Leverage option trading is a powerful investment strategy that can magnify both profits and losses. It involves using borrowed capital to increase the potential returns of an underlying asset. While leverage can provide significant opportunities, it also carries substantial risk. This article will delve into the world of leverage option trading, covering its history, key concepts, risks, and applications.

Image: www.avatrade.com

A Brief History of Leverage in Trading

Leverage has been a staple of financial markets for centuries. As early as the 17th century, Dutch merchants leveraged their capital to invest in the booming East India trade. The practice gained traction in the 20th century with the advent of standardized options contracts. Today, leverage option trading is widely utilized by professional traders and institutional investors.

What is Leverage Option Trading?

Leverage option trading involves purchasing or selling options while simultaneously borrowing capital to increase one’s position size. This allows traders to gain exposure to a greater amount of the underlying asset without having to put up the full value of the investment. For example, if an option premium costs $10,000, a trader with $2,000 can still enter the trade by leveraging up their capital.

Types of Leverage in Option Trading

There are two primary types of leverage in option trading:

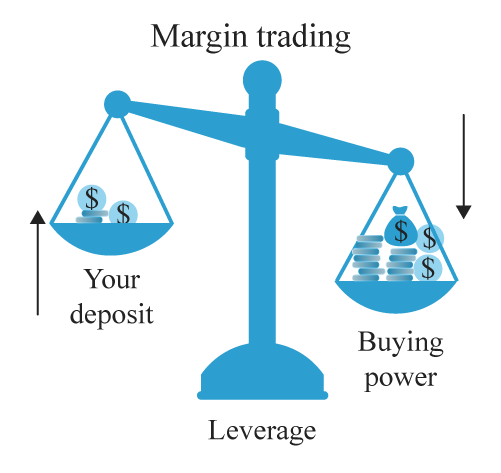

1. Margin Leverage: This allows traders to borrow money from their brokerage firm to purchase options. The amount of leverage is determined by the margin requirement set by the firm and the trader’s account balance.

2. Option Leverage: This refers to the inherent leverage options provide due to their control over a large number of underlying shares. Each option contract represents 100 shares of the underlying asset, so even a small investment can provide considerable exposure.

Image: bookmap.com

The Risks of Leverage Option Trading

While leverage can amplify potential profits, it also magnifies losses. If the underlying asset price moves against the trader’s position, they may lose more than 100% of their initial investment. Leverage increases the risk of margin calls if the value of the trader’s marginable securities falls below a certain level.

Key Concepts in Leverage Option Trading

1. Margin Requirement: This is the percentage of the option premium that must be paid upfront by the trader.

2. Maintenance Margin: This is the minimum equity that must be maintained in the trader’s account in order to cover potential losses.

3. Notional Value: This is the total value of the underlying asset controlled by each option contract (100 shares multiplied by the current price).

4. Margin Risk: This is the potential for losses exceeding the trader’s account balance due to fluctuations in the underlying asset price.

5. Option Premium: This is the price paid to purchase or sell an option contract.

Leverage Option Trading

Image: forums.footballsfuture.com

Conclusion

Leverage option trading can be a lucrative strategy for experienced investors with a high tolerance for risk. However, it is crucial to fully understand the risks involved before engaging in such practices. By carefully managing leverage, traders can enhance their returns while mitigating potential losses. Consult with a financial advisor if you are considering using leverage option trading to ensure you have an appropriate risk management plan in place.