Understanding the Role of Leverage

Leverage is a double-edged sword in the world of finance. It can amplify both profits and losses, making it a crucial factor to consider in options trading. Before delving into the options trading arena, it’s imperative to understand the concept of leverage and how it affects your trading strategies.

Image: www.ig.com

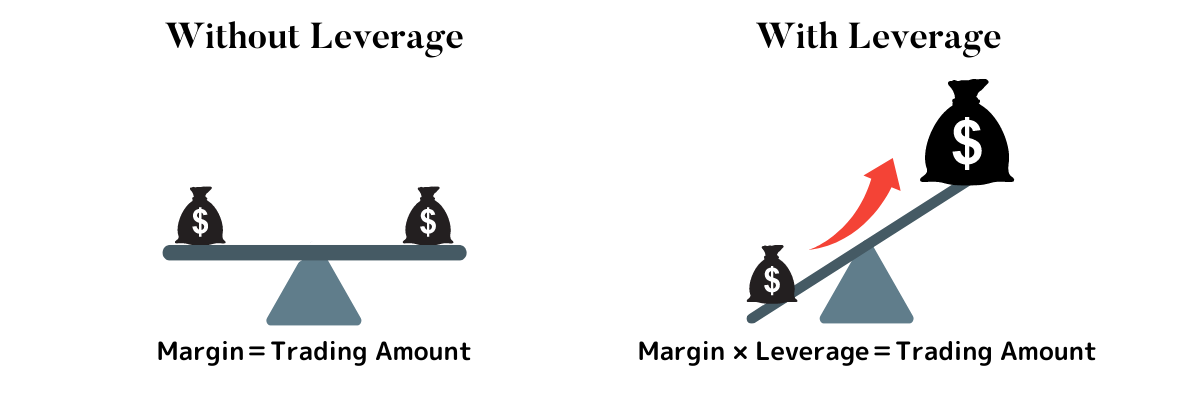

Options trading involves the buying and selling of contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price (the strike price) within a specified time frame (expiration date). Leverage in options trading refers to the amount of borrowed capital employed to enhance market exposure beyond what is available in your trading account. By using leverage, you can control a larger position with a smaller initial investment, potentially magnifying your profits.

Assessing the Pros and Cons

The allure of leverage lies in its potential to augment profits. With increased exposure to the underlying asset, even minor price fluctuations can result in substantial gains. However, it’s crucial to be cognizant of the inherent risks. Leverage can amplify losses just as easily as it magnifies profits. If the market moves against your position, you could face losses that exceed your initial investment, potentially leading to a margin call.

Leverage: Not a Prerequisite

Contrary to common misconception, leverage is not a prerequisite for options trading. It’s entirely possible to trade options without utilizing borrowed capital. In fact, some market experts advise against leveraging for beginners due to the elevated risks involved. Trading with a smaller portion of your capital allows you to manage risk more effectively and gain a deeper understanding of options trading before introducing leverage.

Assessing Your Suitability

Determining whether leverage is appropriate for your options trading strategy requires a thorough self-assessment. Consider your risk tolerance, trading experience, and financial goals. If you’re a risk-averse trader or new to options trading, it’s prudent to refrain from leverage until you’ve established a solid foundation in the market.

Conversely, if you’re an experienced trader with a high risk tolerance and a deep understanding of options trading, you may consider incorporating leverage into your strategies. However, it’s essential to exercise caution and constantly monitor your positions to mitigate potential losses.

Image: www.financedepth.com

Managing Leverage Wisely

For those who choose to trade options with leverage, prudent risk management is paramount. Here are some essential guidelines:

- Calculate Your Leverage Ratio: Determine the ratio of leveraged capital to your own equity, ensuring that it aligns with your risk tolerance.

- Diversify Your Portfolio: Spread your risk by investing in multiple options contracts across various underlying assets.

- Set Stop-Loss Orders: Establish clear levels for automatic liquidation to limit losses if prices fall below a predetermined threshold.

- Monitor Margin Requirements: Regularly check your margin account’s health to prevent a margin call and forced liquidation.

Do You Need Leverage For Options Trading

Image: www.bigboss-financial.com

Conclusion

While leverage can be a powerful tool in options trading, it’s essential to use it judiciously. It’s not a requirement for successful trading and should be reserved for experienced traders with a high risk tolerance and a deep understanding of the market. By thoroughly assessing your suitability, managing leverage wisely, and adhering to sound risk management practices, you can enhance your trading potential while mitigating the inherent risks.