**The Maze of Options Trading**

Navigating the complexities of options trading can be akin to venturing into a labyrinthine maze. Amidst the multitude of strategies, vertical and single spread options stand out as two distinct approaches that warrant a deeper understanding. Join us as we delve into the intriguing world of options, exploring the contrasts between these two trading techniques.

Image: redot.com

**Cracking the Binary Code of Single Spread Options**

Single spread options capture the essence of simplicity and straightforwardness in options trading. As the name suggests, this strategy involves trading a single option spread, essentially pairing two options with contrasting characteristics. For instance, one might buy a call option while concomitantly selling a higher-priced call option with the same underlying asset but a different expiration date.

This ingenious combination translates into reduced capital outlay compared to purchasing outright options. Moreover, it offers a degree of flexibility in customizing risk and reward profiles, with the potential for both limited gains and losses.

**Untangling the Interconnected Web of Vertical Spread Options**

Unlike their single spread counterparts, vertical spread options involve trading multiple options in tandem. This intricate strategy entails buying or selling options with identical expiration dates but different strike prices. By cautiously structuring the spread, traders can adapt their risk-reward profile to specific market expectations.

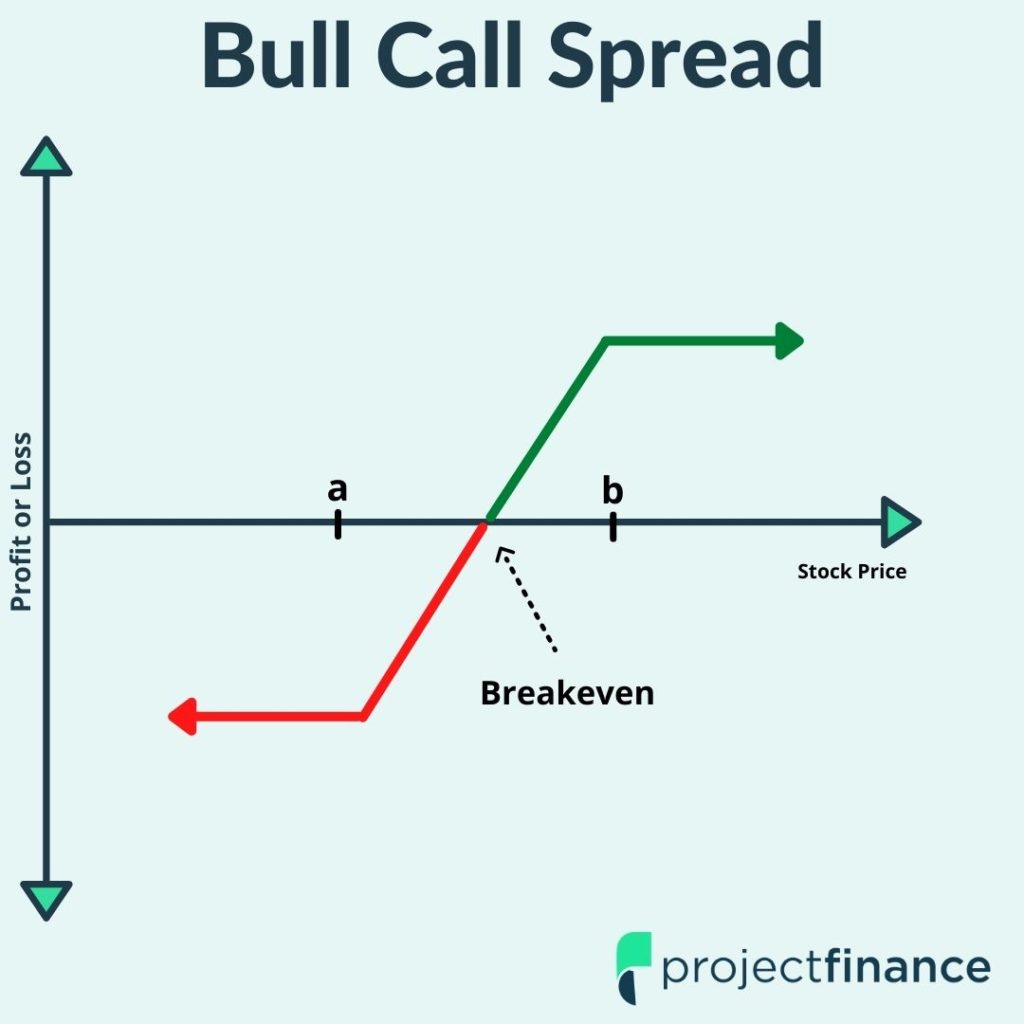

For instance, a vertical call spread entails buying a lower-strike-price call option and simultaneously selling a higher-strike-price call option. This intricate dance aims to capitalize on the potential for moderate gains within a narrower price range. Alternatively, a vertical put spread involves selling a higher-strike-price put option and buying a lower-strike-price put option, striving for profitability in markets anticipated to decline.

**Navigating the Market with Vertical Spread Options**

The art of vertical spread options trading lies in its versatility, catering to various market scenarios. Whether contemplating rising, falling, or stagnant markets, savvy traders can craft tailored strategies. For instance:

-

Bullish markets: Vertical call spreads, predicated on the expectation of price appreciation, afford limited upside potential.

-

Bearish markets: Vertical put spreads, betting on market decline, present opportunities for capped gains.

-

Neutral markets: Neutral vertical spreads, employing opposing strike prices, capitalize on expected price stagnancy, offering limited gains and losses.

Image: www.projectfinance.com

**Leveraging Insider Knowledge: Tips from the Trading Trenches**

Drawing upon countless hours spent dissecting market intricacies, experienced traders generously impart their wisdom:

-

Diligence is Key: Discipline and thorough research are paramount in navigating options trading’s treacherous waters.

-

Patience Pays Dividends: Allow ample time for market forces to unfold and capitalize on favorable conditions.

-

Manage Risk Prudently: Understanding risk and implementing appropriate risk management strategies is vital for long-term success.

**FAQ: Illuminating the Nuances of Options Trading**

Q: What is the primary distinction between vertical and single spread options?

A: Vertical spread options involve trading multiple options with identical expiration dates but different strike prices, while single spread options entail trading a single option spread pairing two options with contrasting characteristics.

Q: Which strategy offers greater flexibility in tailoring risk and reward profiles?

A: Vertical spread options provide more flexibility in adapting risk and reward profiles to specific market expectations.

Verticle Vs Singlle Spread Options Trading

Image: redot.com

**Conclusion: Unveiling the Path to Success**

Embarking on the transformative journey of options trading demands a thorough comprehension of strategies such as vertical and single spread options. By embracing diligence, exercising patience, managing risk prudently, and tapping into expert advice, both novice and seasoned traders alike can unlock the potential of this captivating financial sphere.

Would you like to know more about verticle vs singlle spread options trading? Let us know your thoughts in the comment section below.