Embarking on a Lucrative Journey

Options trading has emerged as a sophisticated arena, offering a multitude of opportunities for astute investors. Among the plethora of platforms, Gemini stands out, offering a robust and user-friendly experience that caters to both seasoned traders and those just starting their journey. Gemini options trading empowers investors to navigate market volatility and harness the potential of both upside and downside movements.

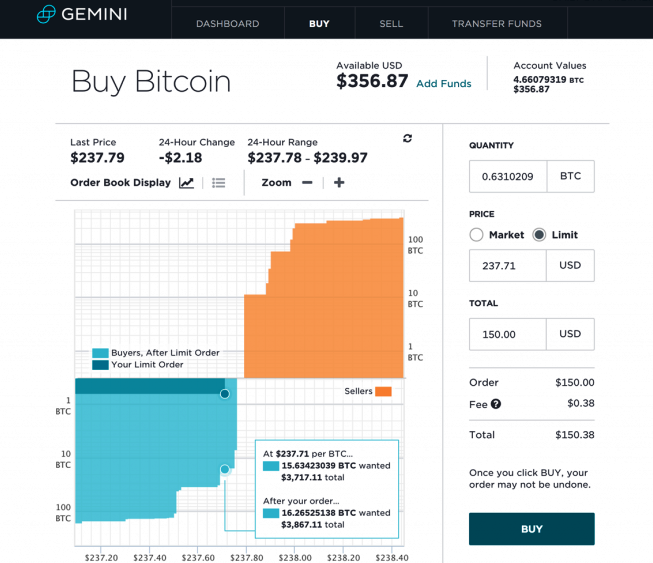

Image: www.bydfi.com

Understanding Gemini Options Trading

Options contracts are derivative instruments that confer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. Gemini options are standardized contracts traded on a regulated exchange, ensuring transparency and fairness. They provide investors with the flexibility to tailor their strategies to meet their risk tolerance and return expectations.

Benefits of Gemini Options Trading

Gemini options trading offers a wealth of advantages for savvy investors:

- Hedging Risks: Options serve as a valuable tool for mitigating risk exposure by allowing investors to offset potential losses in underlying assets.

- Leverage: Options provide leverage, enabling investors to control a larger position with a relatively small investment.

- Tax Advantages: Options strategies can be structured to optimize tax efficiency, providing potential savings.

- Flexibility: Options offer a versatile range of strategies, allowing investors to customize their positions to suit their unique objectives.

Unlocking the Options Market

Navigating the options market requires a comprehensive understanding of key concepts:

- Calls and Puts: Calls grant the right to buy, while puts convey the right to sell the underlying asset at a specified price.

- Strike Price: The predetermined price at which the option can be exercised.

- Expiration Date: The date on which the option expires, rendering it worthless.

- Premium: The price paid for the option, representing its value.

Image: www.fxempire.com

Expert Insights and Tips

To maximize their success in Gemini options trading, investors can heed the following expert advice:

- Proper Risk Management: Determine appropriate position sizing and monitor risk exposure diligently.

- Understanding Market Volatility: Adjust strategies based on expected price fluctuations to enhance potential returns.

- Technical Analysis: Utilize technical indicators and chart patterns to identify trading opportunities and assess market trends.

- Stay Informed: Keep abreast of market news and events that may impact underlying assets and option values.

Frequently Asked Questions

Q: What are the qualifications for Gemini options trading?

A: Gemini requires a minimum account balance and completion of a suitability assessment to ensure understanding of options trading.

Q: How do I calculate potential profits and losses?

A: Utilize an options profit calculator to determine potential returns and losses based on underlying asset price movements and option premium.

Gemini Options Trading

Image: bitsgap.com

Conclusion

Gemini options trading presents a compelling opportunity for investors to expand their portfolios, mitigate risks, and capitalize on market movements. By embracing the insights and tips outlined in this article, readers can unlock the full potential of options trading and embark on a lucrative journey.

Would you like to delve deeper into the intricacies of Gemini options trading? Explore our comprehensive resources and engage with our community of expert traders to elevate your knowledge and maximize your success.