In the captivating realm of the financial markets, options trading presents a thrilling opportunity to amplify potential profits through the strategic use of leverage. Like a magnifying glass, leverage has the ability to enhance gains, but it also amplifies the risks. Join us as we delve into the nuances of options trading leverage, uncovering its mechanisms, benefits, and prudent application to maximize returns.

Image: www.axi.com

Harnessing Leverage in Options Trading

A Catalyst for Exponential Returns

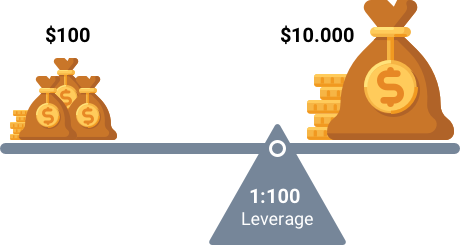

Options trading leverage allows traders to magnify the potential profits of their trades by controlling a larger notional value of the underlying asset with a comparatively smaller upfront investment. This amplified exposure essentially enables traders to multiply their returns, making it a formidable tool for both seasoned investors and ambitious beginners seeking to accelerate their financial growth.

Unveiling the Mechanics of Leverage

- Control at a Fraction of Cost: Options contracts confer upon traders the right, but not the obligation, to buy or sell the underlying asset at a predetermined price on a specified date. Unlike other derivatives, options leverage enables traders to gain exposure to the entire value of the underlying asset without having to pay for its actual purchase.

- Call Options: Call options grant traders the right to purchase the underlying asset at the strike price on or before the expiration date. Leverage in this context allows traders to control a significant quantity of the asset with a fraction of the investment required for an outright purchase.

- Put Options: Put options provide traders with the right to sell (put) the underlying asset at the strike price on or before the expiration date. Leverage in such trades offers traders the ability to protect their portfolio from potential downturns or profit from a decline in the asset’s value.

Image: www.ifcm.co.uk

Embracing the Advantages of Leverage

- Amplified Returns: Leverage in options trading provides traders with the opportunity to magnify their potential returns beyond the initial investment. This can be particularly appealing for traders seeking exponential growth or those with limited capital, allowing them to potentially achieve greater profits.

- Efficient Capital Allocation: With options trading leverage, traders can allocate their capital more efficiently. Instead of purchasing the entire underlying asset, traders can use leverage to control larger notional values, enabling them to diversify their portfolio or invest in multiple assets simultaneously.

- Enhanced Volatility: While leverage can intensify returns, it also amplifies the volatility of the trade. In other words, the value of an option’s underlying asset can fluctuate more dramatically, potentially leading to rapid gains or losses.

Tapping into Expert Advice

To successfully navigate the complexities of options trading leverage, it’s imperative to seek out guidance and advice from seasoned experts in the field. They can provide valuable insights, best practices, and recommendations tailored to your investment goals and risk tolerance. Remember, knowledge is a powerful ally in the pursuit of financial success.

Consider engaging with experienced traders or renowned educators through webinars, books, or specialized training programs. Their wisdom can help you develop a sound understanding of options trading leverage and how to leverage it effectively.

Frequent Questions on Leverage and Options Trading

- Q: What are the risks associated with leverage in options trading?

- A: Leverage enhances volatility, meaning the value of your trades can fluctuate more rapidly, potentially leading to significant losses. It’s crucial to carefully assess your risk tolerance and manage your positions prudently to mitigate the downside.

- Q: How can I use leverage effectively in options trading?

- A: To effectively harness leverage, consider your investment goals, risk tolerance, and market conditions. It’s advisable to start with modest leverage ratios and gradually increase them as you gain experience and become more familiar with options trading dynamics.

- Q: What are some common mistakes to avoid when trading options with leverage?

- A: Some frequent pitfalls include excessive leverage, inadequate risk management, and trading without a clearly defined strategy. Remember, leverage is a double-edged sword; while it can amplify profits, it can also intensify losses if not managed judiciously.

Options Trading Profits Leverage

Image: www.youtube.com

Conclusion

Options trading leverage presents a multifaceted opportunity for investors to magnify their returns, but it also underscores the importance of prudent risk management and strategic execution. By harnessing the power of leverage wisely, traders can unlock the potential for exponential profits while simultaneously mitigating potential losses. If you are interested in the topic I wrote in this article, please kindly share them with your friends.