Introduction

In the realm of investments, navigating the complex world of option trading can be daunting, but with the guidance of an experienced financial advisor, the potential rewards can be substantial. Wells Fargo Advisors offers a comprehensive option trading platform, complemented by a structured agreement form that outlines the terms and conditions governing these transactions. Understanding this agreement is crucial for investors to make informed decisions and protect their interests.

Image: fity.club

Understanding Wells Fargo Advisor Option Trading

Option trading involves buying or selling contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price on a specified date. Options can be used for various purposes, including hedging risks, speculating on price movements, or generating income through premium sales.

Wells Fargo Advisors provides access to a wide range of option strategies, including calls, puts, spreads, and combinations. Their experienced advisors guide clients through the intricate details of these strategies, ensuring they align with their investment objectives and risk tolerance.

The Wells Fargo Advisor Option Trading Agreement Form

Prior to engaging in option trading with Wells Fargo Advisors, clients must sign an Option Trading Agreement Form. This comprehensive document outlines the rights and responsibilities of both parties involved in these transactions. Key elements of the agreement include:

-

Account Approval: The agreement stipulates the criteria for account approval, including knowledge and experience requirements, financial eligibility, and completion of necessary training materials.

-

Trading Authorizations: The client authorizes Wells Fargo Advisors to execute trades on their behalf in accordance with specified parameters, including order types, pricing limits, and risk management guidelines.

-

Risk Acknowledgment: The agreement emphasizes the inherent risks associated with option trading and acknowledges that the client fully understands these potential risks.

-

Margin Trading: If applicable, the agreement outlines the terms of margin trading, including margin requirements, interest rates, and potential consequences of margin calls.

-

Account Monitoring: Wells Fargo Advisors monitors client accounts closely to ensure adherence to trading guidelines and risk thresholds. The agreement details the circumstances under which accounts may be subject to supervision or restrictions.

Benefits of Using Wells Fargo Advisors for Option Trading

-

Experienced Advisors: Wells Fargo Advisors boasts a team of highly skilled and knowledgeable advisors who provide personalized guidance and tailored recommendations.

-

Access to Advanced Trading Tools: The firm offers sophisticated trading platforms with real-time market data, analytical tools, and customizable order entry systems.

-

Risk Management Strategies: Advisors work with clients to develop robust risk management strategies that safeguard their investments from excessive losses.

-

Clear and Comprehensive Agreement: The Option Trading Agreement Form provides a transparent and well-defined framework for all option trading activities.

Conclusion

Wells Fargo Advisor Option Trading offers a powerful tool for sophisticated investors seeking to enhance their portfolio returns or mitigate risks. The Option Trading Agreement Form serves as a critical document that articulates the terms and conditions governing these transactions, ensuring a clear understanding of the rights and responsibilities of all parties involved. By leveraging the expertise of Wells Fargo Advisors and adhering to the provisions of the agreement, investors can maximize the benefits of option trading while diligently managing their exposure to potential risks.

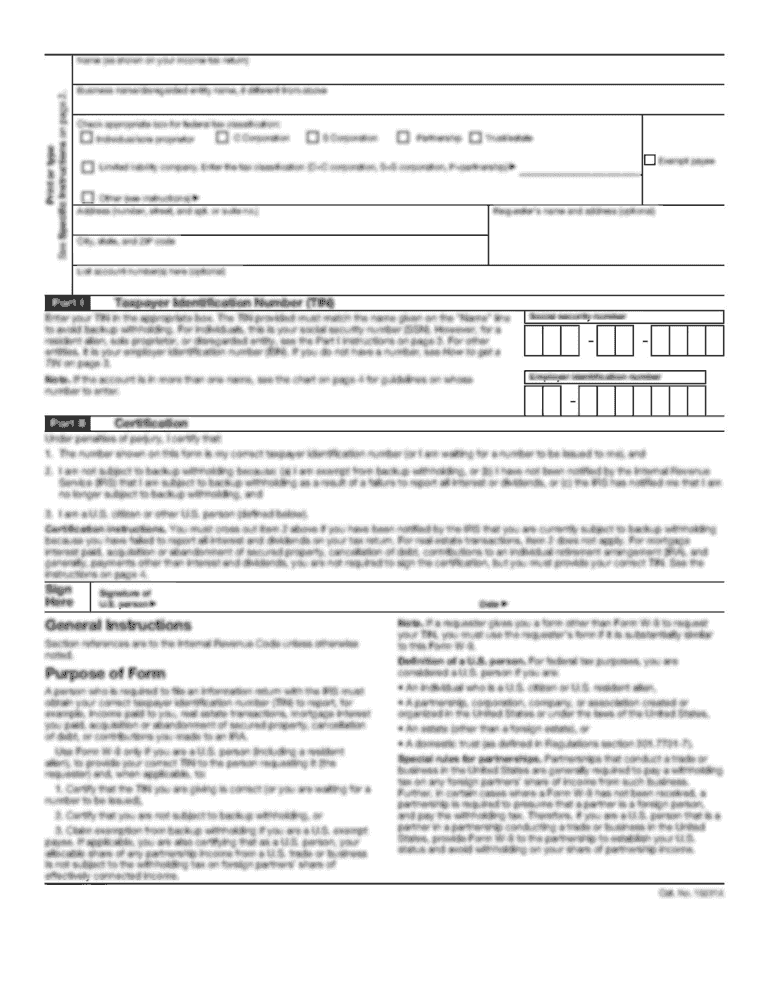

Image: www.pdffiller.com

Wells Fargo Advisor Option Trading And Agreement Form

Image: www.pdffiller.com