Introduction:

As an ardent trader, I vividly recall an exhilarating trade where I leveraged options to amplify my gains phenomenally. The adrenaline rush I experienced from tactically harnessing the intricate dynamics of this trading instrument was unparalleled. Embark on this journey with me as we meticulously explore the fascinating realm of options leverage.

Image: www.forex.com

Understanding Options Leverage

Definition and Mechanics:

Options are financial instruments that grant traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. Leverage refers to the ability to control a significant portion of an underlying asset’s value with a relatively small amount of capital. Through options, traders can magnify their potential profits without investing large sums of money.

Types of Options Leverage:

There are two primary types of options leverage: buying an option on margin and writing (selling) a naked option. Buying an option on margin amplifies your potential returns with the use of borrowed capital, boosting your buying power. Conversely, writing a naked option entails selling an option without owning the underlying asset, exposing you to potentially unlimited losses. Understanding the risks and rewards associated with each type of leverage is crucial.

Image: www.youtube.com

Profiting from Options Leverage:

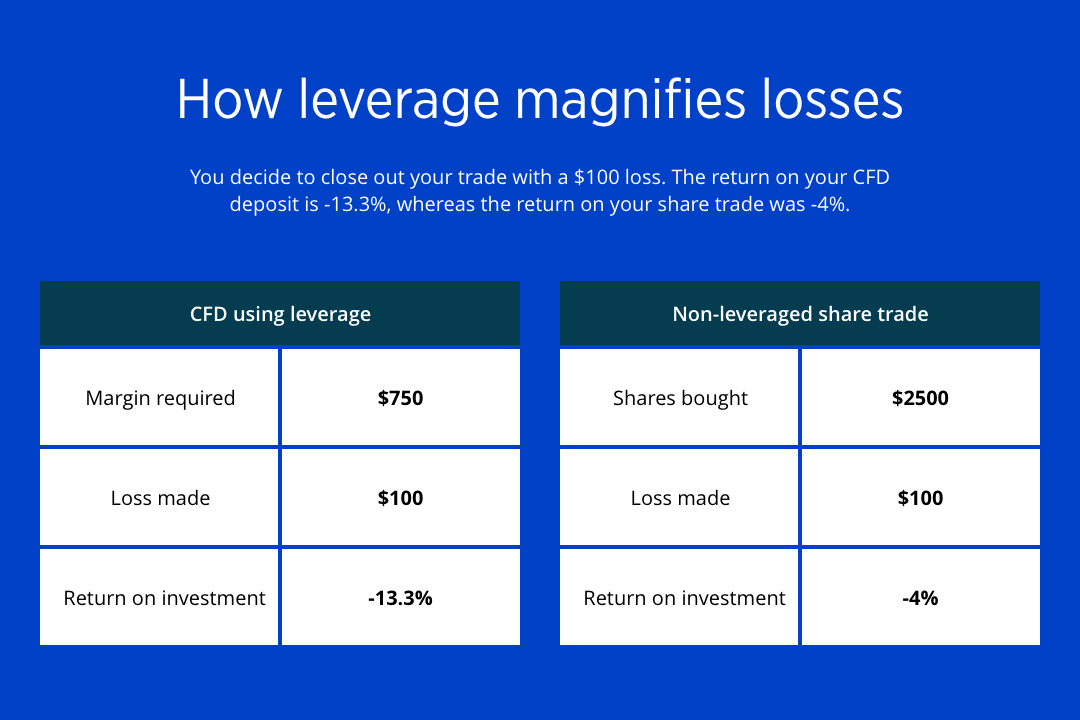

Options offer diverse strategies to exploit market movements and potentially generate substantial profits. The judicious use of leverage can multiply your returns significantly. However, it’s imperative to exercise caution, as leverage can also amplify losses if market conditions turn adverse.

Example:

Consider a stock priced at $100. By purchasing a call option with a strike price of $105 for $5, you control the right to buy 100 shares at $105 per share. If the stock rises to $110, you can exercise your option and sell the shares at a $5 per share profit. This translates to a 100% return on your initial investment, effectively amplifying your potential gains by leveraging the options contract.

Risks Associated with Options Leverage:

Harnessing options leverage comes with inherent risks that must be acknowledged and managed prudently. Volatility, unlimited loss potential, and margin calls are formidable factors that can jeopardize your trading capital. Volatility can cause rapid fluctuations in option prices, potentially leading to significant losses if market conditions move against your position. Moreover, writing naked options exposes you to unlimited potential losses.

Tips on Managing Options Leverage Effectively:

1. Understand Your Risk Tolerance: Assess your financial situation and risk tolerance before employing leverage. Ensure that you have the capacity to withstand potential losses and adjust your leverage accordingly.

2. Choose the Right Options: Carefully select options that align with your trading strategy and risk appetite. Consider factors such as strike price, expiration date, and market volatility.

3. Monitor Your Positions Closely: Monitor your options positions assiduously, especially when using margin. Be prepared to adjust or close positions promptly if market conditions change unexpectedly.

4. Hedge Your Risks: Diversify your portfolio and employ hedging strategies to mitigate risk. Consider pairing options with other positions to neutralize or minimize potential losses.

FAQs about Options Leverage:

Q: What are the benefits of using options leverage?

A: Amplification of potential profits, enhanced buying power, increased flexibility in trading strategies.

Q: What are the risks associated with options leverage?

A: Magnification of losses, volatility risk, unlimited loss potential (for naked options).

Q: How do I manage options leverage effectively?

A: Assess risk tolerance, choose appropriate options, monitor positions closely, and implement hedging strategies.

Options Leverage For Trading

Conclusion:

Leverage through options can be a powerful tool in the arsenal of astute traders. By strategically employing leverage, one can potentially multiply their profits while controlling significant portions of the underlying asset. However, it’s equally important to acknowledge and manage the associated risks diligently. By embracing a prudent approach and adhering to sound risk management principles, traders can harness the potential of options leverage to achieve remarkable trading success.

Call to Action:

Embark on a deeper exploration of options leverage. Leave a comment below indicating your interest, and we will provide you with additional resources and insights into this captivating trading strategy.