Introduction

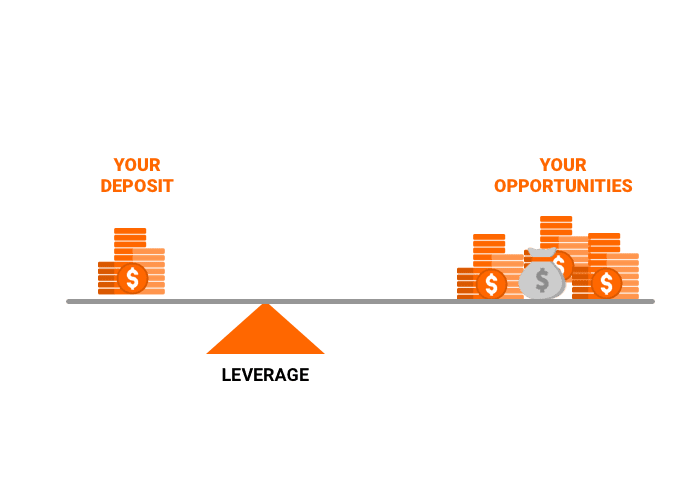

Leverage is a powerful tool in the world of financial trading. It allows traders to amplify their returns while minimizing their initial capital investment. While leverage can be beneficial in many ways, it’s crucial to understand its potential risks and how to use it effectively. In this comprehensive guide, we will delve into the world of leverage for option trading, exploring its advantages, risks, and strategies for maximizing its benefits while minimizing potential pitfalls.

Image: blog.earn2trade.com

Understanding Leverage in Option Trading

In option trading, leverage refers to the ability to control a larger position than what your account balance would normally allow. This is achieved by purchasing options, which grant the trader the right but not the obligation to buy or sell an underlying asset at a specified price within a given time frame. The amount of leverage in an option is determined by its delta, which measures the option’s sensitivity to changes in the underlying asset’s price.

Leverage Benefits

Leverage offers numerous benefits to option traders:

- Increased Profits: With leverage, traders can potentially earn higher profits by magnifying their gains on successful trades.

- Capital Efficiency: Leverage allows traders to control large positions with a relatively small amount of capital.

- Hedging Strategies: Leverage can be utilized for hedging purposes to minimize losses in different market conditions.

Leverage Risks

While leverage can amplify gains, it also magnifies losses. Traders must be aware of the potential risks associated with leverage:

- Margin Calls: If the underlying asset’s price moves against the trader’s position, they may receive a margin call, requiring them to deposit additional funds or face liquidation.

- Unlimited Losses: Unlike stocks, where losses are limited to the investment amount, option trading can result in unlimited losses if the underlying asset’s price moves significantly.

- Time Decay: Options have a limited lifespan, and their value decays with time. This can be a significant consideration for leveraged traders who must closely monitor the time decay of their options.

Image: www.projectfinance.com

Leverage Strategies

To effectively use leverage in option trading, traders should implement the following strategies:

- Manage Risk: Always prioritize risk management. Limit the amount of leverage used and ensure you have sufficient capital to cover potential losses.

- Understand the Greeks: Options have unique performance measures called Greeks, such as delta and theta. Traders must fully understand these Greeks to assess and manage the risks associated with their positions.

- Diversify Options: Avoid putting all your eggs in one basket. Spread your trades across different options contracts with varying expiration dates and underlying assets to mitigate risks.

- Proper Timing: Time decay is a major factor in option trading. Determine an appropriate time frame for your trades based on your risk tolerance and the underlying asset’s volatility.

Leverage For Option Trading

The Bottom Line

Leverage can be a powerful force multiplier for option traders, offering the potential for substantial profits. However, it’s crucial to use leverage judiciously, being fully aware of the inherent risks. By understanding the benefits, risks, and strategies associated with leverage, traders can harness its power to maximize their returns while minimizing their exposure. As with any financial instrument, thorough research and a disciplined approach are essential for successful leverage trading.