Prologue

I had spent countless hours poring over charts and studying market trends, hoping to crack the code of successful investing. Just as I was beginning to lose faith, I stumbled upon the alluring world of option trading. It promised to elevate my financial prowess and bestow upon me the power to profit from both rising and falling markets.

Image: algotrading101.com

Embarking on this exciting journey, I learned that options trading is akin to an intricate dance between risk and reward. It requires a deft understanding of the market’s ebb and flow and a willingness to embrace both the potential rewards and the inherent risks. As I delved deeper into this captivating realm, I discovered a treasure trove of strategies and techniques that could help me navigate the complexities of this financial arena.

Understanding Option Basics

What are Options?

In the realm of financial instruments, options stand out as contracts that convey the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a certain date. These versatile tools provide investors with a myriad of opportunities to shape their investment strategies and capitalize on market movements.

Types of Options

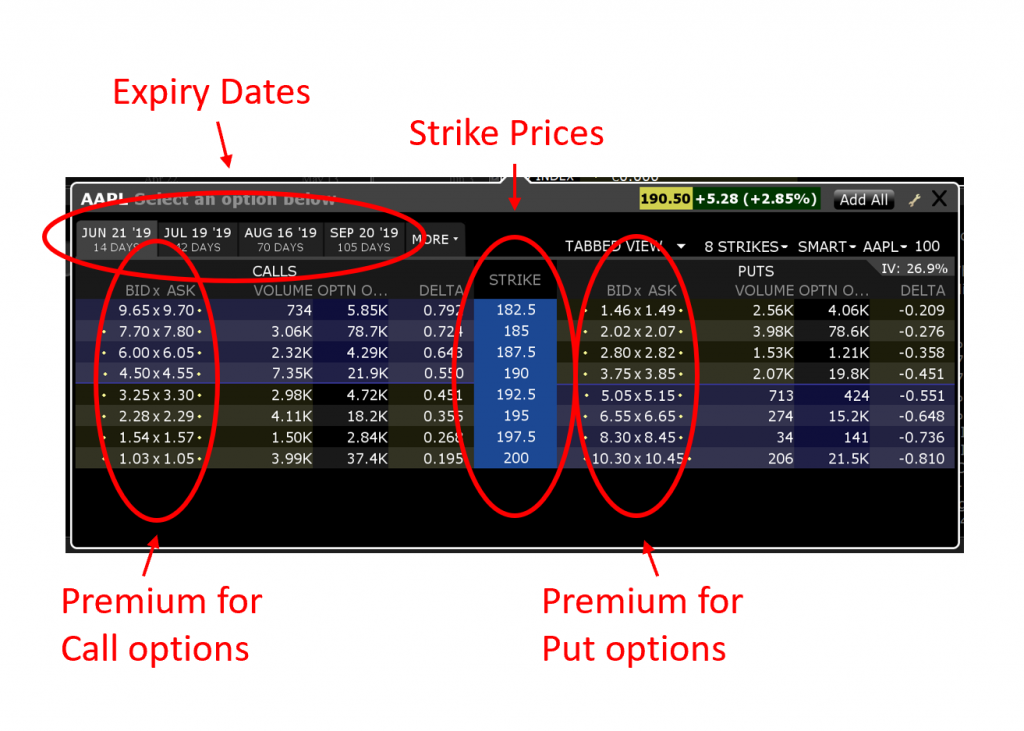

The world of options trading encompasses two primary types: calls and puts. Call options provide investors with the right to buy an underlying asset at the strike price on or before the expiration date. Conversely, put options grant the right to sell an underlying asset at the strike price on or before the expiration date.

Image: www.projectfinance.com

Mechanics of Option Trading

To initiate an options trade, an investor must pay a premium to the seller of the option. This premium represents the price of the option contract and grants the buyer the right to exercise the option at the predetermined price. In return, the option seller assumes the obligation to honor the terms of the contract if the buyer chooses to exercise it.

Options trading offers investors a diverse range of strategies, including long calls, long puts, short calls, and short puts. Each strategy carries its own set of risk and reward characteristics, allowing investors to tailor their approach based on their individual risk tolerance and investment objectives.

Navigating the Options Arena: Trends and Strategies

Market Insights

To excel in option trading, it is imperative to stay abreast of the latest market trends and developments. This entails monitoring economic indicators, such as interest rates, inflation, and GDP growth, as well as geopolitical events and their potential impact on financial markets.

Delving into financial news and analysis from reputable sources can provide valuable insights into the direction of the market and the performance of specific industries or sectors.

Expert Advice

Seasoned options traders often emphasize the importance of understanding the risks associated with this form of trading and exercising sound risk management practices. This includes setting clear profit targets and stop-loss levels and avoiding overleveraging your portfolio.

Moreover, they advocate for continuous learning and staying up-to-date with the latest trading techniques and market insights. Successful options traders recognize the ever-evolving nature of financial markets and the need to adapt their strategies accordingly.

Frequently Asked Questions

Q: How do I get started with options trading?

A: Before embarking on options trading, it is essential to acquire a thorough understanding of the basics, various strategies, and associated risks. This can be achieved through books, online courses, and educational resources.

Q: What are the key factors to consider when choosing an options strategy?

A: When selecting an options strategy, it is crucial to assess your risk tolerance, investment horizon, and the prevailing market conditions. Different strategies carry different levels of risk and reward potential, so it is important to align your choice with your individual investment goals.

How To Earn In Option Trading

Conclusion

The world of option trading presents a captivating realm of possibilities for investors seeking to amplify their financial prowess. However, it is essential to approach this arena with a clear understanding of the inherent risks and a willingness to learn and adapt. By embracing the right strategies, staying informed, and adhering to sound risk management practices, you can unlock the potential of this exciting financial tool and capitalize on the opportunities it offers.

Are you ready to embark on the thrilling adventure of option trading? Share your thoughts and experiences in the comments below.