The ever-fluctuating global oil market presents both challenges and opportunities for investors seeking to diversify their portfolios. Among the various investment strategies, trading options on oil futures stands out as a compelling choice for savvy market participants. This article delves into the realm of oil futures options, providing a comprehensive guide to empower traders with the knowledge and insights necessary to navigate this dynamic market successfully.

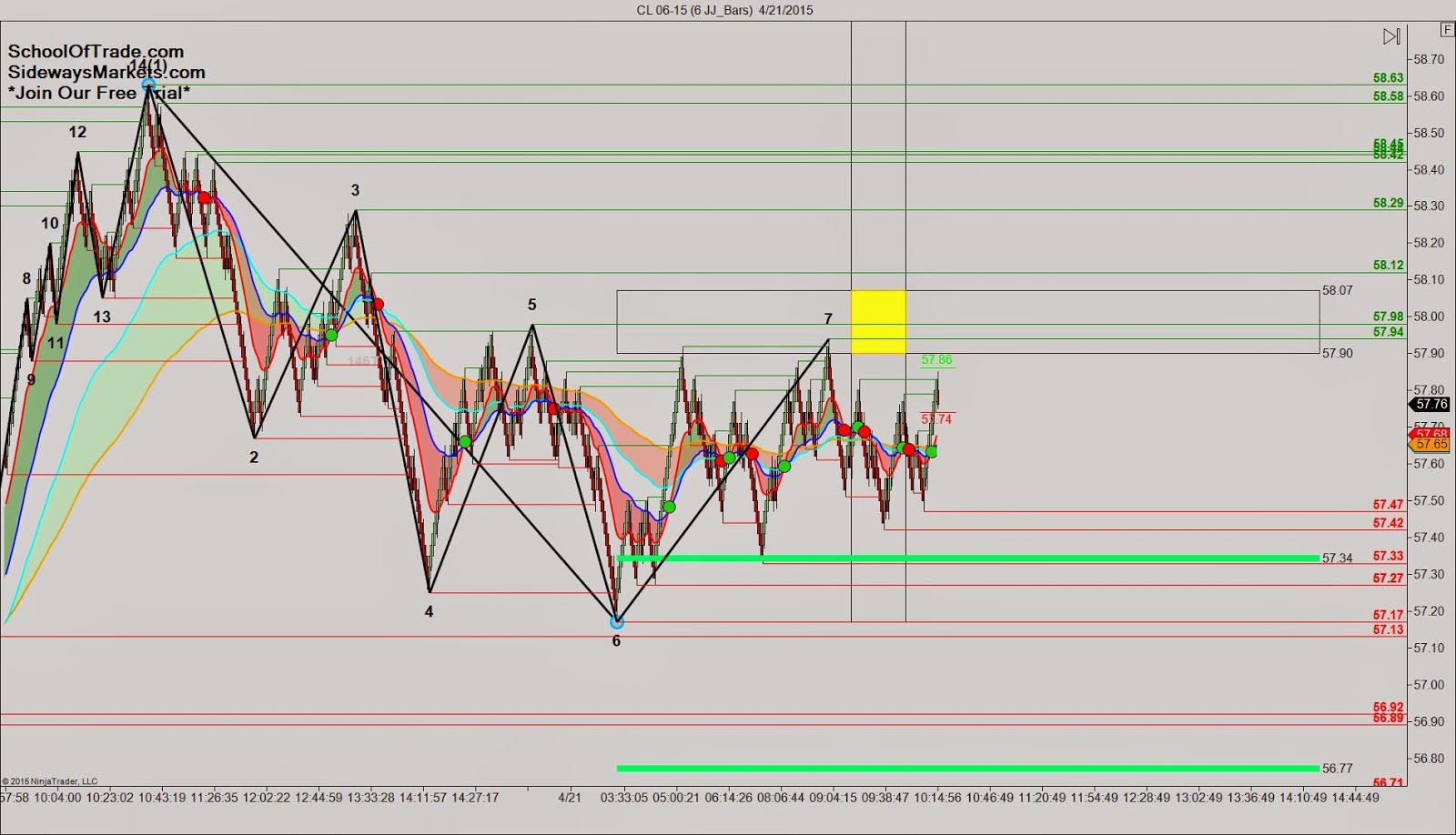

Image: www.sidewaysmarkets.com

Introduction to Oil Futures Options

An option is a derivative contract that grants the buyer the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) a specified amount of an underlying asset at a predefined price (known as the strike price) on or before a specified date (known as the expiration date). In the context of oil futures, the underlying asset is a futures contract that represents a standardized quantity of oil to be delivered on a particular date in the future.

Oil futures options offer a unique blend of risk and reward. They provide investors with the potential for significant returns while also limiting their downside risk to the premium paid for the option. Additionally, options offer flexibility, allowing traders to tailor their strategies to their specific risk tolerance and investment goals.

Basic Concepts of Oil Futures Options

Futures Contract: An agreement to buy or sell a specific amount of oil at a set price on a predetermined future date.

Option Premium: The price paid to acquire an option contract.

Strike Price: The price at which the underlying futures contract can be bought or sold, as per the option type (call or put).

Expiration Date: The last date on which the option contract can be exercised.

Call Option: Gives the buyer the right to buy the underlying futures contract at the strike price on or before the expiration date.

Put Option: Gives the buyer the right to sell the underlying futures contract at the strike price on or before the expiration date.

In-the-Money (ITM): An option is ITM when its strike price is favorable relative to the current market price of the underlying asset.

Out-of-the-Money (OTM): An option is OTM when its strike price is unfavorable relative to the current market price of the underlying asset.

At-the-Money (ATM): An option is ATM when its strike price is equal to the current market price of the underlying asset.

Trading Strategies for Oil Futures Options

The versatility of oil futures options allows for a wide range of trading strategies, each catering to specific market conditions and risk appetites.

Bullish Strategies: These strategies are designed for traders who anticipate a rise in oil prices. Examples include buying call options or selling put options.

Bearish Strategies: These strategies are designed for traders who anticipate a decline in oil prices. Examples include buying put options or selling call options.

Hedging Strategies: These strategies are used to reduce risk exposure to price fluctuations. For example, an oil producer may buy put options to protect against falling prices.

Neutral Strategies: These strategies combine both bullish and bearish elements to create a more balanced approach. Examples include straddles or strangles.

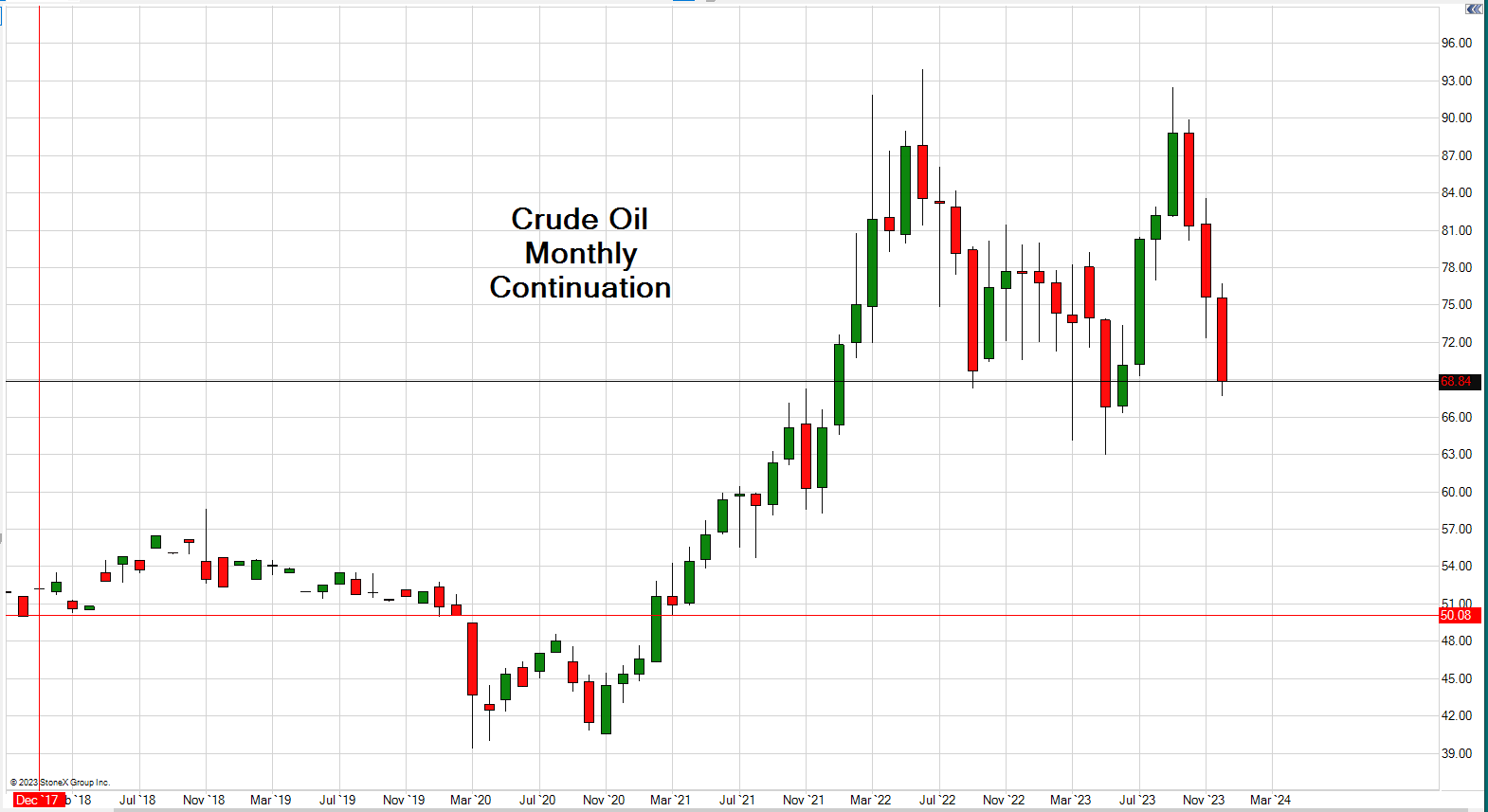

Image: www.hotzxgirl.com

Market Factors Influencing Oil Futures Options

The oil futures options market is influenced by a multitude of factors, including:

Global Economic Growth: Increased economic activity typically leads to higher oil demand, potentially pushing up prices and driving up the value of call options.

Supply and Demand Dynamics: Disruptions to oil production or supply chains can significantly impact prices, affecting the profitability of options contracts.

Geopolitical Events: Conflicts or political instability in oil-producing regions can create market volatility, leading to price fluctuations and increased option premiums.

Weather Conditions: Extreme weather events, such as hurricanes or droughts, can affect oil production and distribution, influencing prices and option values.

Seasonality: Seasonal factors, such as increased heating demand during winter months, can also impact oil prices and the value of futures options.

Trading Options On Oil Futures

Image: s3.amazonaws.com

Conclusion

Trading options on oil futures offers a sophisticated investment tool for navigating the complexities of the oil market.