Have you ever wondered how options traders navigate the volatile world of financial markets? Join us as we unravel the intricacies of one key aspect of their toolkit: position delta. In this comprehensive guide, we’ll dispel the complexities of position delta, empowering you with the insights needed to make informed trading decisions.

Image: www.scribd.com

What is Position Delta?

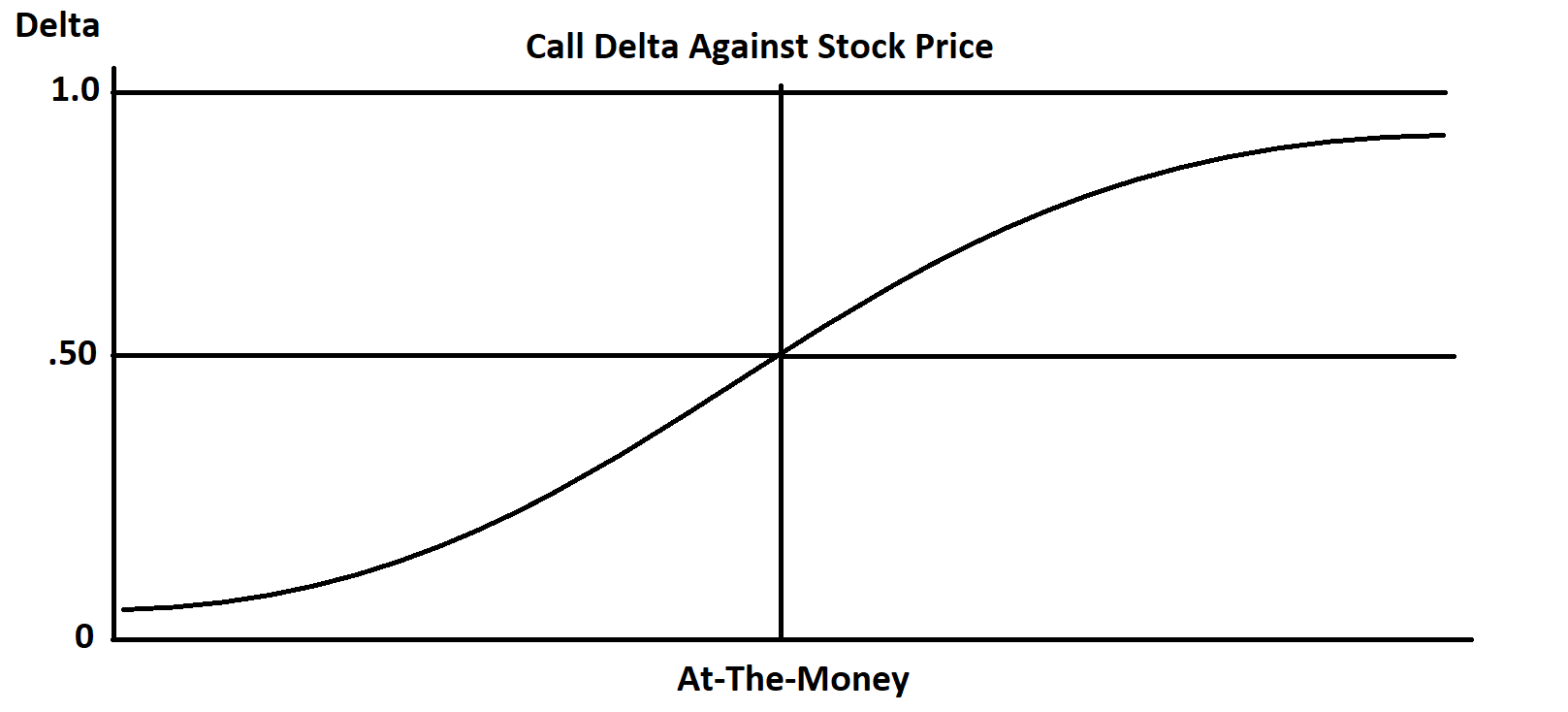

Position delta measures the sensitivity of an option’s price to changes in the underlying asset’s price. It reflects the number of shares or units of the underlying that would be bought or sold if the option were exercised. In essence, position delta indicates the potential profit or loss per unit of price movement in the underlying asset.

Types of Position Delta

- Positive Delta: A positive delta indicates that the option’s value will increase as the underlying asset’s price rises.

- Negative Delta: A negative delta signifies that the option’s value will decrease as the underlying asset’s price declines.

- Zero Delta: An option with zero delta will not change in value with respect to the underlying asset’s price movement.

Significance of Understanding Position Delta

Understanding position delta is paramount for determining an option’s risk and reward potential. It helps traders:

- Manage Risk: By knowing the delta of their options positions, traders can assess their exposure to market fluctuations and adjust their strategies accordingly.

- Maximize Profits: Position delta allows traders to identify options with the optimal balance of risk and reward, maximizing their profit potential.

- Implement Hedging Strategies: Delta plays a crucial role in hedging strategies, enabling traders to reduce their overall risk by offsetting the opposing delta of another position.

Image: www.pinterest.com

Calculating Position Delta

The delta of an option can be calculated using the following formula:

Delta = Change in Option Price / Change in Underlying PriceFor example, if the price of an option increases by $0.10 for every $1 increase in the underlying asset’s price, the option has a delta of 0.1.

Expert Insights on Position Delta

“Position delta provides a valuable indicator of an option’s risk profile,” says Anthony Marino, a seasoned options trader. “Traders who monitor their positions’ delta can proactively adjust their strategies and avoid significant losses.”

“By combining position delta with other technical indicators, such as implied volatility, traders can make informed decisions about strike prices and expiration dates,” adds Emily Carter, a financial analyst.

Actionable Tips for Utilizing Position Delta

- Choose Options With Appropriate Delta: Consider your risk tolerance and trading objectives when selecting options with specific delta values.

- Monitor Delta Regularly: Keep track of your options positions’ delta as the underlying asset’s price fluctuates to identify potential risks or opportunities.

- Utilize Delta for Hedging: Offset your market exposure by combining positions with opposing deltas, reducing overall risk.

Options Trading Strategies Understanding Position Delta

Image: www.newtraderu.com

Conclusion

Embracing the concept of position delta empowers options traders with vital insights into their positions’ behavior. By understanding its significance and utilizing it effectively, traders can navigate the financial markets with greater confidence and increase their chances of profitable trades. Remember to approach options trading with a sound understanding of its complexities and seek guidance from qualified professionals when needed.