Introduction:

Image: www.jumpstarttrading.com

Imagine the exhilaration of entering the financial arena, where fortunes can be won and lost with every strategic move. Options trading, a captivating realm within this realm, offers the allure of leveraging your insights into market movements to potentially reap substantial rewards. But navigating this complex landscape requires a solid foundation, and that’s where the options trading Excel worksheet steps in as an indispensable tool. In this comprehensive guide, we’ll delve into the intricate mechanics of options trading, unveiling how this powerful tool can empower your investment decisions.

Understanding Options Trading

Options, financial instruments derived from underlying assets like stocks or indices, grant the holder the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a specified price (strike price) within a predefined period (expiration date). Options trading involves buying and selling these contracts, speculating on future price movements and potentially generating lucrative returns.

The Significance of Excel Worksheets

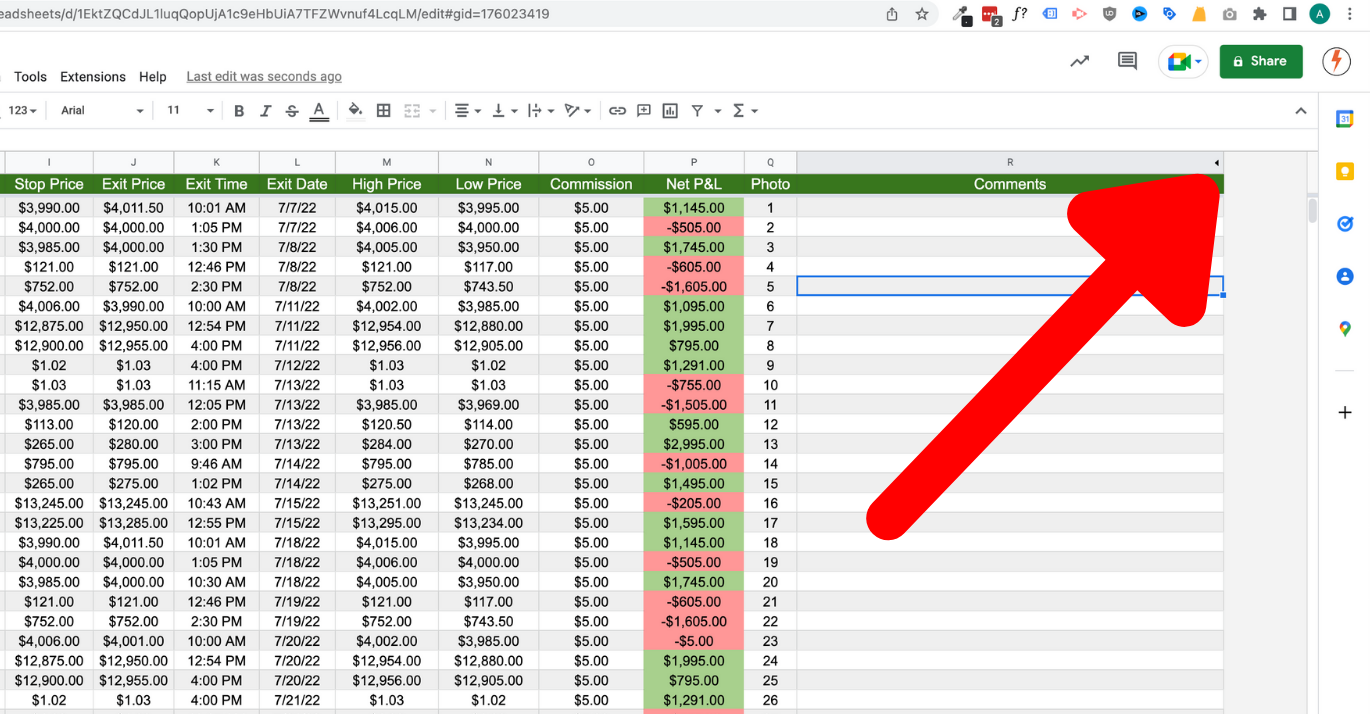

Excel worksheets are not just numerical tables but versatile tools that simplify complex financial calculations. In options trading, they become indispensable companions, meticulously crunching numbers to provide insights into potential outcomes and guiding your investment decisions. With an options trading Excel worksheet, you’ll have the power to:

-

Calculate premiums: Determine the initial cost of purchasing an option contract.

-

Evaluate potential profits and losses: Assess the potential return and risk for different market scenarios.

-

Visualize profit graphs: Plot potential profit curves based on varying underlying asset prices.

-

Analyze Greeks: Evaluate key metrics (Delta, Gamma, Theta, Rho, and Vega) to gauge option sensitivity to market factors.

Step-by-Step Guide to Using an Options Trading Excel Worksheet

-

Input Underlying Asset Information: Enter details such as the underlying asset’s symbol, current price, and volatility.

-

Specify Option Contract Details: Define the option type (call/put), strike price, and expiration date.

-

Calculate Premium: Use built-in formulas like the Black-Scholes model to determine the option contract’s initial cost.

-

Plot Profit Graph: Utilize the graph generation feature to visualize potential profits or losses based on different underlying asset prices.

-

Analyze Greeks: Calculate Greeks such as Delta to determine the impact of underlying asset price changes on option value.

Expert Insights and Actionable Tips

-

Seek Guidance from Experts: Consult reputable sources, brokers, or financial advisors to gain deep insights into options trading strategies.

-

Practice Risk Management: Understand the potential risks involved in options trading and implement strategies to mitigate losses.

-

Tailor to Your Goals: Customize your Excel worksheet to reflect your investment objectives and risk tolerance.

Conclusion:

The options trading Excel worksheet is an indispensable tool that empowers you to navigate the complexities of options trading with confidence. By mastering its capabilities, you’ll have the knowledge and expertise to make informed decisions, optimize your investment strategies, and reap the rewards of this exhilarating financial arena. Remember, the path to success in options trading lies in a combination of sound judgment, risk management, and leveraging the power of tools like the options trading Excel worksheet.

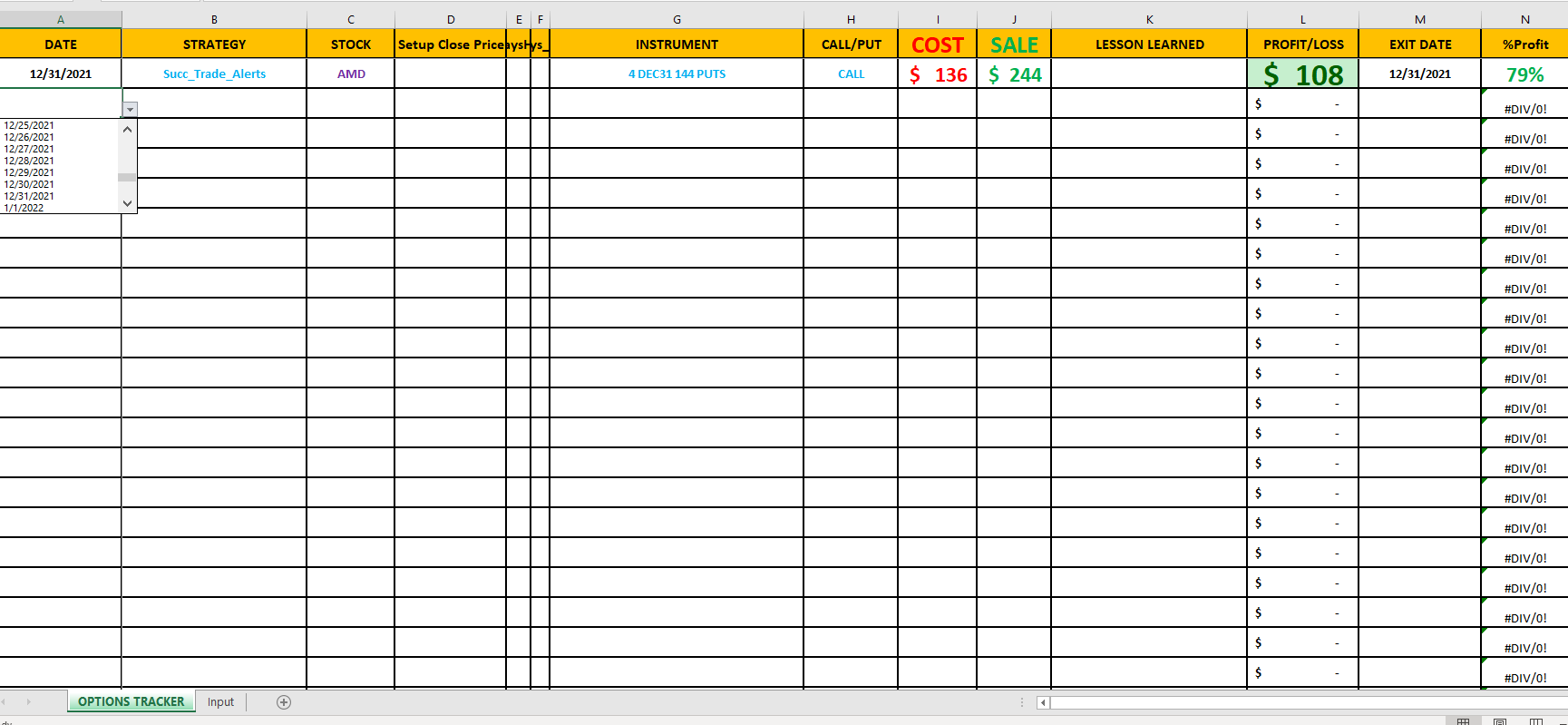

Image: www.tradingoptionscashflow.com

Options Trading Excel Worksheet

Image: successfultradings.com