In the intricate labyrinth of financial markets, options trading stands as an alluring yet treacherous path, fraught with both the promise of astronomical rewards and the specter of crippling losses. As a seasoned adventurer who has navigated this perilous realm, let me share the hard-learned lessons and insights that may serve as a guide for those who dare to venture into its treacherous waters.

Image: www.pinterest.com

Before embarking on this treacherous odyssey, it is imperative to grasp the fundamental nature of options trading. An option, simply put, is a financial contract that grants the buyer the right, but not the obligation, to buy or sell a specific asset (like a stock) at a predetermined price (the strike price) on or before a specified date (the expiration date). This flexibility renders options immensely potent tools for investors seeking to hedge against risk or speculate on market movements.

The Art of Options Pricing

To delve deeper into the complexities of options trading, we must unravel the art of pricing these elusive contracts. Two primary factors govern the value of an option: intrinsic value and time value. Intrinsic value represents the difference between the underlying asset’s current price and the option’s strike price. Positive intrinsic value implies that the option is “in the money,” while negative intrinsic value suggests it is “out of the money.” Time value, on the other hand, reflects the time remaining until the option’s expiration date and the likelihood that the underlying asset’s price will reach or exceed the strike price.

Striking the right balance between these two components is crucial for maximizing profit potential while minimizing risk. Time value diminishes as the expiration date approaches, emphasizing the importance of timing in options trading. It is not uncommon for inexperienced traders to fall prey to the allure of “cheap” long-dated options, only to discover the cruel reality of time decay eroding their premiums.

Options Trading Strategies

With a firm grasp of options pricing, let us explore the myriad strategies that savvy traders employ to navigate the turbulent seas of the financial markets. From the straightforward call and put options to the more intricate synthetic strategies, there is a vast array of options trading strategies to suit every appetite for risk and reward. Call options grant the buyer the right to buy the underlying asset, while put options confer the right to sell. Savvy traders combine these basic options to create sophisticated strategies, such as covered calls, protective puts, and straddles, to enhance their potential returns or mitigate risk.

Understanding the Greeks, a set of metrics that quantify an option’s sensitivity to various factors, is essential for mastering the art of options trading. These metrics, aptly named Delta, Gamma, Theta, Vega, and Rho, provide invaluable insights into how an option’s price will react to changes in the underlying asset’s price, implied volatility, time decay, interest rates, and dividend yield, respectively. By employing these metrics, traders can refine their strategies, optimize their risk-reward ratios, and navigate market fluctuations with greater precision.

Expert Advice for Options Trading Success

To enhance your odds of triumph in the treacherous waters of options trading, heed the sage advice of seasoned experts. They urge traders to:

- Understand the risks: Options trading is inherently risky, and it is imperative to fully comprehend the potential losses before venturing into this arena.

- Start small: Prudent traders commence their options trading journey with modest positions, gradually increasing their stake as they gain experience and confidence.

- Learn the Greeks: Mastering the intricacies of the Greeks is paramount for success in options trading. Armed with this knowledge, traders can make informed decisions and refine their strategies.

- Manage risk: Options trading, by its very nature, entails risk. Prudent traders employ risk management techniques, such as protective stop-loss orders and position sizing, to safeguard their capital.

- Seek professional guidance: If you are new to options trading, seeking guidance from a qualified financial advisor can be invaluable. A seasoned professional can provide tailored advice, helping you navigate the complexities of options trading and avoid costly mistakes.

Image: www.pinterest.fr

FAQs on Options Trading

- What is the difference between a call option and a put option?

Call options grant the buyer the right to buy, while put options grant the right to sell. - How do I calculate the profit potential of an option?

The profit potential of an option is the difference between the option’s selling price and the purchase price. - What is the importance of implied volatility in options trading?

Implied volatility is a measure of the market’s expectations for future volatility. Higher implied volatility translates into higher option premiums. - What are the risks of options trading?

Options trading involves significant risk, including the potential loss of the entire investment. - Is options trading a good way to make money?

Options trading can be a lucrative endeavor, but it requires a sound understanding of the risks and rewards involved.

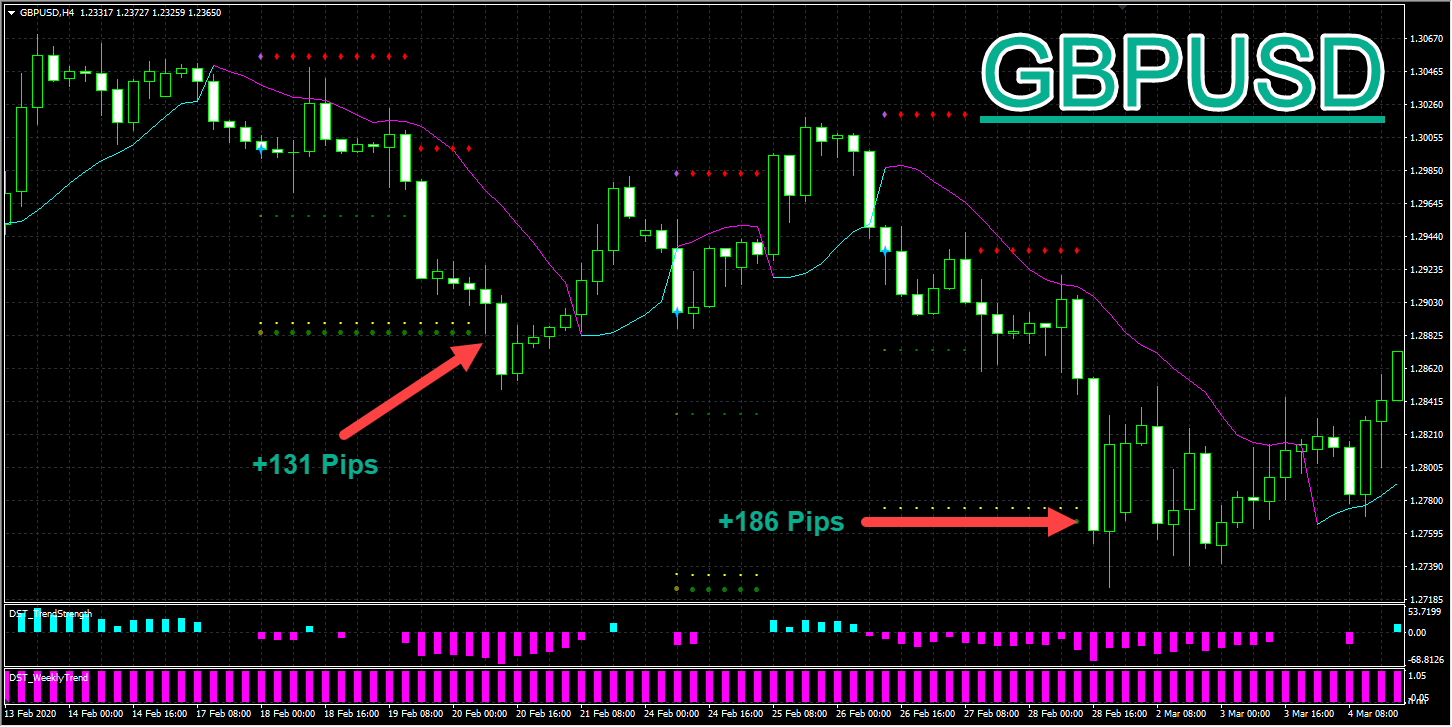

Options Trading The Hard Way

Image: forexsignalsystemtrading.blogspot.com

Call to Action

If you are enticed by the allure of options trading, I urge you to proceed with caution. This treacherous path is fraught with both immense opportunities and formidable risks. Embark on this journey only if you are willing to invest the necessary time and effort to master the complexities of options trading. And remember, even the most seasoned traders encounter setbacks along the way. The key to success lies in learning from your mistakes, refining your strategies, and never losing sight of your financial goals.

Are you ready to brave the storm of options trading? The choice is ultimately yours, but I implore you to approach this endeavor with the utmost respect for the risks involved. May fortune favor your sails as you navigate the turbulent waters of the financial markets.