In the dynamic and evolving world of financial markets, option trading has emerged as a powerful tool for savvy investors seeking tailored investment strategies and the potential to enhance their portfolio’s performance. India, with its robust economy and growing financial landscape, offers a fertile ground for the flourishing of option trading platforms. This article delves into the intricacies of option trading platforms in India, providing a comprehensive guide to help investors navigate this exciting arena with confidence and clarity.

Image: daotaonec.edu.vn

Understanding Option Trading Platforms: A Gateway to Financial Empowerment

An option trading platform acts as the bridge between investors and the world of options, providing a user-friendly interface to execute complex trading strategies. These platforms enable investors to buy and sell options contracts, which grant them the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. It’s important to remember that options trading involves both rewards and risks, and investors should carefully consider their financial objectives and risk tolerance before embarking on this journey.

Unveiling the Building Blocks of Option Trading: A Foundation for Understanding

To comprehend the intricacies of option trading, it is essential to grasp the fundamental concepts that underpin this sophisticated financial instrument. Options contracts are characterized by two key elements: the strike price and the expiration date. The strike price represents the predetermined price at which an underlying asset can be bought or sold, while the expiration date defines the period within which this transaction can take place.

Options contracts fall into two primary categories: calls and puts. Call options grant the buyer the right to purchase an underlying asset at the strike price, whereas put options confer the right to sell the asset at the agreed-upon price. Depending on an investor’s market outlook and strategy, they can choose to buy or sell either call or put options, opening up a vast array of tailored trading opportunities.

Navigating the Indian Option Trading Landscape: A Realm of Opportunities

India boasts a vibrant and well-regulated option trading ecosystem, overseen by the Securities and Exchange Board of India (SEBI). The country’s leading stock exchanges, including the National Stock Exchange of India Limited (NSE) and the Bombay Stock Exchange (BSE), provide a robust infrastructure for option trading activities.

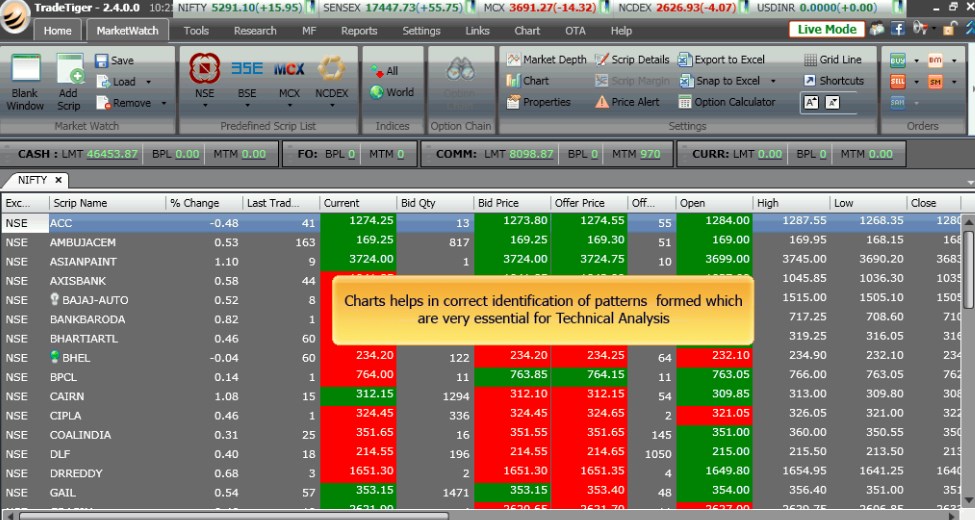

A diverse array of option trading platforms operate within the Indian market, ranging from full-service brokerages offering comprehensive support to discount brokers catering to cost-conscious traders. Each platform has its unique strengths, whether it’s advanced charting tools, sophisticated trading algorithms, or dedicated educational resources, empowering investors to select the platform that best aligns with their investment objectives and trading style.

Image: www.adigitalblogger.com

Strategies for Success: Harnessing the Power of Option Trading

Seasoned option traders employ a variety of strategies to optimize their returns and manage risk. Some prevalent strategies include:

-

Covered Call Strategy: Selling call options against an underlying asset that the trader owns, aiming to generate additional income while limiting downside risk.

-

Protective Put Strategy: Buying put options as a form of insurance against a potential decline in the value of an underlying asset, offering protection against downside risk.

-

Collar Strategy: Combining a protective put with a covered call strategy, creating a customized risk-return profile that caters to the trader’s specific circumstances.

-

Iron Condor Strategy: A neutral strategy that involves selling both call and put options at different strike prices, seeking to profit from a limited movement in the underlying asset’s price.

The choice of strategy depends on multiple factors, including the trader’s risk tolerance, market outlook, and the characteristics of the underlying asset. It is advisable for investors to thoroughly research and understand the nuances of each strategy before implementing them in their trading endeavors.

Embarking on Your Option Trading Journey: A Path to Financial Empowerment

As with any financial endeavor, venturing into option trading requires a well-disciplined approach and a commitment to continuous learning. For beginners, it is vital to lay a solid foundation by understanding the basics of options trading, familiarizing themselves with the available platforms, and practicing cautious trading with realistic expectations.

Seasoned traders emphasize the significance of risk management in achieving long-term success in option trading. Prudent risk management involves setting well-defined stop-loss orders, maintaining appropriate position sizing, and constantly monitoring market conditions. By adhering to sound risk management principles, investors can minimize potential losses and safeguard their financial well-being.

Option Trading Platform India

Conclusion: Unlocking the Potential of Option Trading in India

Option trading platforms in India offer a potent tool for investors seeking to augment their financial strategies and grasp the opportunities presented by the nation’s growing financial landscape. This comprehensive guide has delved into the intricacies of option trading, providing a roadmap for investors to embark on their journey with confidence and understanding.

Remember, the path to success in option trading lies in continuous education, disciplined execution, and a commitment to understanding the nuances of this complex yet rewarding financial instrument. Embrace the opportunities that the