Introduction

In the labyrinthine world of financial markets, options trading stands out as a mesmerizing yet perilous realm. With the allure of potentially exponential gains, many investors are drawn to the seductive whispers of this speculative paradise. However, beneath the veneer of promise lies a treacherous undercurrent of risk. Embarking on this financial odyssey requires a sober understanding of the pitfalls that can transform dreams of wealth into nightmares of loss.

Image: www.youtube.com

The Labyrinth of Options Trading

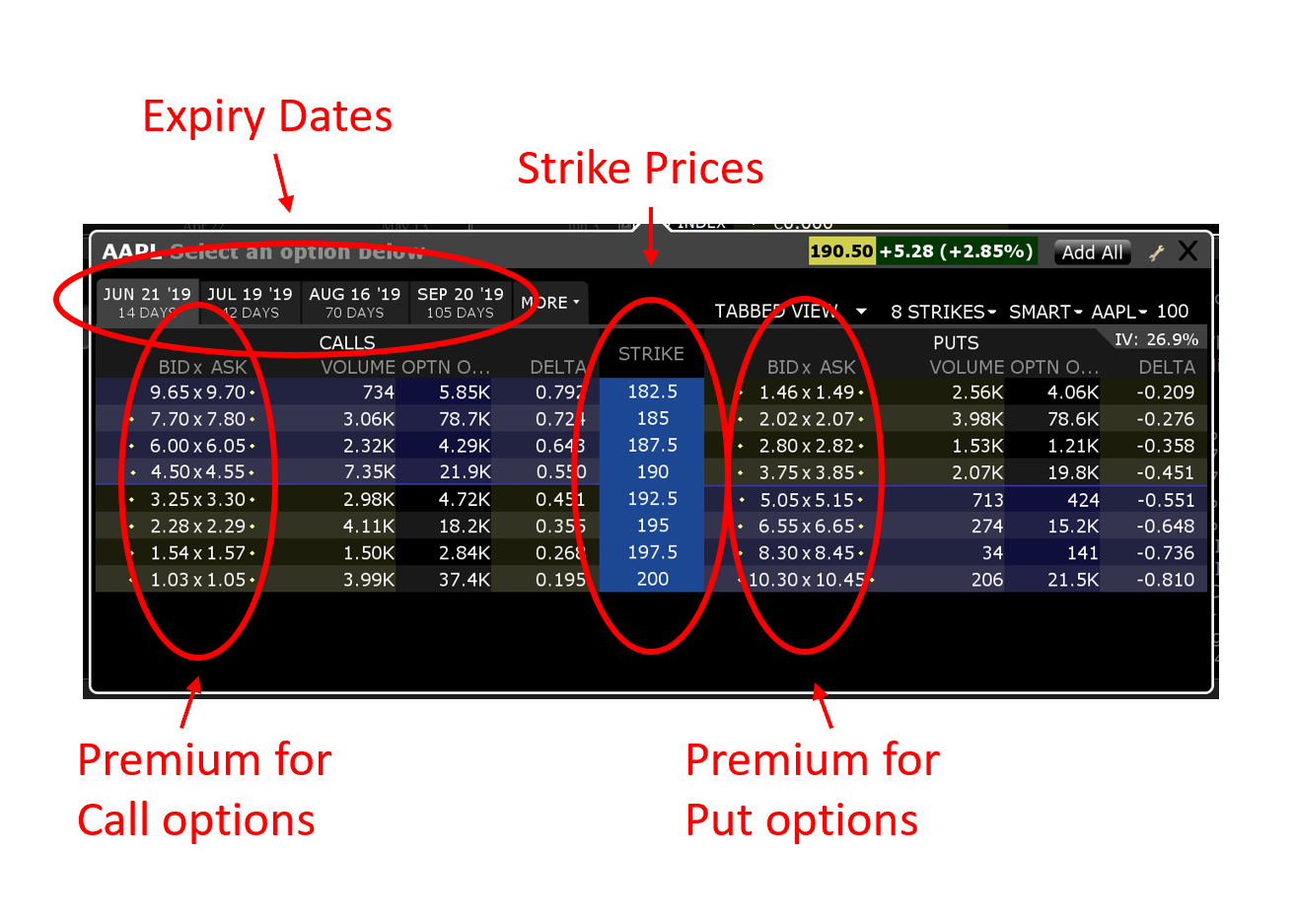

Options are contracts that grant the buyer the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predefined price (the strike price) on or before a specified date (the expiration date). This flexibility empowers traders to speculate on the future price direction of assets, ranging from stocks and bonds to currencies and commodities. However, this freedom comes at a price – risk.

Pitfalls of Option Trading

-

Unpredictable Volatility: Option premiums are highly sensitive to changes in the underlying asset’s volatility. Unexpected spikes or plunges can wreak havoc on the value of options, leading to significant losses.

-

Time Decay: All options have a finite lifespan, with the value steadily eroding as expiration approaches. This “time decay” factor can be substantial, especially for short-term options, amplifying the importance of timing in option trading.

-

Leverage Effect: Options amplify the potential for both gains and losses due to their inherent leverage. Even a small movement in the underlying asset’s price can result in disproportionate gains or losses for options holders.

-

Liquidity Risks: Unlike underlying assets, options often have limited liquidity, particularly for far-out-of-the-money options or those close to expiration. This can make it challenging to execute trades quickly and efficiently, especially in volatile markets.

-

Miscalculations and Mistakes: Option trading involves complex strategies and calculations. Misunderstandings, errors in pricing, or misinterpreting market data can lead to catastrophic losses.

Expert Insights and Actionable Tips

-

Thorough Due Diligence: Conduct meticulous research and due diligence on the underlying asset, market conditions, and available options contracts. Understanding the nuances of different options strategies is crucial.

-

Risk Management: Employ robust risk management techniques to mitigate potential losses. Clearly define entry and exit points with the help of stop-loss orders, and allocate only a portion of your portfolio to option trading.

-

Time Horizon: Carefully consider the time horizon for your option trades, aligning them with your investment goals and risk tolerance. Avoid holding options close to expiration, as time decay can accelerate losses.

Image: capitalflow.info

How Can Option Trading Go Wrong

Image: algotrading101.com

Conclusion

Option trading is a complex and demanding endeavor that should be approached with caution and a profound understanding of the potential risks. Volatility, time decay, leverage effects, liquidity concerns, and the ever-present specter of miscalculations can bring even the most seasoned investors to their knees. Embark on this financial odyssey only if you possess the requisite knowledge, skills, and emotional fortitude to navigate its treacherous waters. Remember, the pursuit of financial gains should never come at the expense of your hard-earned capital.