The realm of options trading has witnessed a significant paradigm shift with the introduction of leverage, empowering investors with amplified market access and unparalleled opportunities. In this captivating article, we unravel the intricacies of options trading leverage, unraveling its mechanics, strategic applications, and potential pitfalls. Join us as we delve into this transformative financial instrument, unlocking the potential for exponential returns.

Image: www.xtremetrading.net

Essence of Leverage in Options Trading

Leverage, in its financial guise, refers to the practice of utilizing borrowed funds or financial instruments to magnify the impact of an investment. In the realm of options trading, leverage allows investors to control a larger pool of capital relative to their initial stake. This mechanism amplifies both potential gains and losses, offering savvy investors the tantalizing possibility of outsized returns.

The concept of leverage in options trading can be likened to an orchestra conductor who wields a baton to coordinate a symphony of financial instruments. Just as the conductor’s movements amplify the sound of the orchestra, leverage enhances the impact of an investor’s capital, potentially orchestrating a crescendo of profits.

Unveiling the Mechanics of Leverage

The application of leverage in options trading revolves around the concept of margin accounts. A margin account is a specialized trading account that permits investors to borrow funds from their brokerage, increasing their purchasing power. This borrowed capital acts as a catalyst, enabling investors to control a greater number of options contracts than would be possible with their own funds alone.

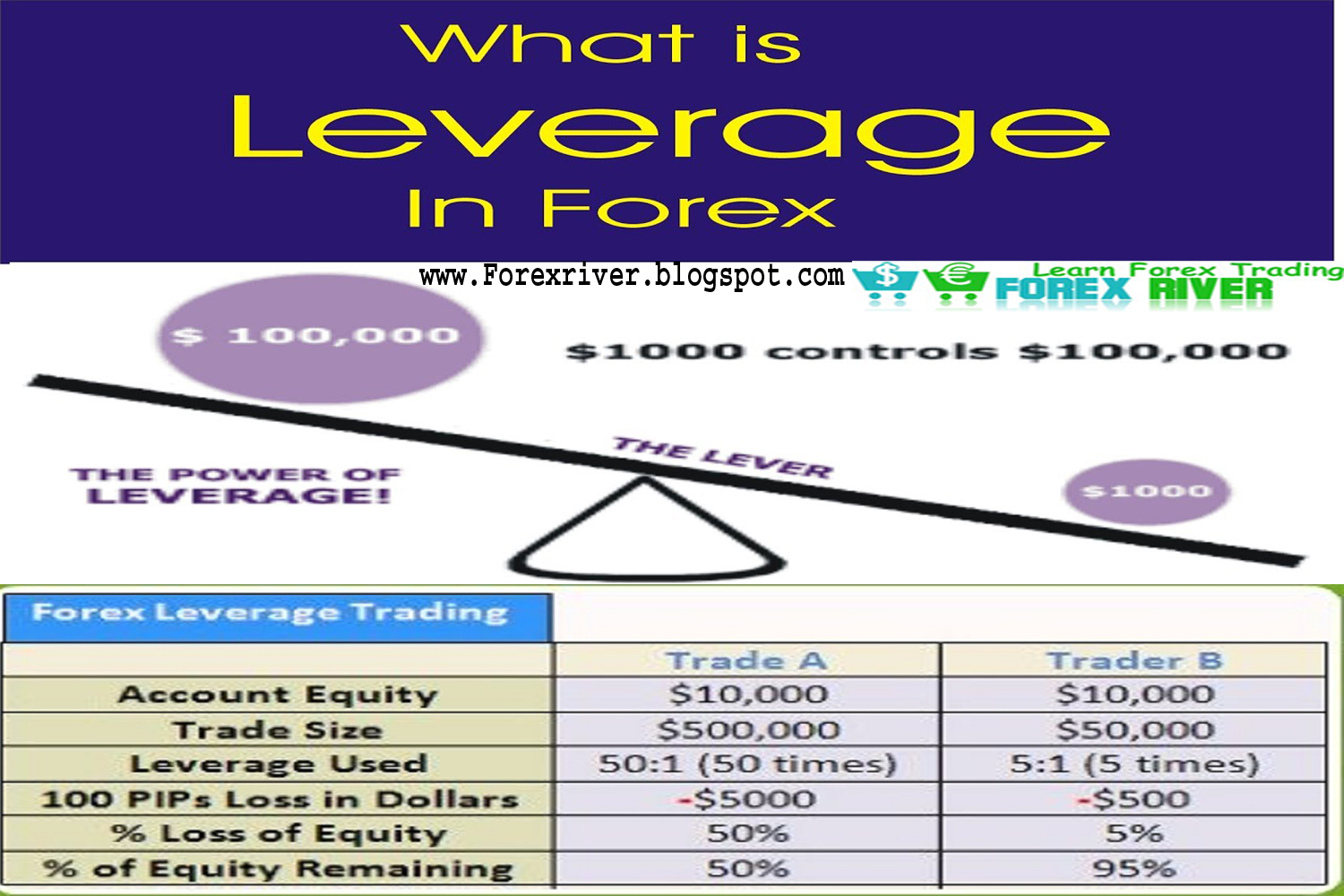

The extent to which leverage can be utilized is dictated by the maintenance margin requirement set by the broker. This requirement represents the minimum equity that must be maintained in the margin account to cover potential losses. The higher the maintenance margin, the lower the leverage available.

For instance, if an investor possesses $10,000 in their margin account and faces a maintenance margin requirement of 25%, they can access leverage of up to 4:1. This implies that they can control options contracts worth $40,000, significantly magnifying their potential for both profits and losses.

Strategic Applications: Unleashing the Power of Leverage

The strategic utilization of leverage can propel an investor’s portfolio to new heights, unlocking opportunities that were previously unattainable. Leverage can be effectively employed in various trading strategies, including:

Directional Trading: Leverage amplifies the potential returns for investors seeking to capitalize on price movements in the underlying asset. By controlling a larger position, investors can magnify their profits when the market moves in their favor.

Hedging: Leverage can serve as a protective tool in hedging strategies. By selling options, investors can generate income to offset potential losses on other positions in their portfolio, cushioning themselves against market downturns.

Income Generation: Some options trading strategies, such as covered calls and cash-secured puts, leverage the time value decay of options to generate steady income. Leverage can enhance these income streams, providing a consistent flow of returns.

Image: unbrick.id

Navigating the Potential Pitfalls

While leverage offers a tantalizing path to amplified returns, it is imperative to acknowledge its potential pitfalls. Leverage is a double-edged sword that can exacerbate both profits and losses.

Magnified Losses: The use of leverage magnifies not only potential gains but also potential losses. Investors should exercise caution, ensuring that they fully comprehend the risks involved and have a sound risk management strategy in place.

Margin Calls: Margin calls occur when the value of the investor’s account falls below the maintenance margin requirement. In such situations, investors may be forced to liquidate positions to meet the call, potentially incurring significant losses.

Volatility Considerations: The volatility of the underlying asset plays a crucial role in leverage-based trading. Highly volatile assets can amplify losses rapidly, rendering excessive leverage a perilous endeavor.

Options Trading Leverage Offered

Image: forexriver.blogspot.com

Conclusion: Leverage as a Transformative Tool

The judicious application of leverage in options trading empowers investors, providing them with the means to amplify their market impact. By understanding the mechanics, strategic applications, and potential pitfalls of leverage, investors can harness this powerful tool to enhance their portfolios and navigate the ever-evolving financial landscape with confidence.