In the labyrinthine world of financial markets, options trading offers a tantalizing yet treacherous path for both novice and seasoned investors alike. Among the myriad strategies that can enhance an investor’s risk-averse approach, delta hedging stands out as a beacon of stability in an otherwise volatile sea. This comprehensive guide will delve into the intricacies of delta hedging, unraveling its secrets and empowering you with a deeper understanding of this valuable technique.

Image: navigationtrading.com

What is Delta Hedging?

Delta hedging is an options trading strategy designed to mitigate risk by continuously adjusting the position of an underlying asset while simultaneously holding an opposite position in the options market. This constant balancing act aims to neutralize the inherent volatility associated with options while enhancing the investor’s ability to capitalize on market fluctuations. By dynamically adjusting the delta of the portfolio, investors can hedge against adverse price movements, preserving their capital and increasing the probability of profitable outcomes.

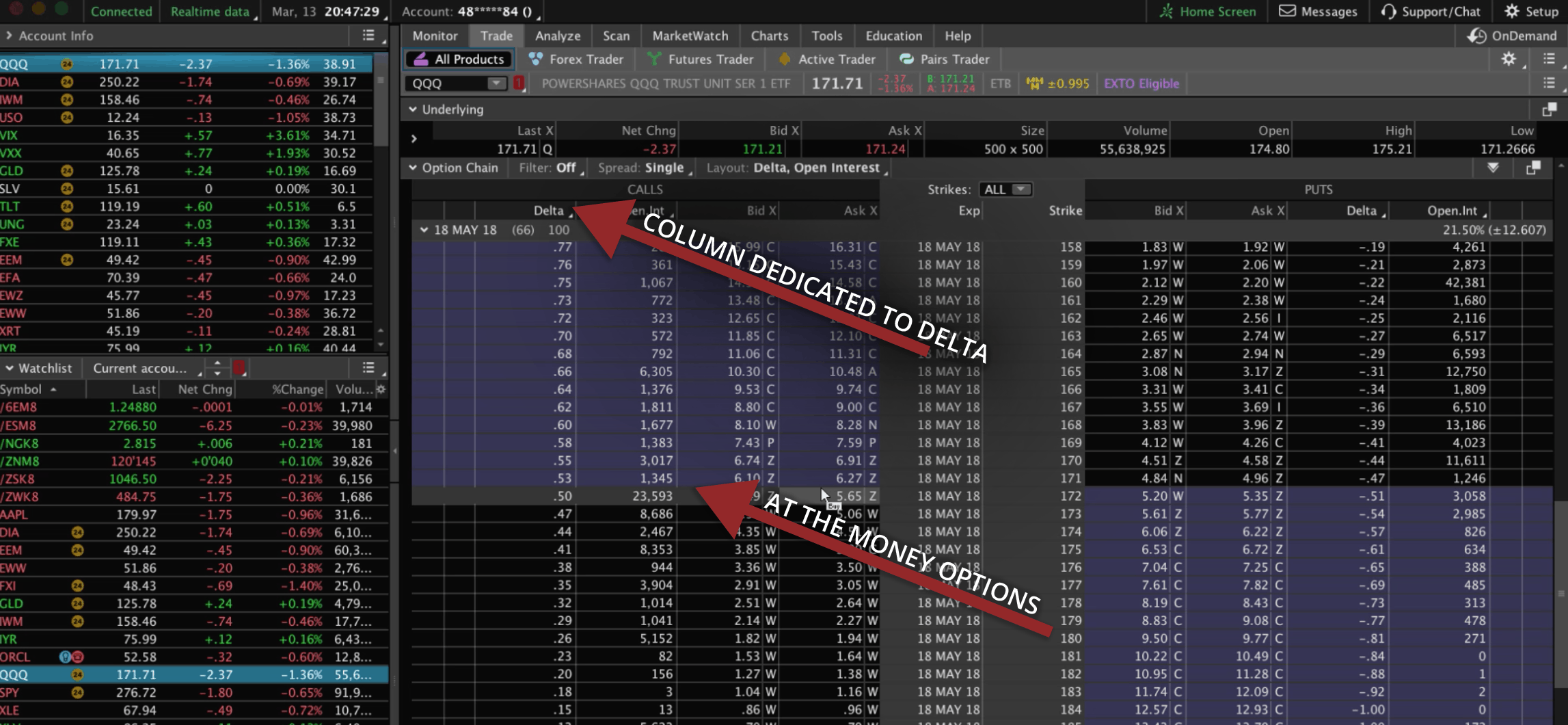

Understanding the Greeks: Delta and Its Significance

The Greek letter “delta” measures the sensitivity of an option’s price to changes in the underlying asset’s price. It represents the number of units the option will gain or lose for every one-unit increase or decrease in the underlying asset. A positive delta indicates that the option will increase in value as the underlying asset rises, while a negative delta suggests the opposite. Delta hedging involves maintaining a portfolio with a delta close to zero, minimizing the impact of price fluctuations on the overall investment.

Practical Implementation: Balancing the Hedge

Delta hedging is an active strategy that requires continuous monitoring and adjustment. As the price of the underlying asset fluctuates, the delta of the portfolio will either increase or decrease. To maintain a neutral delta, the investor must either buy or sell additional options or adjust the position of the underlying asset accordingly. The goal is to create a dynamic equilibrium where the gains and losses from the underlying asset and the options offset each other, effectively neutralizing the overall risk exposure.

Image: www.youtube.com

Advantages of Delta Hedging

-

Risk Reduction: Delta hedging is primarily employed to mitigate risk by reducing the volatility of the portfolio. By offsetting gains and losses, investors can minimize the impact of adverse market movements, protecting their capital and increasing their chances of securing profits.

-

Enhanced Returns: While risk reduction is paramount, delta hedging can also enhance returns by optimizing the investor’s position. By dynamically adjusting the delta, investors can capitalize on market fluctuations, capturing potential gains while minimizing losses.

-

Versatility: Delta hedging is a versatile strategy that can be applied to a wide range of underlying assets, including stocks, bonds, and currencies. Its flexibility allows investors to tailor the hedge to their specific risk appetite and investment goals.

Implementation Challenges: Navigating Complexity

-

Complexity: Delta hedging requires a deep understanding of options trading dynamics and the ability to adjust positions swiftly. It can be a complex strategy for novice investors to implement effectively.

-

Execution Costs: Buying and selling options, as well as adjusting positions continuously, can incur transaction costs that may erode returns, especially for small-scale traders.

-

Market Uncertainty: Delta hedging relies on assumptions about the future behavior of the underlying asset. In highly volatile or unpredictable markets, it can be challenging to maintain an effective hedge.

Delta Hedging Options Trading

Image: tradeproacademy.com

Conclusion

Delta hedging is a powerful risk-management technique that can empower investors to navigate the treacherous waters of options trading with increased confidence. By dynamically adjusting the delta of their portfolio, investors can neutralize volatility, enhance returns, and safeguard their capital. While it is not without its complexities and implementation challenges, delta hedging remains a valuable tool for investors seeking to maximize their trading potential while minimizing risk. A thorough understanding of this strategy and its nuances will equip traders with the knowledge and skills necessary to navigate the ever-changing landscape of financial markets.