Capture the Essence of Delta

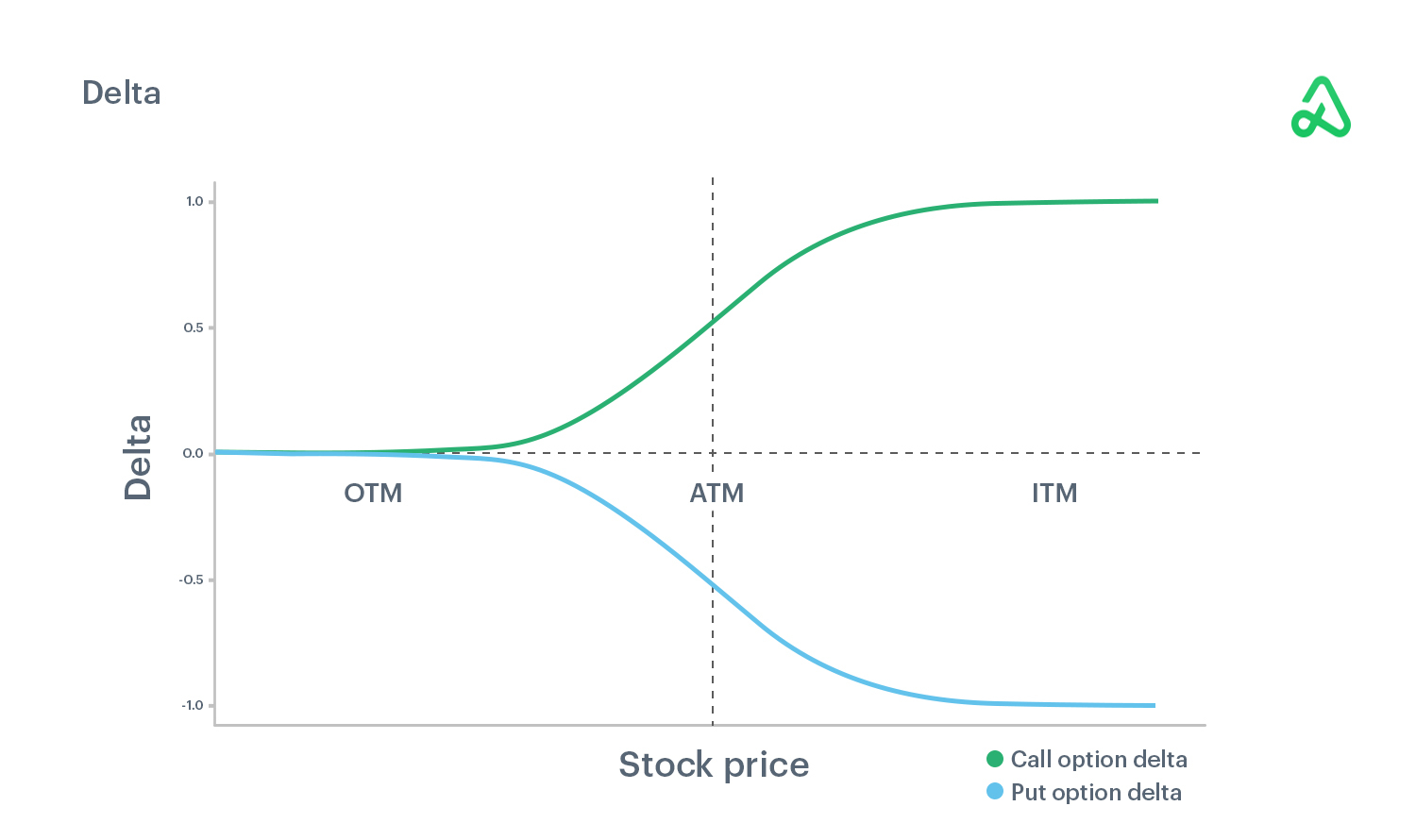

In the realm of options trading, the concept of Delta governs the relationship between an option’s price and the underlying security. It quantifies how much the option’s value changes in response to a one-dollar change in the security’s price. Delta, often expressed as a decimal, allows traders to gauge an option’s sensitivity to underlying price movements.

Image: optionalpha.com

Delta’s Dynamic Influence

Delta’s numerical value ranges from −1 to +1. This span portrays the proportionate change in option value against the underlying security. A delta of +1 indicates that for every $1 increase in the security’s price, the call option’s value increases by $1. Conversely, a delta of −1 signifies a $1 decrease in put option value for each $1 decline in the underlying’s price. When delta equals 0, the option’s value remains unaffected by price changes in the underlying security.

Comprehending Delta’s Role in Options Trading Strategies

Delta plays a crucial role in devising and executing options trading strategies. It empowers traders to:

- Assess Risk: Delta quantifies the potential gain or loss associated with an option position, allowing traders to manage risk and set appropriate position sizes.

- Adjust Positions: Traders can utilize delta to adjust existing option positions as underlying prices fluctuate, ensuring optimal performance.

- Create Synthetic Positions: By combining options with different delta values, traders can construct synthetic positions that mimic the behavior of other financial instruments.

Expert Insights and Tips for Effective Delta Utilization

Harnessing the power of delta, experienced traders employ various techniques in their trading strategies:

- Directional Trading: Traders can select call options with high positive deltas (+0.8 to +1) or put options with high negative deltas (-0.8 to -1) to capitalize on expected price increases or decreases in the underlying security.

- Delta Neutral Trading: Creating portfolios with options having opposing deltas (e.g., long on a call with delta +0.5 and short on a put with delta -0.5) helps mitigate market risk while generating income from option premiums.

Image: www.redfox-trading.com

FAQs to Clarify Delta and its Impact

Q: How does delta impact option premiums?

A: Higher delta values typically correspond with higher option premiums, as the option is more likely to move in sync with the underlying security.

Q: What is the significance of delta at expiration?

A: Delta converges to 1 for call options and 0 for put options at expiration, indicating that the option’s value is directly tied to the underlying security’s price.

Q: Can delta be used to predict future stock prices?

A: While delta measures the sensitivity of an option to the underlying security’s price, it cannot predict future market movements or security values accurately.

Understanding Delta In Options Trading

Image: optionstradingiq.com

Conclusion: Empowering Traders with Delta’s Insights

Delta serves as an invaluable tool in options trading, providing traders with a deeper understanding of price relationships and potential risks. By leveraging delta effectively, traders can make informed decisions, optimize position management, and enhance overall trading performance. Embracing the knowledge of delta not only sharpens trading skills but also elevates the path toward financial success.

Ask yourself, are you ready to unleash the power of delta in your options trading endeavors? Embark on this journey of clarity and strategic decision-making today!