Trading Russell 2000 Options: An Overview

The Russell 2000 Index, which tracks the performance of the 2000 smallest companies listed on the U.S. stock exchanges, is a widely used benchmark for measuring the health of the U.S. small-cap market. Trading options on the Russell 2000 Index provides investors with a variety of opportunities to express their views on the direction of the market.

Image: tujogim.web.fc2.com

Russell 2000 options trade on the CBOE Options Exchange and are available with a variety of expiration dates, including monthly, quarterly, and yearly expirations. The most actively traded Russell 2000 options have expiration dates of one month from the trading date. Options premiums are typically lower for options with shorter expiration dates, while options with longer expiration dates have higher premiums.

Understanding Russell 2000 Options

Russell 2000 options are contracts that give the buyer of the option the right, but not the obligation, to buy or sell a certain number of shares of the Russell 2000 Index at a specified price on or before a certain date. The buyer of an option pays a premium to the seller of the option in exchange for this right. Each option contract represents 100 shares of the underlying security.

There are two types of Russell 2000 options: calls and puts. Call options give the buyer the right to buy shares of the Russell 2000 Index at a specified price, while put options give the buyer the right to sell shares of the Russell 2000 Index at a specified price. The specified price is known as the strike price.

Trading Russell 2000 Options

Trading Russell 2000 options requires a margin account. Margin accounts allow investors to borrow money from their brokers to buy stocks and other investments. The amount of leverage allowed in a margin account varies from broker to broker, but it is typically in the range of 2:1 to 4:1.

When trading Russell 2000 options, investors should understand that there is a risk of losing more money than their initial investment. This is because options are leveraged products that can amplify both gains and losses. Investors should also be aware that options prices can fluctuate rapidly, so it is important to monitor their positions closely.

Tips for Trading Russell 2000 Options

Here are a few tips for trading Russell 2000 options:

- Understand the risks involved in options trading. Options are leveraged products that can amplify both gains and losses, so it is important to understand the risks involved before trading options.

- Choose the right strike price and expiration date. The strike price and expiration date of an option should be chosen based on the investor’s market outlook and risk tolerance.

- Have a trading plan. A trading plan outlines the investor’s goals, strategy, and risk management parameters.

- Monitor positions closely. Options prices can fluctuate rapidly, so it is important to monitor positions closely.

- Use stop-loss orders. Stop-loss orders can help to protect against large losses if the market moves against the investor’s position.

Image: moneyandmarkets.com

Expert Advice for Trading Russell 2000 Options

Numerous experts provide advice on trading Russell 2000 options. Here is some widely accepted expert advice:

- Trade the right way. Don’t just trade options on a whim. Do your research and develop a trading plan that suits your risk tolerance and investment goals.

- Use technical analysis. Technical analysis is a widely used method of analyzing price charts to identify potential trading opportunities.

- Be patient. Don’t expect to get rich quick from options trading. It takes time and practice to become a successful options trader.

- Trade with a broker you trust. A good broker will provide you with the guidance and support you need to succeed.

FAQ on Trading Russell 2000 Options

Q: What are Russell 2000 options?

A: Russell 2000 options are contracts that give the buyer the right, but not the obligation, to buy or sell a certain number of shares of the Russell 2000 Index at a specified price on or before a certain date.

Q: How do I trade Russell 2000 options?

A: You can trade Russell 2000 options through a broker that offers options trading.

Q: What is the risk involved in trading Russell 2000 options?

A: The risk involved in trading Russell 2000 options is that you could lose more money than your initial investment.

Q: What are some tips for trading Russell 2000 options?

A: Here are a few tips for trading Russell 2000 options:

- Understand the risks involved in options trading.

- Choose the right strike price and expiration date.

- Have a trading plan.

- Monitor positions closely.

- Use stop-loss orders.

Trading The Russell 2000 Options August 21 2017

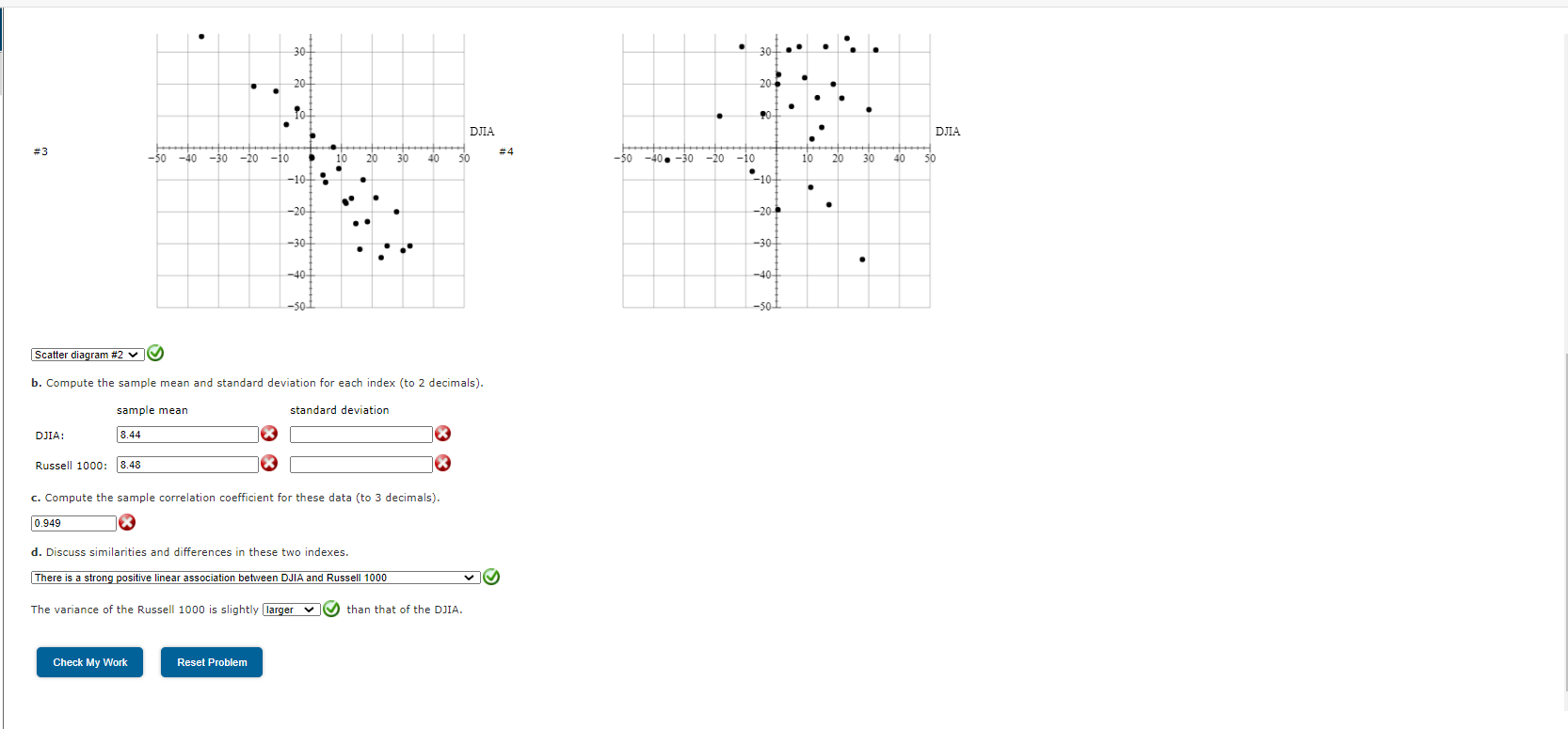

Image: www.chegg.com

Conclusion

Trading Russell 2000 options can be a rewarding experience for investors who understand the risks involved and take a disciplined approach to trading. By following the tips and advice outlined in this article, investors can increase their chances of success when trading Russell 2000 options.

Are you interested in learning more about trading Russell 2000 options? If so, I encourage you to do some research on the topic. There are many resources available online and in libraries that can help you get started.