Introduction: Embark on a Financial Adventure

In the realm of finance, a realm where risk and opportunity intertwine, options trading holds a captivating allure. Amidst this bustling landscape, RUT options trading stands out as a prime avenue for intrepid investors seeking to navigate the volatile waters of the market. RUT, an acronym for the Russell 2000 Index, embodies a barometer of small-cap stocks, offering ample opportunities for savvy traders. This comprehensive article delves into the intricacies of RUT options trading, empowering readers with the knowledge and strategies to conquer this dynamic market.

Image: www.investing.com

Unraveling the Essence of RUT Options Trading

Options, in the financial context, are contracts essentially conveying the right to buy (in the case of call options) or sell (in the case of put options) underlying assets at predetermined prices (known as strike prices) on or before a specific date (expiration date). RUT options, hence, revolve around the Russell 2000 Index, which comprises the 2,000 smallest publicly traded U.S. companies by capitalization. These options offer investors an array of strategies to harness the price movements of the underlying index, ranging from speculative ventures to risk-hedging endeavors.

Historical Roots: Tracing the Evolution of RUT Options

The genesis of RUT options can be traced back to the advent of the Russell 2000 Index in 1984. Initially, these options were primarily traded over-the-counter (OTC), confined to a select group of market participants. However, in 1999, the Chicago Board Options Exchange (CBOE) introduced standardized RUT options, paving the way for broader access and enhanced liquidity. Since then, RUT options trading has gained immense popularity, attracting both seasoned professionals and burgeoning traders alike.

Understanding the Mechanics: Demystifying the RUT Options Chain

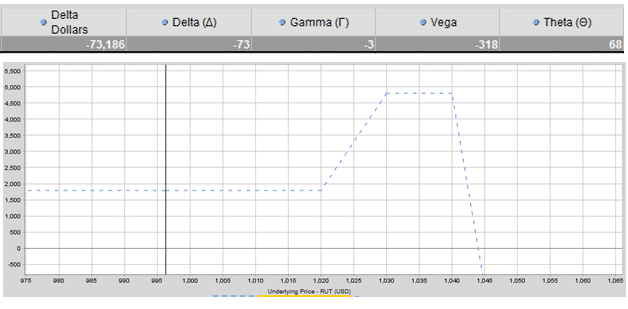

At the heart of RUT options trading lies the concept of an options chain, a comprehensive listing of all available call and put options for a given underlying asset at varying strike prices and expiration dates. Each option contract represents 100 shares of the underlying index. Traders can select the strike price and expiration date that best align with their investment objectives and risk tolerance, enabling them to tailor their trading strategies accordingly.

Image: optionstradingiq.com

Unlocking the Power of Leverage: Embracing the Double-Edged Sword

Options trading, including RUT options, offers investors the potential for significant leverage, magnifying their exposure to price movements without committing exorbitant capital. This leverage can amplify both profits and losses, heightening the importance of judicious risk management. It is imperative for traders to carefully weigh the potential rewards and risks associated with leveraged positions to ensure alignment with their financial goals and risk appetite.

Exploring RUT Options Strategies: Navigating the Spectrum of Possibilities

The realm of RUT options trading presents a myriad of strategies, empowering investors to adapt to different market scenarios. Some of the most commonly employed strategies include:

-

Covered Calls: A conservative strategy involving selling (writing) call options while simultaneously holding an equivalent number of shares of the underlying index. This strategy aims to generate additional income through option premiums, potentially offsetting the potential decline in the underlying asset’s price.

-

Naked Calls: A more aggressive strategy that involves selling call options without holding any shares of the underlying index. This strategy entails higher risk but also carries the potential for greater profit if the underlying asset’s price moves in the trader’s favor.

-

Bull Call Spreads: A bullish strategy that entails buying a lower strike price call option and simultaneously selling a higher strike price call option. This strategy aims to capitalize on the expectation of a moderate increase in the underlying asset’s price, offering limited profit potential but also defined risk.

-

Bear Put Spreads: A bearish strategy that involves buying a higher strike price put option and simultaneously selling a lower strike price put option. This strategy seeks to profit from the expectation of a moderate decline in the underlying asset’s price, also offering limited profit potential and defined risk.

Rut Options Trading

Image: www.tradingview.com

Conclusion: Embracing the Opportunities, Acknowledging the Risks

RUT options trading offers a captivating avenue for investors seeking to amplify their returns, but it is essential to approach this market with a keen understanding of the inherent risks. Prudent risk management, thorough research, and a well-defined trading plan are indispensable elements for navigating the often turbulent waters of options trading. By embracing the opportunities and acknowledging the potential pitfalls, investors can harness the power of RUT options to achieve their financial objectives. Whether you are a seasoned market veteran or embarking on your trading journey, may this guide serve as your compass in the uncharted territories of RUT options trading.