Introduction

In the realm of options trading, the concept of exchange-traded funds (ETFs) has emerged as a revolutionary force, granting investors unprecedented versatility and efficiency. ETFs have managed to bridge the gap between the stock market and the options market, offering a plethora of benefits that can empower traders at every skill level.

Image: clevertrading.qa

Understanding Option Trading ETFs

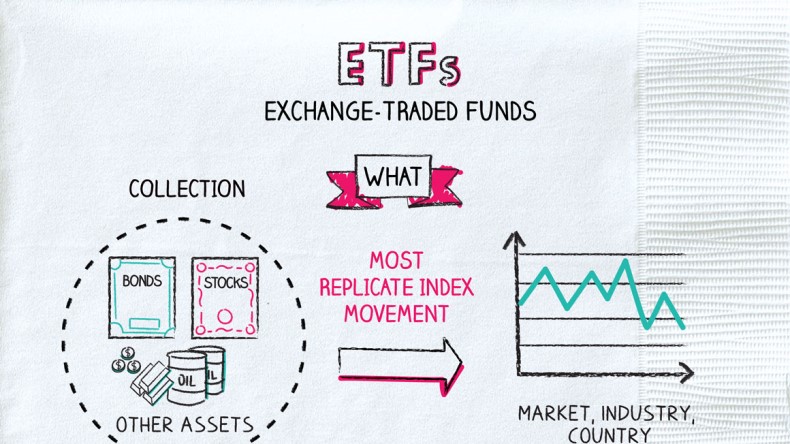

ETFs are essentially baskets of securities that track a specific index or asset class. In the context of options trading, ETFs offer several key advantages:

- Diversification: ETFs provide instant exposure to a diversified portfolio of stocks, bonds, or commodities, minimizing the risks associated with investing in individual securities.

- Liquidity: ETFs trade just like stocks, ensuring high liquidity and real-time execution of trades.

- Accessibility: ETFs make options trading accessible to a broader range of investors, including those with limited capital or experience.

- Flexibility: Traders can employ options ETFs to implement various strategies, from income generation to hedging.

Types of Option Trading ETFs

The universe of option trading ETFs is vast and encompasses a diverse range of offerings, each tailored to specific investment objectives:

- Broad Market ETFs: These ETFs track broad stock market indices like the S&P 500 or Nasdaq 100, providing exposure to the entire market.

- Sector-Specific ETFs: These ETFs focus on specific industry sectors, such as technology, healthcare, or energy, allowing investors to target particular areas of growth.

- Volatility ETFs: These ETFs seek to profit from market volatility by tracking indices that measure implied volatility.

- Inverse ETFs: These ETFs offer inverse exposure to their underlying indices, providing a way to hedge against market downturns or generate short-term gains.

Effective Strategies Using Option Trading ETFs

Harnessing the power of option trading ETFs requires a strategic approach:

- Covered Calls: Selling covered calls on ETFs generates income while maintaining exposure to the underlying assets.

- Protective Puts: Purchasing protective puts on ETFs provides a safety net against market declines.

- Call Spreads: Call spreads involve buying one call option and selling a call option with a higher strike price, allowing for profit generation in a bullish market.

- Put Spreads: Put spreads involve buying one put option and selling a put option with a lower strike price, enabling the potential for gains in a bearish market.

Image: napkinfinance.com

Expert Tips for Success

Seasoned option traders emphasize the following tips:

- Manage Risk: Carefully assess the risk-reward profile of each trade and allocate capital accordingly.

- Understand Volatility: Understand the impact of implied volatility on option premiums and adjust strategies accordingly.

- Monitor the Market: Keep abreast of market trends and news events that may affect underlying assets and volatility.

- Educate Yourself: Continuously seek knowledge and insights from books, articles, and webinars.

FAQ

Q: Is option trading using ETFs suitable for beginners?

A: ETFs offer a more accessible entry point into options trading due to their inherent diversification. However, a basic understanding of options and market dynamics is still essential.

Q: Can ETFs be used for both long-term and short-term trading?

A: Yes, ETFs provide flexibility for various trading strategies, including long-term investment, income generation, or short-term speculation.

Q: What are the key considerations when selecting an option trading ETF?

A: The choice of ETF depends on investment objectives, risk tolerance, and the underlying assets being tracked.

Best Option Trading Etfs

Conclusion

Option trading ETFs have transformed the landscape of options trading, offering investors unparalleled access, diversification, and flexibility. By embracing a strategic approach, coupled with expert guidance, aspiring traders can unlock the full potential of option trading ETFs and achieve their financial goals.

Are you ready to elevate your options trading strategy and join the ranks of successful ETF traders?