In the realm of financial markets, options trading offers investors a sophisticated tool to manage risk, enhance returns, and navigate market volatility. Wells Fargo Advisors, a renowned wealth management firm, empowers its clients with access to options trading services that cater to their unique investment objectives. This article delves into the intricacies of options trading with Wells Fargo Advisors, providing comprehensive insights and actionable strategies to help investors maximize their investment potential.

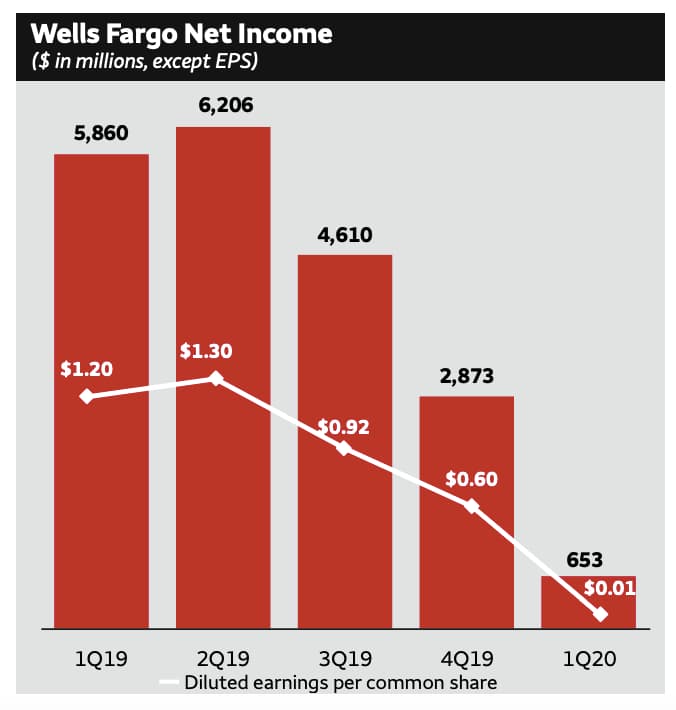

Image: news.alphastreet.com

Understanding Options Trading

Options are financial contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). They allow investors to speculate on the future direction of an asset’s price, hedge against potential losses, or generate income through option premia.

Wells Fargo Advisors Options Trading Services

Wells Fargo Advisors offers a comprehensive suite of options trading services tailored to the needs of both experienced and novice investors. These services include:

-

Education and Research: Wells Fargo Advisors provides extensive educational materials, webinars, and market research to help clients understand options trading strategies and make informed decisions.

-

Dedicated Advisors: Clients have access to dedicated financial advisors who specialize in options trading and can provide personalized guidance based on their individual risk tolerance and investment goals.

-

Trading Platform: Investors can access a user-friendly trading platform that allows them to execute trades seamlessly and monitor their positions in real-time.

-

Options Strategies: Wells Fargo Advisors offers a range of options strategies, including covered calls, cash-secured puts, and iron condors, to help clients meet their specific investment objectives.

Expert Insights: Unlocking the Power of Options Trading

“Options trading can be a powerful tool for investors seeking to enhance their returns or manage risk,” says Michael Anderson, a senior options strategist at Wells Fargo Advisors. “However, it’s crucial to approach options trading with a clear understanding of the risks and potential rewards involved.”

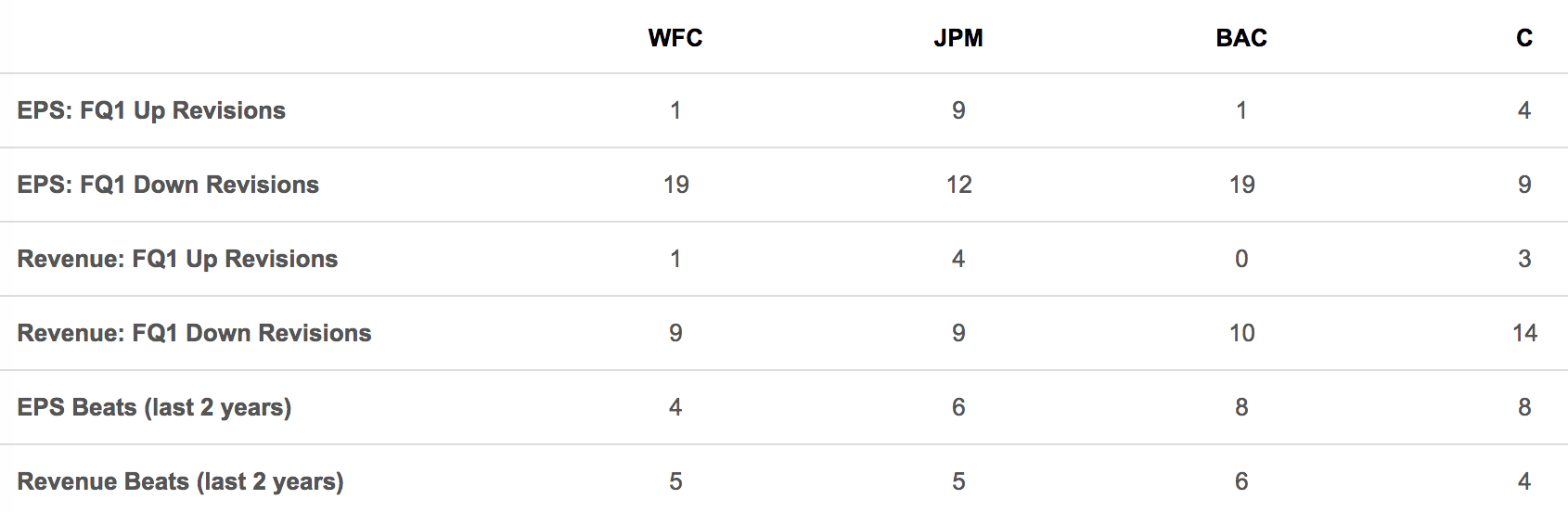

Image: seekingalpha.com

Actionable Tips for Options Trading with Wells Fargo Advisors

-

Start with Education: Before embarking on options trading, it’s essential to educate yourself thoroughly. Attend webinars, read educational materials, and consult with a financial advisor to gain a solid foundation.

-

Determine Your Risk Tolerance: Options trading carries inherent risks. Determine your risk tolerance and trade within your limits to avoid potential losses that could impact your financial well-being.

-

Choose the Right Options Strategy: There are numerous options strategies available. Identify the strategy that aligns with your investment objectives, risk tolerance, and time horizon.

-

Manage Your Positions Regularly: Once you’ve executed a trade, it’s crucial to monitor your position regularly. Adjust your strategy or exit the trade as market conditions change to maximize your potential returns.

Wells Fargo Advisors Options Trading

Image: www.forexfees.com

Conclusão

Options trading with Wells Fargo Advisors provides investors with a powerful tool to enhance their investment portfolio. By combining comprehensive educational resources, dedicated financial advisors, and a user-friendly trading platform, Wells Fargo Advisors empowers its clients to navigate the complex world of options trading and make informed decisions. Whether you’re an experienced trader or just starting your options trading journey, Wells Fargo Advisors can help you unlock the potential of this dynamic financial instrument. Remember, investing in options involves risk, and it’s crucial to approach it with a clear understanding of the potential rewards and risks involved. Partnering with a reputable financial advisor and exercising responsible trading practices can help you maximize your investment potential while mitigating risk.