As I ventured into the enigmatic world of options trading, I stumbled upon a concept that ignited my curiosity: option order flow. Like a hidden river beneath the surface, this stream of information holds the key to unlocking trading opportunities and navigating market volatility. In this comprehensive guide, we’ll delve into the depths of option order flow, exploring its intricacies and empowering you with the knowledge to make informed trading decisions.

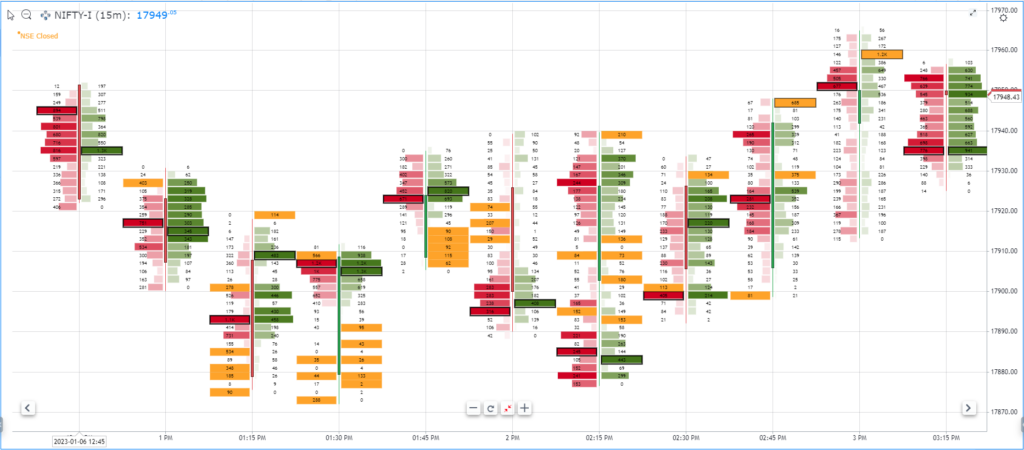

Image: stocksonfire.in

In the realm of options trading, every order leaves a ripple in the market, creating a tapestry of information that can guide astute traders. This order flow, a continuous stream of buy and sell commands, reflects the collective sentiment and expectations of market participants. By deciphering the patterns embedded within this flow, traders can gain valuable insights into price movements, market momentum, and potential trading setups.

Navigating Option Order Flow

The art of trading option order flow lies in the ability to interpret the intentions and strategies hidden within each order. Institutional traders, hedge funds, and other large market participants often leave their mark on the order book, their footprints revealing their underlying rationale.

Understanding the nuances of order flow requires a keen eye for detail and a comprehensive grasp of market dynamics. Seasoned traders study the size, timing, and sequencing of orders, piecing together a narrative that uncovers the true drivers of market movements. By analyzing the concentration of orders at specific price levels or the presence of large blocks of orders, traders can identify imbalances in supply and demand, potentially signaling impending market swings.

Essential Elements of Trading Option Order Flow

To effectively harness the power of option order flow, traders must possess a solid understanding of its core elements:

- **Order Size:** Large orders, especially those that significantly exceed the average order size, can indicate institutional involvement or a potential shift in market sentiment.

- **Order Type:** Buy and sell orders are the building blocks of order flow. Buy orders represent a desire to acquire an asset, while sell orders indicate an intention to sell.

- **Timing:** The timing of orders can provide insights into market sentiment. A flurry of orders at a specific time may signal a price breakout or a change in market conditions.

- **Price:** The price of an option order is crucial, as it reflects the premium that buyers are willing to pay for the right to exercise the option.

- **Implied Volatility:** Implied volatility, derived from option prices, measures the market’s expectation of future price volatility. High implied volatility may indicate market uncertainty, while low implied volatility suggests complacency.

Demystifying the Language of Order Flow

Trading option order flow is a highly specialized field, employing a unique lexicon to describe market behavior. Here’s a brief decoding of some common terms:

- **Delta Neutral:** A strategy that involves holding an equal number of long and short options with the same delta, aiming to neutralize market risk.

- **Gamma Neutral:** A strategy that involves holding an offsetting number of long and short options with opposing gammas, reducing exposure to changes in volatility.

- **Order Book:** A collection of buy and sell orders for a specific security, reflecting the liquidity and depth of the market.

- **Tape Reading:** The art of analyzing the real-time flow of orders to identify potential trading opportunities.

- **Time and Sales:** A data feed that provides detailed information about executed trades, including price, time, and volume.

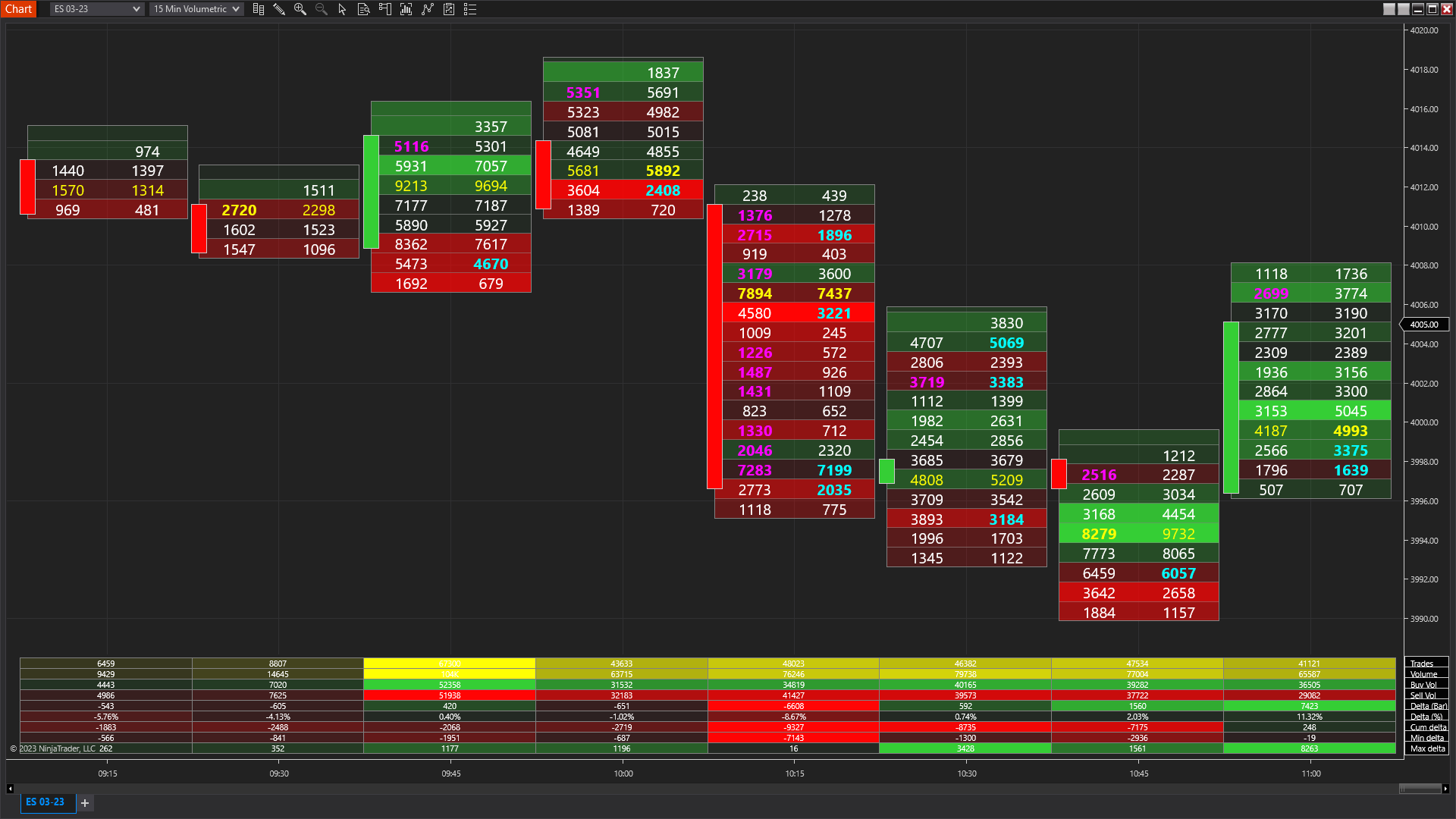

Image: the5ers.com

Tips for Enhancing Your Option Order Flow Trading

To improve your success in trading option order flow, consider these expert tips:

- **Use Level 2 Data:** Accessing Level 2 data provides a more comprehensive view of the order book, allowing you to observe the full depth of market orders.

- **Identify Consistent Patterns:** By studying historical order flow patterns, you can develop a better understanding of market behavior and identify recurring trading setups.

- **Consider Market Context:** Analyze order flow in conjunction with technical analysis, fundamental news, and economic data to form a holistic view of market dynamics.

- **Manage Risk Effectively:** Implement proper risk management techniques, such as setting stop-loss orders and limiting your position size.

- **Utilize Technology:** Leverage trading platforms and software tools designed to analyze order flow and alert you to potential trading opportunities.

Frequently Asked Questions on Option Order Flow

Q: How do I get started with trading option order flow?

A: Begin by studying the basics of options trading, then gradually incorporate order flow analysis into your strategy.

Q: Can order flow predict future market movements?

A: While order flow provides valuable insights, it is not a perfect predictor. Traders should combine order flow analysis with other market data and technical indicators to make informed decisions.

Q: Is order flow trading a profitable strategy?

A: Trading option order flow can be profitable, but it requires a high level of skill, experience, and risk management. Traders should approach this strategy with caution.

Q: What are some common pitfalls in order flow trading?

A: Overtrading, relying too heavily on a single indicator, and ignoring market context are common pitfalls. Traders should approach order flow trading with patience, discipline, and a comprehensive understanding of market dynamics.

Trading Option Order Flow

Image: ninjatrader.com

Call to Action

If you are intrigued by the complexities and potential rewards of trading option order flow, this comprehensive guide has equipped you with the foundational knowledge to embark on your trading journey. By mastering the art of deciphering option order flow, you can unlock powerful insights into market behavior and enhance your decision-making process. Remember, the financial markets are a constant source of learning and adaptation. Embrace the continuous pursuit of knowledge and experience to elevate your trading skills and navigate the ever-evolving world of options.

Are you ready to explore the dynamic realm of option order flow and unleash its trading potential?