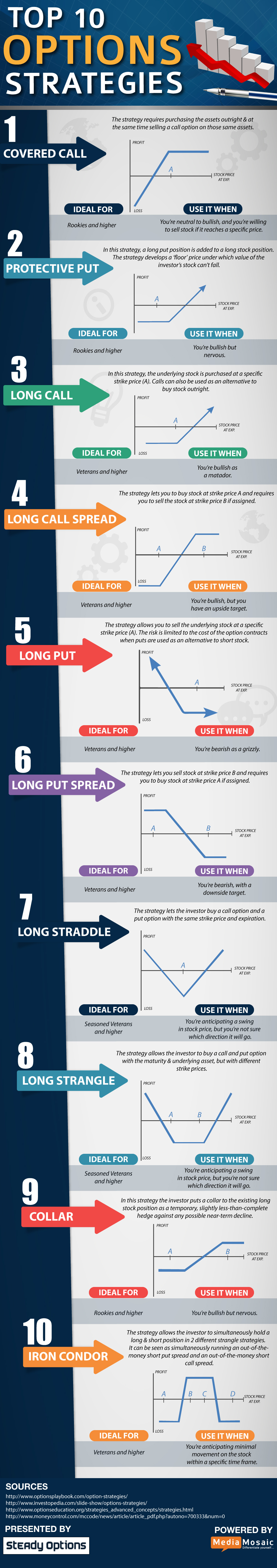

Image: steadyoptions.com

Risk Management: The Cornerstone of Survival

In the high-stakes world of day trading, risk management is not just an option but a necessity. Set realistic profit targets and stop-loss levels to protect your capital from substantial losses.

Implement a position-sizing strategy that limits the amount of capital you allocate to each trade. Remember, the goal is to minimize risk while maximizing potential returns.

The Art of Trade Execution

Once you’ve identified a promising trading opportunity, it’s time to execute your trade. Choose reputable brokers who offer low trading fees and reliable platforms.

Employ disciplined entry and exit strategies. Don’t chase losses or hold on to losing trades in the hope of a reversal. Cut your losses quickly and move on to the next opportunity.

Psychology of a Day Trader

Emotional control is paramount in day trading. Fear and greed are the two most dangerous emotions that can cloud your judgment. Cultivate a detached and analytical mindset, focusing on data and probabilities rather than emotions.

Develop a trading plan and stick to it. Don’t let impulsive decisions lead you astray.

Best Option Strategy For Day Trading

Conclusion

Mastering day trading is an ongoing journey that requires patience, dedication, and a willingness to learn from both your successes and failures.

By understanding the fundamentals of day trading, crafting a robust strategy, leveraging technical analysis, practicing meticulous risk management, and mastering the art of trade execution, you can unlock the potential of this challenging but potentially rewarding endeavor.

Remember, the path to day trading success is paved with challenges and setbacks. Embrace them as opportunities for growth and continuous refinement. With perseverance and a commitment to excellence, you can claim your rightful place among the ranks of successful day traders.