In the realm of financial markets, options trading offers an alluring path to amplify gains and hedge risks. But delving into the intricacies of this multifaceted instrument can be daunting. This guide will illuminate the nuances of trading different asset types of options, empowering you with the knowledge and confidence to navigate this complex landscape.

Image: www.stockradar.in

Cracking the Options Code

An option is a contract that bestows upon its holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). Options contracts come in two primary flavors: calls and puts. Call options grant the holder the right to buy the underlying asset, while put options grant the right to sell.

Trading Different Asset Types

The diverse world of options trading encompasses a wide range of underlying assets, each with its unique characteristics and risk-reward dynamics. Let’s unpack the most prevalent asset types:

Stocks

Equity options, linked to the performance of individual stocks, offer precise exposure to specific companies. While they provide opportunities for substantial gains, they also carry significant risk due to the volatility of underlying stock prices.

Image: en.rattibha.com

Indices

Index options track the performance of market indices, such as the S&P 500 or Nasdaq 100. They offer diversified exposure to a basket of stocks, mitigating individual company risk but still maintaining exposure to broader market trends.

Commodities

Commodity options, closely tied to the prices of physical assets like gold, oil, and grains, enable investors to speculate on global supply and demand dynamics. These markets can be highly volatile, presenting both rewards and challenges.

Foreign Exchange (Forex)

Forex options allow traders to speculate on the exchange rates between currencies. With a global market that operates 24/5, these options provide opportunities for round-the-clock trading and exposure to global economic events.

Harnessing the Power of Experts

Navigating the intricacies of options trading requires guidance from the trenches. Seasoned experts recommend adhering to the following principles:

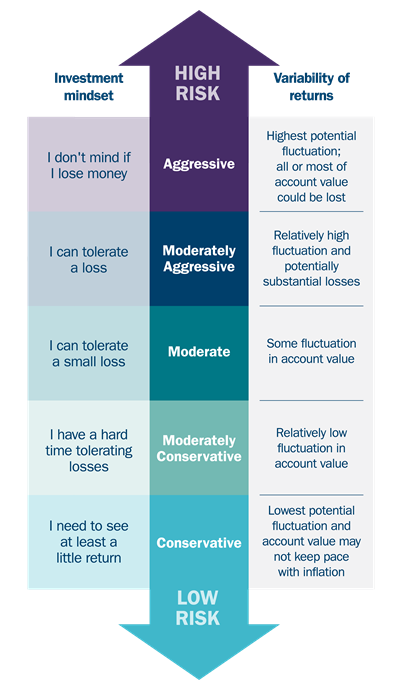

- Manage Risk Prudently: Understand your risk tolerance and implement strategies to mitigate potential losses.

- Understand the Greeks: Greeks are metrics that quantify option risk and sensitivity to various market factors. Study them to refine your trading decisions.

- Stay Informed: Keep abreast of market trends, economic data, and geopolitical events that can impact option prices.

Trading Different Asset Types Of Options

Image: investguiding.com

Conclusion: Empowering Your Trading Journey

By grasping the nuances of trading different asset types of options, you unlock a world of potential financial opportunities. Approach this journey with a thirst for knowledge, a commitment to prudent risk management, and the guidance of trusted experts. Embracing this comprehensive approach will empower you to navigate the complexities of options trading with confidence and poise. Remember, the path to financial mastery begins with one step at a time, so embrace this adventure with determination and the belief that you can succeed.