In the tumultuous waters of options trading, where volatility can besiege even the most seasoned investors, delta hedging emerges as a lifeline, a guiding beacon in the storm. It is a strategy that has saved many a trader from financial peril, and it is one that I highly recommend to anyone who ventures into the realm of options.

:max_bytes(150000):strip_icc()/deltahedging.asp-final-0f7419fd8d574f35a8db99c1339fec37.png)

Image: sallyscorners.com

Think of delta hedging as a balancing act, a constant adjustment to mirror the changing risks of an underlying option. It is the art of counteracting risk, of keeping it at bay as the market ebbs and flows. By understanding delta, the Greek letter that measures the sensitivity of an option’s price to changes in the underlying asset’s price, traders can position themselves to mitigate losses and capture gains.

Delta Hedging: A Comprehensive Guide

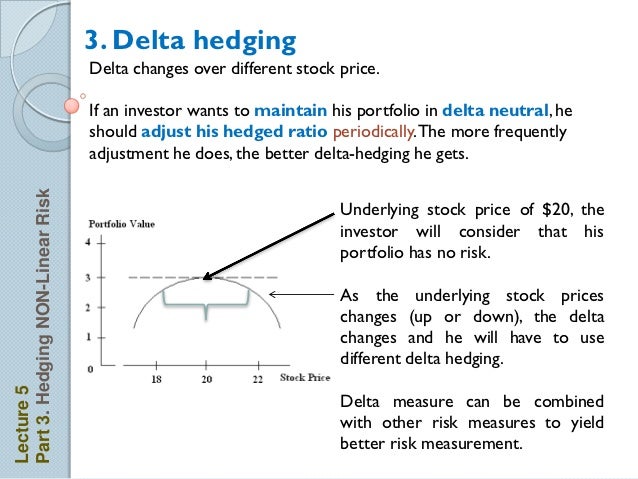

At its core, delta hedging is a strategy employed by options traders to reduce the risk associated with their positions. Options, financial instruments that give traders the right to buy or sell an underlying asset at a specified price on or before a specific date, carry with them inherent risk. Delta hedging aims to mitigate this risk by adjusting the trader’s exposure to the underlying asset. This is achieved by simultaneously entering into opposing positions in the underlying asset and the corresponding option.

The goal of delta hedging is to maintain a neutral or zero delta position, effectively neutralizing the price movements of the underlying asset. By doing so, the trader minimizes the potential for significant losses, particularly in fast-moving or volatile markets. Delta hedging is a popular technique among market makers, who aim to maintain a neutral position in order to facilitate trades without accumulating substantial risk.

Understanding the Mechanics of Delta Hedging

As an illustrative example, let’s say a trader purchases an at-the-money (ATM) call option with a delta of 0.5. This means that for every $1 increase in the underlying asset’s price, the call option’s price will increase by $0.50. To hedge this position and neutralize their risk, the trader would simultaneously sell short an equivalent number of shares of the underlying asset.

This hedging strategy, by design, maintains a neutral delta position. If the underlying asset’s price increases, the call option’s price will rise, as will the value of the trader’s long position. However, the short position in the underlying asset will offset this gain by losing value. This dynamic ensures that the overall delta position remains close to zero, thereby mitigating the risk of loss.

Latest Trends and Developments in Delta Hedging

The world of options trading is constantly evolving, with new strategies and techniques emerging to meet the ever-changing market landscape. Delta hedging has stood the test of time, remaining a cornerstone strategy for risk management. However, there have been notable advancements in the application of delta hedging.

One significant development has been the advent of electronic trading platforms. These platforms have made delta hedging more accessible and efficient, allowing traders to monitor and adjust their positions in real-time. Additionally, the use of sophisticated trading algorithms has enhanced the accuracy and speed of delta hedging, enabling traders to respond swiftly to market changes.

Image: tffinnigan.com

Tips from an Expert: Mastering Delta Hedging

As a seasoned options trader, I have witnessed firsthand the power of delta hedging. Over the years, I have developed some valuable tips that can help you master this strategy:

- Embrace Technology: Utilize electronic trading platforms to streamline your delta hedging operations. These platforms provide real-time data, enabling you to make informed decisions and adjust your positions swiftly.

- Embrace Algorithms: Consider employing trading algorithms to automate your delta hedging strategies. Algorithms can execute trades with greater speed and accuracy, optimizing your risk management.

- Monitor Market News: Stay abreast of market news and economic events that may impact the underlying asset’s price. This knowledge will help you anticipate potential risks and adjust your delta hedging strategy accordingly.

Remember, delta hedging is not a foolproof strategy. Market conditions can change rapidly, and there is always the potential for losses. However, by adhering to these expert tips, you can significantly enhance your risk management and increase your chances of success in options trading.

FAQs on Delta Hedging

To provide clarity on some common questions surrounding delta hedging, I have compiled a brief FAQ:

Q1: What are the benefits of delta hedging?

A: Delta hedging helps reduce risk, maintain a neutral position, and potentially increase profitability in options trading.

Q2: What is the primary goal of delta hedging?

A: The primary goal is to establish a neutral or zero delta position, thereby mitigating potential losses from fluctuations in the underlying asset’s price.

Q3: Is delta hedging suitable for all traders?

A: Delta hedging is particularly valuable for market makers who aim to remain neutral in their positions. However, it can also benefit experienced options traders seeking to manage risk.

Options Trading Delta Hedging

Image: www.stockinvestor.com

Conclusion

Delta hedging stands as an essential risk management strategy in the realm of options trading. By embracing this technique, traders can navigate the complexities of options markets with greater confidence and mitigate potential losses. Remember, understanding delta and applying effective hedging strategies are key to long-term success in options trading.

Are you intrigued by the concepts of delta hedging and options trading? Share your thoughts and experiences in the comments below. Your insights and questions can foster a valuable discussion and further enhance our understanding of this fascinating subject.